The increase in bulkier items purchased online is causing some carriers to acquire providers with specialized services

Earlier this year Werner Enterprises entered the last-mile delivery market with the launch of Werner Final Mile. The service will handle large or heavy items using a lift-gate equipped straight truck and two uniformed employees. Werner is leveraging its existing network of nearly 200 locations to handle the “white glove” deliveries to homes and businesses.

“With our customers’ rapid growth in the e-commerce market, we continue to adapt our services and technology to meet and exceed their expectations,” Marty Nordlund, COO, said in a statement. “Our significant investment in technology and network development make Werner Final Mile services another key element in our comprehensive logistics portfolio.”

Werner is the latest truckload carrier to get into the final mile business. J.B. Hunt offers J.B. Hunt Final Mile to customers, providing delivery of “non-conveyable” products with both drop-off and white glove deliveries.

In June of 2016, Schneider National acquired both Watkins & Shepard and Lodeso. Watkins & Shepard is a provider of LTL, truckload and logistics services for difficult-to-handle goods such as furniture and floor coverings with nearly 800 drivers and 20 terminals. Lodeso provides technology for continuous tracking of goods throughout the supply chain with a focus on national home delivery.

But while the large truckload carriers are trying to leverage their expertise and grab a portion of the last-mile business, it’s the LTL carriers that have been busy perfecting the deliveries. Fleets such as Estes, Saia, Eastern, R+L Carriers and Ward’s are among the companies leading the way.

“Really, the activity has been with the LTL carriers,” Thom Albrecht, president of Sword & Sea Transport Advisors, tells FreightWaves. “The action has been with LTL carriers buying equipment that is different; it may still be 28-foot trailers, but they may be lower roofs, or straight trucks.”

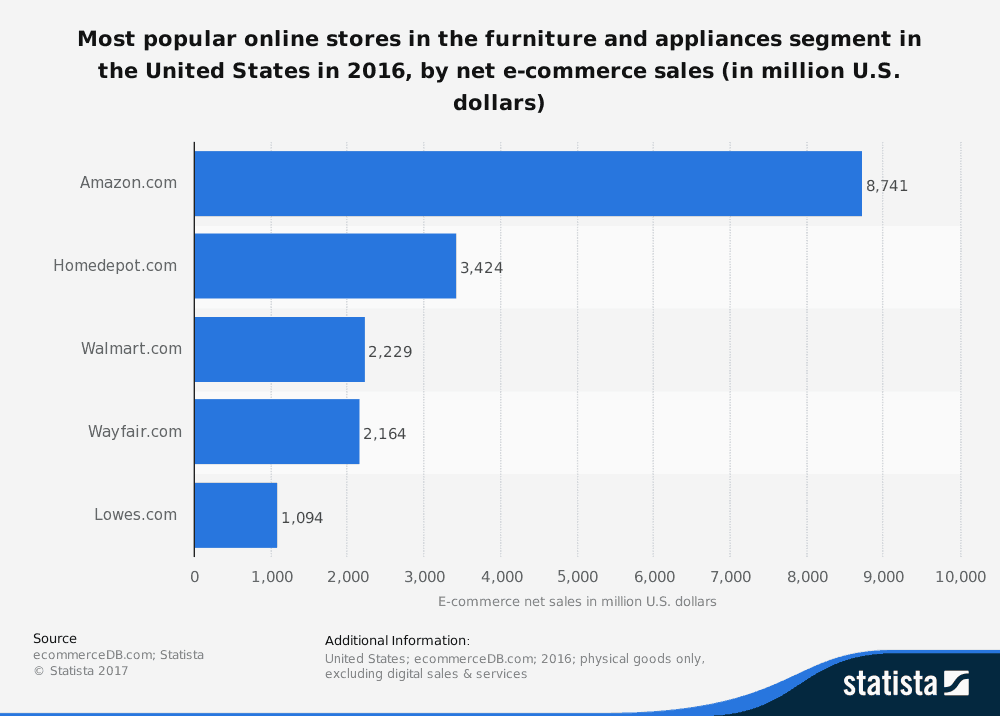

While FedEx, UPS and the U.S. Postal Service are all generating large amounts of revenue from e-commerce, they are not equipped to handle the growing trend of furniture and appliance e-commerce sales. A Statista report on the furniture & appliances segment earlier this year found that 30% of revenue is now generated through online sales. The global e-commerce market for furniture and appliances is now $199 billion, which is 17% of the overall e-commerce market.

That’s where the LTL carriers have been succeeding and where Albrecht says innovation is happening, including investing in different equipment types that can more easily navigate urban neighborhoods and city streets.

But one obstacle these LTL (and truckload firms) have in this space is the existing competition. There are already plenty of last-mile, white-glove trucking firms effectively and efficiently handling deliveries. That’s why some of the truckload carriers have been busy snapping them up.

“Our focus is on last mile only,” says Daniel Sayne, director of sales for Fidelitone. “We don’t dabble in less-than-truckload or truckload. We go into homes, whether it’s full white glove, room of choice or taking it to the threshold” of the house.”

Last-mile companies like Fidelitone are offering something that many LTL carriers are not: personalized service. When a Fidelitone truck arrives at your house, there will be two men on the truck who will meet the customer’s needs. This can include assembly and installation, furniture deluxing and repair, and pickups and exchanges. The company offers GPS track and trace capabilities and will schedule deliveries within 2- to 4-hour windows with each customer receiving a call, email or text (based on their preference) within 30 minutes of arrival. The company has more than 30 strategically placed hub and client-based locations to make that last mile even faster.

Sayne says that about 65% of the business is full white glove delivery with assembly.

“The growth of e-commerce and bulky items is certainly [continuing] and I think that’s why you are seeing more LTL carriers getting into the space,” he says.

For the LTL carriers, that is coming with a cost, though, as Albrecht alluded. First, they don’t often have two people in a cab making a delivery, meaning bulkier and heavier items are being moved via a pallet jack or hand truck, which can be difficult to deliver inside a home. Many of them also don’t have the equipment for making such deliveries, being forced to navigate through neighborhoods with either 53-foot tractor-trailers or more likely a 28-foot pup trailer, that while easier, can still be difficult in some neighborhoods with narrow streets, cul de sacs, or sharp turns.

Sayne says 99% of Fidelitone’s equipment is either a 24-foot or 26-foot straight truck and all are equipped with liftgates.

“We’re the face for a lot of our customers, especially when you talk about e-commerce,” he says. “We’re the last touchpoint. All of my fleet has two drivers in the trucks, they have liftgates, they put booties on their feet, they have tools needed to perform assembly services.

“I think we are far enough along that I think shippers are realizing that if they want repeat business, they need to offer these [value-added] services,” Sayne adds. Shippers (whether small or large) should look at the technology available in the marketplace to allow them to work with specialized carriers that can handle the in-home suite of services that provide an exceptional experience for the customer for large ticket purchased items.

LTL carriers, in many cases, are not providing that personal touch.

“The issue with the LTL carriers making residential deliveries is the efficiency of delivering in residential neighborhoods with tractor-trailers and having to perform services that require two men,” Sayne adds.

Because these providers are the final link in the logistics supply chain that starts with the website the customer ordered the item through, image is important.

“Brand visibility is key when the last-mile carrier arrives to your customer’s home,” Sayne says. “Companies like Fidelitone pride themselves on having newer model trucks and crisp clean unformed drivers that represent the brand they are delivering for in a manner that is comfortable to the consumer.”