Containerized imports to the Port of Los Angeles in January followed the same pattern as in neighboring Long Beach: up versus December but down year on year and down versus pre-COVID levels.

It looks like it will get worse in Los Angeles before it gets better.

During a news conference on Thursday, Port of Los Angeles Executive Director Gene Seroka predicted “a significant volume decline” in February, with more canceled sailings in the weeks and months ahead and “a softer market heading into the second quarter.”

However, Seroka does expect volumes to improve in the second half, with a return to a more traditional peak-season import pattern. “While last year we saw strong volumes in the first six months, 2023 is shaping up to be more robust in the back half of the year,” he said.

Still no labor deal

Seven and a half months after the West Coast port labor contract expired on July 1, 2022, there’s still no deal.

Seroka once again acknowledged the lack of a deal is affecting imports and pushing cargo to East and Gulf Coast ports and conceded “some of that cargo may be lost for good.”

“There is still trepidation,” Seroka said. “There are many transportation managers who couldn’t go back to the boss for a third straight year and say, ‘I got our cargo stuck in the jaws of congestion out in California.’ To meet the criticism and to meet the conjecture that’s out there, we’ve got to get this collective bargaining agreement done and remove that from the discussion.”

Seroka had previously predicted a new West Coast port labor contract in the February-March time frame. He sounded less confident about that Thursday.

“With respect to timing, we’re now at the outer edges of what historically has been the [longest period] of negotiations between these two sides,” he said. “It may not get done in February or March, but I’m still pretty confident that we’ll see some real progress in the springtime.”

‘Mini-bump’ in January

The Port of Los Angeles reported total throughput of 726,014 twenty-foot equivalent units, down 16% year on year (y/y).

Imports came in at 372,040 TEUs, down 13% y/y. Exports totaled 102,723 TEUs, up 3% y/y. Empty containers totaled 251,251 TEUs, down 26% y/y.

On a positive note, Los Angeles’ January imports were up 6% compared to December. That “mini-bump” can be attributed to “cargo owners who pushed their product here ahead of the Lunar New Year holidays,” said Seroka.

West Coast vs. East Coast

The unprecedented COVID-era import surge was in full swing at this time in 2022, meaning that y/y comparisons at U.S. ports are down.

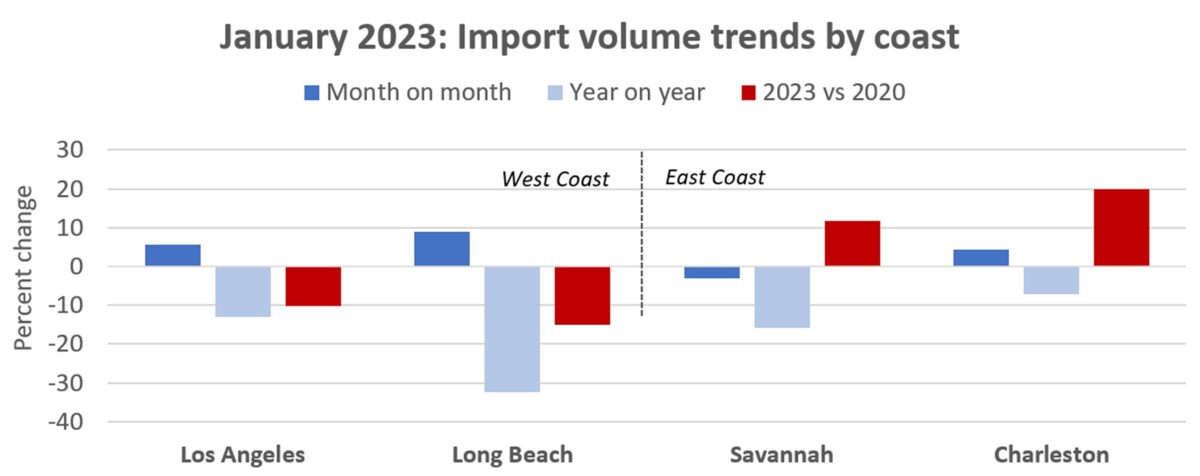

Long Beach’s imports plunged 32% y/y in January, a much steeper fall than in Los Angeles. On the East Coast, January imports to Savannah were down 16% y/y, with imports to Charleston, South Carolina, down 7%.

In contrast, Long Beach did even better in January versus December than Los Angeles, with imports up 9% sequentially. Charleston’s January imports were up 4% versus the month before, while Savannah’s pulled back by 3%.

The big divide between the East and West coasts can be seen in comparisons to the pre-pandemic period. While Los Angeles was down 10% and Long Beach was down 15% compared to January 2020, Savannah’s imports were up 12% over the same time frame and Charleston’s were up 20%.

Seroka maintained that the shift from the West Coast to the East Coast is not all about recent labor issues.

“Let’s be clear. This cargo shift isn’t new. It started more than 20 years ago,” he said. “Since 2002, the West Coast share of the trans-Pacific trade has declined from 80% to 56%. Right here at home in San Pedro Bay, the share of import volume has dropped from 50% of our nation’s boxes down to 33%.

“Cargo owners and decision makers tell us we’re too expensive, overregulated and have complicated labor issues. Meanwhile, East and Gulf Coast ports have hired leadership aligned with policymakers and they partner together state to state with elected officials going to D.C. to get money for infrastructure projects.

“Between 2010 and 2020, we got left behind on federal investment here along the West Coast. East and Gulf Coast ports received more than $11 billion compared to just over $1.2 billion invested in West Coast ports during that 10-year span. And the early take on the bipartisan infrastructure bill: two projects for the West Coast compared to more than 30 for the East and Gulf coast ports.”

Click for more articles by Greg Miller

Related articles:

- January imports up from December, but February is looking weak

- Maersk: Container shipping contract rates will sink to spot levels

- Lag effect: Why liner profits stay high much longer than spot rates

- Here’s how container shipping lines can escape a crash in 2023

- ‘Surge finally over,’ US imports back near pre-pandemic levels

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels