Fleet idle capacity is at 1%, but wait for summer peak season for rate increases

Tariffs could bring a headwind to long term outlook

Last Friday, the Shanghai Shipping Exchange released their weekly update of the China Containerized Freight Index (CCFI), which measures spot rates for exported Chinese containers. The American-destination lanes posted the strongest weekly growth, with the West Coast up 3.9% on the week and the East Coast up 4.6% on the week.

DAT’s RateView tool shows dry van spot rates from the Los Angeles market, which includes the Ports of Los Angeles and Long Beach, to the Dallas market moving up from an average of $1.69 in March to $1.77 over the past seven days.

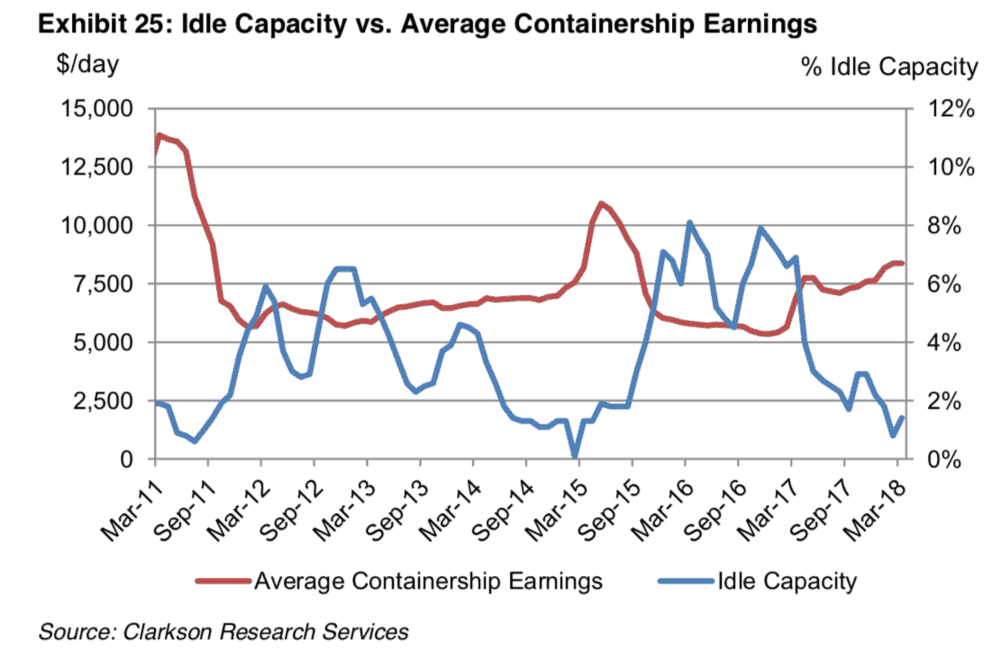

Stifel analyst Benjamin J. Nolan reported in a maritime industry note this morning that year to date, container shipping charter rates for 9,000, 4,400, and 2,000 TEU vessels were up 29%, 3%, and 40% respectively, year over year. Nolan wrote that with only 1% of the global containership fleet idle, rates are poised to respond quickly to an uptick in volume once the summer peak season commences.

“Also historically idle capacity typically falls during the summer months due to seasonably higher demand with the trend continuing through mid-2017,” wrote Nolan. “Idle capacity typically remains low through August before increasing in September as seasonal demand falls.” The graph below shows the historical relationship between idle capacity and average containership earnings:

“Unfortunately, there could be lower container demand growth due to the tariffs imposed by both China and the U.S., which could become a long-term headwind for the space, but should have little to no impact in the near term,” Nolan wrote.

The American Association of Port Authorities (AAPA) wrote an open letter to U.S. Trade Representative Robert Lighthizer regarding their concerns about the potentially damaging effects tariffs could have on international trade and port traffic. “We support and encourage steps focused on expanding exports rather than creating new import restrictions,” wrote the AAPA. “With today’s worldwide supply chain, American manufacturers, farmers and businesses often rely on ports to handle the raw materials and semi-finished components needed for production here in the United States. These imports enable U.S. manufacturers to export their products and enhance their international competitiveness.”

The South China Post reported that Chinese manufacturers are adding shifts and working overtime to move product into the United States before tariffs hit. Cixin, a ball bearing manufacturer in Ningbo, is considering plans to rush shipments of its product to the United States, which takes 30% of its exports, before steel tariffs hit.

The container shipping industry is still working through some extra supply from a capacity glut that collapsed rates in the back half of 2015 and held them down through the majority of last year, but, judging from container fleets’ orderbooks, new capacity will be slow to come online for the rest of 2018 and will slow further in 2019.

The rise of oil prices (Brent Crude is trading at $74.07 per barrel, up 29.1% in the past six months) will eventually drive bunker fuel costs up, but as supply and demand is slowly returning to equilibrium, fuel prices are not expected to move container rates.

The bottom line, according to Nolan: “Global trade is healthy, fleet utilization is tight, and supply is not excessive. However, with an influx of near-term deliveries and box rates still unimpressive, we expect it could continue to take time for shipping rates to improve and container shipping equities are likely to remain range bound.”

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.