Investors are betting that carriers and 3PLs will ride the wave through 2018

If high TL rates cause inflation, the Fed might raise rates and end the party

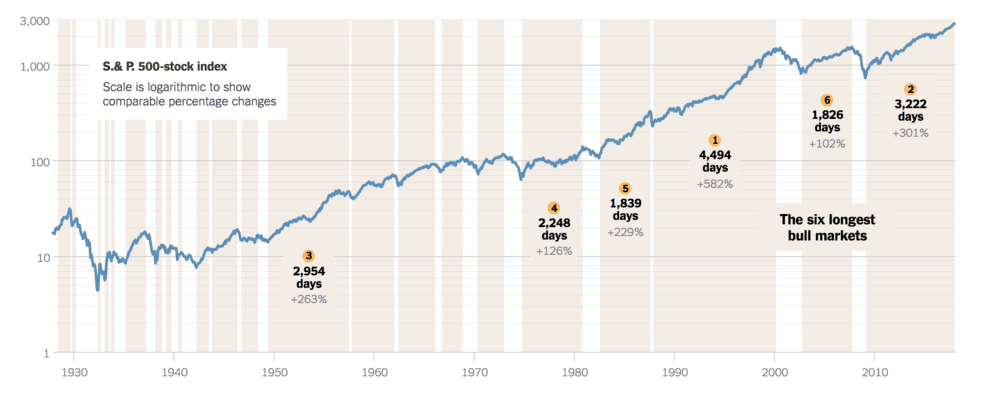

Right now we are already 3,226 days into the second-longest bull market since the 1920s—only the 4,494 day bull market from 1987-2000 was longer. The Dow Jones Industrial Average rose 25% in value during 2017 alone. The New York Times created a graph that compares the relative lengths of these up-cycles:

Every one of the world’s 45 major economies tracked by the Organization for Economic Cooperation and Development grew in 2017. The OECD forecasts show more of the same in store for 2018. Jerome Dodson, founder and president of Parnassus Investments, said, “Everybody thinks the market is overvalued. So do I… I look for stocks that are undervalued, but I’m having terrible trouble finding anything that’s reasonably priced.”

In two recently released 2018 outlooks, both Stifel and Susquehanna doubled-down on their optimistic forecasts for the transportation and logistics industries through the end of this year. The main message of Stifel’s January 4 industry update was “Pace of change continues to accelerate; some companies are better positioned to leverage the accelerating rate of change,” but authors John Larkin, John Engstrom, and Roxanna Islam highlighted several reasons to be bullish on the whole industry: these include high rates for the foreseeable future, tax reform boosting capital investment, and technology enabling new synergies for M&A.

But according to Stifel’s analysts, one of the biggest risk factors for continued economic growth through 2018 could be a chain reaction set off by the prolonged driver shortage FreightWaves has been writing about for months. If spot and contract truckload rates remain sky-high because of a lack of capacity—if they become a ‘new normal’—those increased costs will eventually be passed on to consumers. That could lead to inflation, and the Federal Reserve may raise interest rates more sharply than it otherwise would have in order to keep inflation low. It’s hard to know exactly how many of those rate increases our current bull market will be able to absorb before losing steam.

In Stifel’s words: “So to summarize, the labor shortage, increased demand, and capacity constraints, related to well-meaning safety regulations, will likely combine to create a capacity shortage which will most probably drive up freight rates for the foreseeable future. Too much of a good thing, however, could contribute to enough inflation to cause the Federal Reserve to tighten monetary policy sufficiently so as to drive up the price of money/interest rates, which could well cause the rate of economic growth to slow or that could cause the economy to actually contract and slip into a recession.”

“Most bull markets die by the sword of the Fed,” said James Stack, market historian and president of InvesTech Research. “If there are any certainties, one will be that this party will eventually come to an end,” said Stack. “A correction would be healthy. The longer we go without one, the greater the risk this will end badly. A lot of people will get hurt. And when it ends, it will end badly, and with high volatility,” Stack continued.

Whether the bull market stays strong in 2018 or the Fed ultimately kills demand with heavy-handed rate increases, it would be helpful if carriers and shippers had access to a freight futures exchange so they could hedge against further movement. Carriers afraid of a correction could lock in their high rates now, while shippers could protect themselves against an increasingly lopsided supply-demand imbalance if the bull market stays on course.

Bascome Majors, an equity research analyst at Susquehanna, still managed to find some upsides in transportation and logistics in his Multi-Company Update released yesterday. Susquehanna raised their XPO Logistics price target from $85 to $112 (current price: $91.08); C.H. Robinson’s target increased from $85 to $99 (current price: $89.57); and Echo Logistics saw its price target move from $24 to $33 (current price: $27.65). SIG upgraded Landstar System’s stock to a “buy” and raised the price target to $124, up from $109 (current price: $104.70).

Majors explained why he thought fundamentals were upshifting: “For 2018, we organically raised most of our forecasts (before tax reform’s boost) in the 2% to 4% range on cyclically stronger expectations for volumes and pricing, with JBHT the laggard (down <1% but still above pre-tax consensus) and ECHO in the lead (+15% on operating leverage to net revenue upside). Tax reform adds an additional double-digit increase to our EPS forecasts, though with few sell-side estimates including tax reform today, our estimates are much higher than consensus and not yet comparable.”

The impact of the tax reform should not be understated: with that single piece of legislation, the United States went from having the highest corporate tax rate of any G7 country (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) to having the lowest. Last month FreightWaves reported on a McKinsey analysis that showed that American corporate tax rates were a key barrier to competition with other advanced manufacturing economies. If the lower corporate rate, the profit repatriation component, and the bonus depreciation reform lead to a new wave of on-shoring manufacturing, the transportation sector will see a multiplier effect, since domestic manufacturing requires the movement of raw materials, component parts, and finished goods. In other words, much more of the overall supply chain will be located in the United States and will be facilitated by the American transportation sector.

Carriers are trying to figure out what to do about the driver shortage: FreightWaves has reported on efforts to allow 18-21 year olds to get CDLs; unprecedented signing bonuses for team drivers; and we’ve even called for massive increases in driver pay across the board. We’ve also reported on the elephant in the room, of course: autonomous trucking. We’ve covered driverless garbage truck demonstrations in Brussels, Amazon’s patent for autonomous flying warehouses, and we wondered how autonomous vehicle technology might be implemented in developing economies like India. For now, though, we agree with Stifel’s analysts that the technology is at least 3 business cycles away from solving the driver shortage/capacity crunch the United States is currently experiencing. Autonomous trucks are not going to be able to keep inflation, fueled by high shipping rates, from ending this bull market.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.