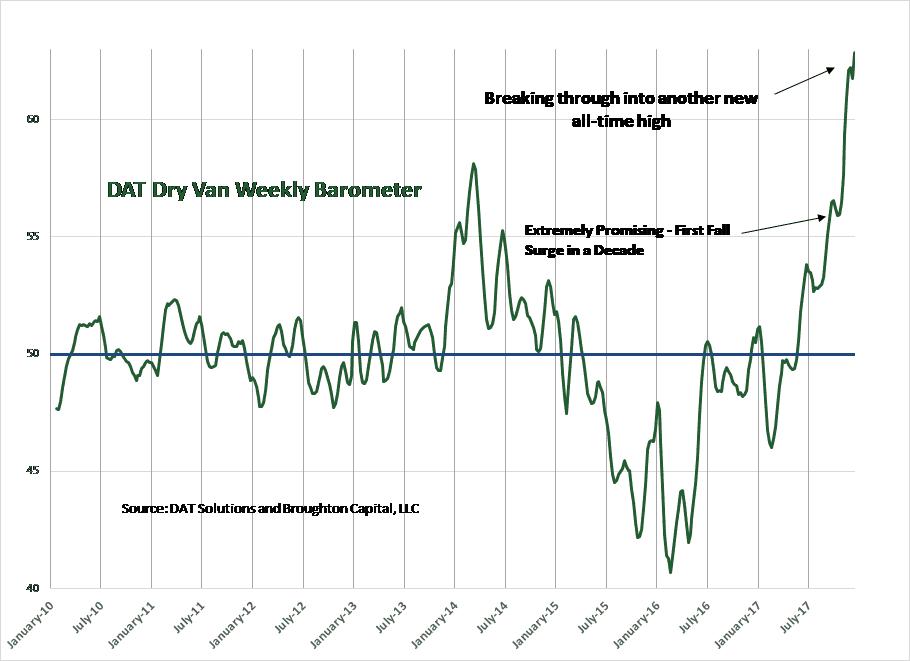

Last week’s DAT Dry Van Barometer established yet another record high, reflecting a current environment in which demand exceeds capacity by the widest margin in the history of the barometer. The latest weekly and monthly DAT Trucking Freight Barometers are continuing to surge strongly into even more positive territory, and proving our September prediction that “the ‘fall surge’ is happening for the first time since 2007,” has come to pass.

- The Dry Van Weekly Barometer is now predicting even stronger pricing in coming months as it reflects the highest level of demand in excess of capacity in the history of the barometer (see figure 1);

- The DAT Reefer Weekly Barometer is also now predicting stronger contract pricing in coming months. After consolidating and ‘establishing a base,’ it has moved higher and set another high for this cycle (see figure 2);

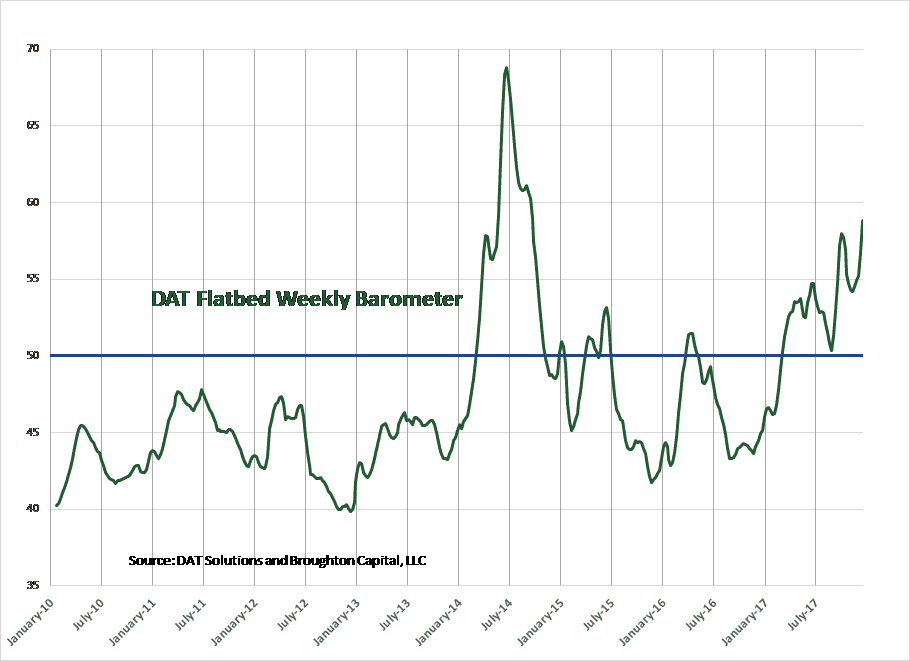

- The DAT Flatbed Weekly Barometer is also now predicting stronger contract pricing in coming months. After consolidating and ‘establishing a base,’ it has moved higher and set another high for this cycle (see figure 3).

The DAT Dry Van Barometer

Weekly – after breaking 50 thirty-six weeks ago, the weekly barometer has established a succession of ever-higher levels and last week broke into yet another record new high. Last week’s 62.9 is still signaling a dry van marketplace in which loads are exceeding equipment. The Barometer’s high level for this recovery appears poised to remain elevated going into 2018. This level, coupled with the first fall surge in freight in over a decade and the ELD rule (effective December 18th), should bode well for carriers seeking higher pricing in the early 2018 bid season. The Dry Van Weekly Barometer is now predicting even stronger contract pricing in coming months.

The DAT Reefer Barometer

Weekly – At 58.7 it is above 50 for the twenty-ninth week in a row. After a brief period of consolidation, the Barometer hit another new high for this recovery. Especially given the incremental volumes that will be driven by the use of reefers (temperature controlled trailers) to keep things from freezing over the next several weeks, we believe the DAT Reefer Barometer is poised to retain strength going into the 2018 contract bid season. The current level of DAT Reefer Weekly Barometer is predicting contract stronger pricing in coming months.

The DAT Flatbed Barometer

Weekly – came in at 58.8, and after accelerating in a manner even stronger than dry van and reefer, entered a consolidation phase before breaking out into new highs for this cycle. The DAT Flatbed Barometer has now been above 50 for forty-two consecutive weeks. The metric originally broke through 50 in early March as the rise in the price of crude back above $50 a barrel drove an increase in heavy industrial activity that began in October of 2016, and continued to improve as oil stayed in the $45 to $50 range ($60 as we write this). Hurricanes Harvey and Irma started a strong uptick in building material shipments, but that strength has been continued by an oil price that makes fracking profitable in most parts of the U.S. and the high level of flatbed activity that fracking drives.

What is this? DAT Solutions operates the broadest spot marketplace for trucking freight in the US, with the greatest number of participants, including: trucking companies, freight brokers, and shippers. The DAT marketplace is also the deepest, with the most loads and trucks offered across all trailer types. We have long considered DAT the equivalent of the NYSE and NASDAQ combined of trucking.

Because the DAT database is so broad and deep, we assert that these barometers have predictive value in determining the magnitude and direction of both spot and contract market rates, as well as predictive value for the overall economy.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.