When CSX CEO Hunter Harrison passed away on Dec. 16, 2017, railroad industry veterans mourned the loss of a legend. Rail observers and analysts also wondered if CSX’s corporate culture would be able to absorb Harrison’s “precision scheduled railroading” program in his absence. Would CSX be able to implement a model proven on the long, linear routes of Canadian railroads in its own dense maze of urban lines?

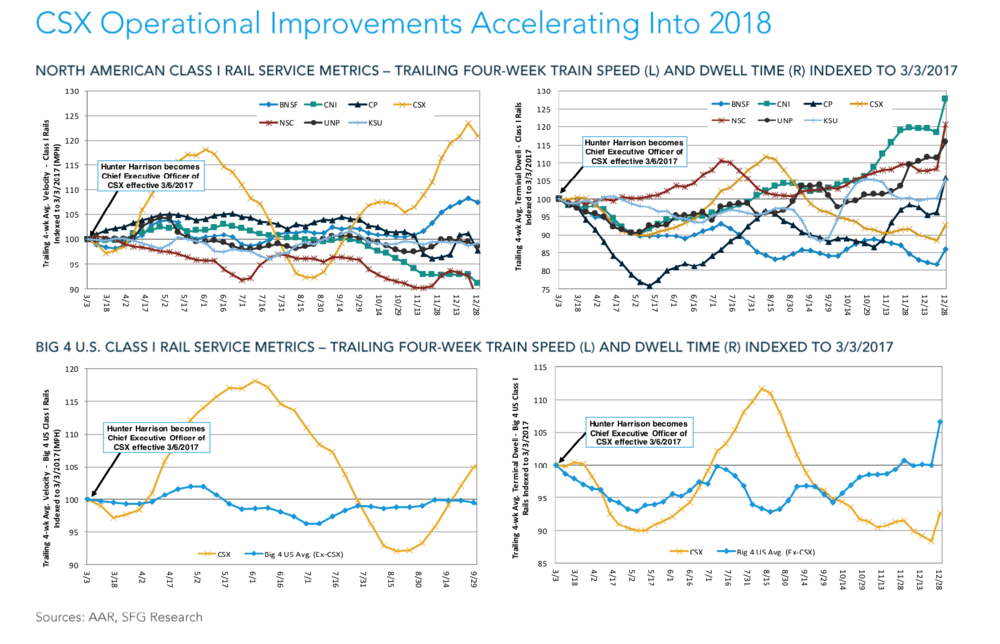

According to data presented by analyst Bascome Majors in Susquehanna’s Multi-Company Railroads Update released this morning, after a pain period in August when CSX was adopting rapid changes, the carrier’s metrics improved. CSX finished 2017 outperforming its competitors in two key metrics: train speed and dwell time. In the graphs below, train speed and dwell time are indexed to the day that Harrison assumed the CEO position at CSX, March 6, 2017. Within a month of Harrison’s start date, CSX was outperforming the other Class 1 railroads, and within two months CSX had improved train speed by 12% and reduced dwell time by 10%.

FreightWaves covered the disruptive adoption period, when shippers complained that delayed trains were causing plant shutdowns. Paul Hilal, the hedge fund manager who masterminded Harrison’s takeover of CSX, said this about the late summer and fall service disruptions: “You can’t make these changes without disrupting employees and customers. You tell customers that instead of picking up freight on Monday and Wednesday at 9 a.m., it’s now Thursday and Saturday at 3 p.m. Some of these improvements are best made gradually, but where improvements are best made by ripping the Band-Aid off, the customers suffer some near-term disruption, then things get much better.”

Harrison thought that the increased efficiencies from switching to a point-to-point transit network from a hub-and-spoke model would make railroads more competitive with trucking companies, which he thought faced major challenges. Harrison said, “[Truckload carriers] can’t hire drivers. The highways are crumbling. I won’t get on I-95—it’s like NASCAR. We can offer truck-competitive services at lower rates.”

But August was complicated. Closing 8/12 hump yards and reducing the number of locomotives from 3,900 to just 3,000 took its toll on CSX’s service, and train speed plummeted, while dwell times skyrocketed. Harrison was “sweating the assets,” his term for increasing capacity by intensifying utilization of cars and engines, and he was asking his customers to accelerate the pace at which they dispatched cars. Traffic snarled, and all of CSX’s network slowed down while Harrison and his team worked out the kinks. By the end of October, CSX was back in the money—moving its trains faster than other railroads and keeping its trains idle for the shortest periods in the industry. CSX finished 2017 in pole position on those metrics: by year’s end CSX had grown its EBITDA by 11.2% compared to 2016 and its EPS by 23.2% compared to 2016.

On the strength of those numbers, Susquehanna increased its CSX stock price target from $61 to $71 (current price: $58.71; upside 20.9%). Susquehanna also likes Norfolk Southern, and increased its price target from $151 to $186 (current price: $154.90; upside 20%), and gives Union Pacific a ‘positive’ rating, increasing its price target from $139 to $167 (current price: $140.95; upside 18.4%). Susquehanna thinks that railroads in general will benefit from structural tailwinds (tax reform, the winding-down of the Positive Train Control investment period) and cyclical tailwinds (strong economic growth and industrial performance) in 2018.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.