“We’re starting to see some traction,” Port of Los Angeles Executive Director Gene Seroka proclaimed on Bloomberg TV on Tuesday. “Those aging containers are down by 50% over the last six weeks.”

Seroka was referring to long-dwelling containers targeted by a dramatic, highly controversial fee plan backed by the Biden administration. Or rather, a plan that threatens to levy a fee that no one, including the ports, ever wants to be levied.

The fee on long-dwelling containers was set to begin on Nov. 1, then delayed until Nov. 15, then to Nov. 22, Nov. 29, Dec. 6 and Dec. 13. The string of delays has led to an increasing belief that the fee will never happen.

Will a plan to threaten a fee continue to work after so many reprieves, particularly as the “empty Christmas shelves” political risk dissipates?

It’s already working a lot less than it used to. American Shipper analyzed all of the available statistics and found that progress in clearing long-dwelling containers has slowed significantly over recent weeks.

Shipping consultant Jon Monroe wrote in his weekly newsletter: “My money says the new port surcharge may never be implemented — as long as we continue to improve the port congestion. And is this happening? NO. But don’t tell anybody. This is best kept a dirty little secret left uncovered.”

Meanwhile, percentage changes such as the one cited by Seroka are inherently prone to spinning. The White House reports declines measured in twenty-foot equivalent units, whereas the ports publicly report declines in containers, regardless of size. The ports of Long Beach and Los Angeles report their container numbers in two different ways. And any percentage change is heavily skewed by which date range you pick.

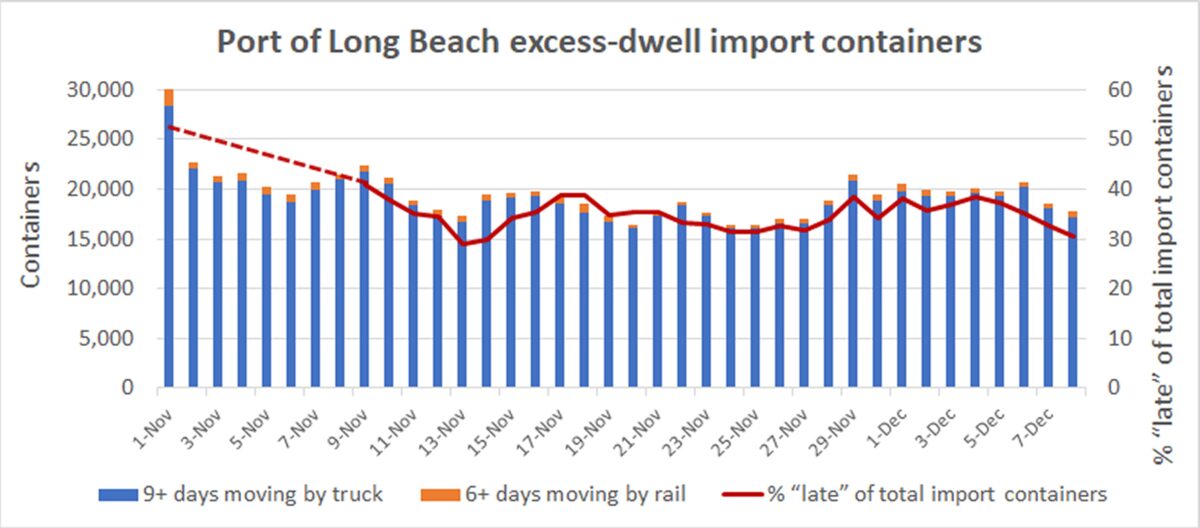

Port of Long Beach

The fee plan, if ever implemented, would charge ocean carriers $100 per import container for boxes moving by truck that dwell for nine or more days, and for boxes dwelling six or more days that move by rail. The charge would escalate by $100 a day until a container leaves the port. Carriers have said they will pass the charge along to shippers.

The Port of Long Beach provides statistics on the number of containers that meet these two specific “late” definitions. But the Port of Los Angeles does not.

For Long Beach, the vast majority of reported late containers are in the nine-days-plus category for trucking, not the six-days-plus category for rail. The total on Monday, 20,772 containers, was actually 20% higher than the total three weeks prior, on Nov. 13, of 17,271 containers. Excess-dwell containers represented 35% of total import containers on the port on Monday, up from 29% on Nov. 13.

Looking all the way back to Nov. 2, five weeks ago, the total number of excess dwell containers in Long Beach was down 22% as of Wednesday (the decrease is even higher, at 32%, when comparing to Oct. 28). Yet the numbers in Long Beach have plateaued more recently. Furthermore, the number of total import containers at Long Beach terminals has not decreased — it has actually slightly increased. There were 57,042 import containers at Long Beach terminals on Nov. 1 and 57,970 on Tuesday.

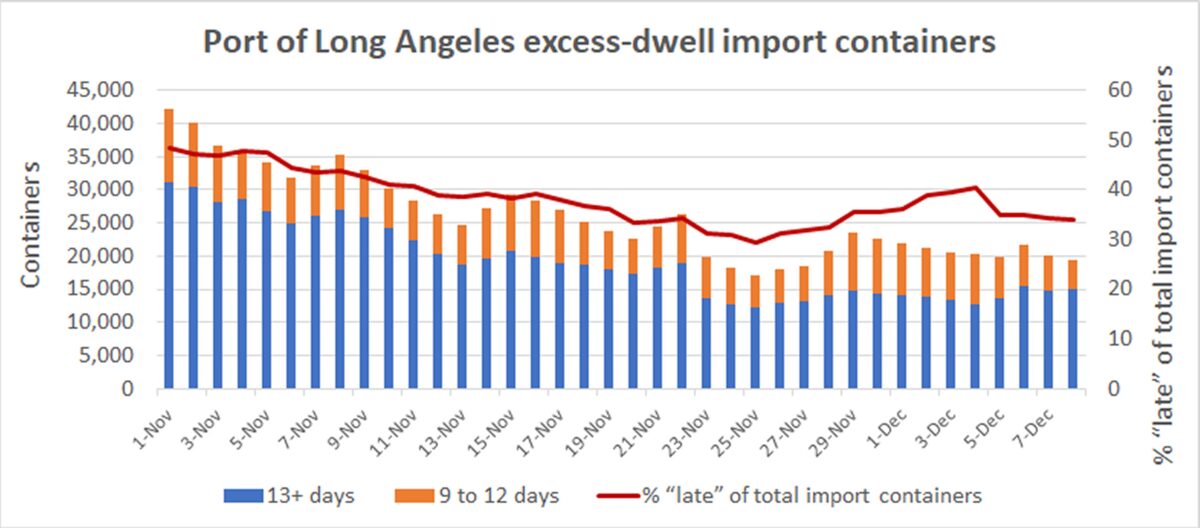

Port of Los Angeles

The Port of Los Angeles posts numbers on containers by days dwelling: up to four, five to eight, nine to 12, and 13-plus. Stats are available from Nov. 1. (The Port of Long Beach has these figures as well, but only from Nov. 9.)

The number of containers in Los Angeles dwelling nine days or more is a fair approximation of the number that would be charged excess-dwell fees if those fees were ever charged, but it excludes late rail containers in the six-to-eight-day category.

On Oct. 24, the day before the fee announcement was made, there were 37,410 containers in Los Angeles dwelling nine days or longer. The decline over the past six weeks matches the figure cited by Seroka on Bloomberg.

Unlike in Long Beach, Los Angeles has seen a sharp drop in total import containers on the port. On Nov. 1, there were 87,485. On Wednesday, there were 57,311.

Despite the drop in total import containers at Los Angeles terminals, the percentage of containers dwelling nine days or more versus the total was 34% on Wednesday, the same percentage as Nov. 21.

As far as the long-dwelling containers targeted by the fee-threat plan, progress stalled in Los Angeles around Nov. 23. The numbers over the past two weeks have plateaued.

White House reports

The White House puts out twice-monthly releases on supply chain issues, including stats on containers dwelling nine days or more at the ports of Los Angeles and Long Beach. The White House reports the numbers in TEUs, not containers (most of the containers in LA/LB are 40-footers).

On Nov. 29, the White House reported that the number of long-dwelling containers in the two ports was 75,000 TEUs, a week-on-week drop of 7% from 81,000 TEUs on Nov. 22.

The ports of Los Angeles and Long Beach reported a combined 45,458 containers dwelling nine days or more on Nov. 22, and 44,919 on Nov. 29, representing a much smaller week-on-week drop of 1%.

Click for more articles by Greg Miller

Related articles:

- It’s official: 96 container ships are waiting to dock at SoCal ports

- Ships in California logjam now stuck off Mexico, Taiwan and Japan

- California ship pileup still piling up — but out of sight, over horizon

- Congestion, falling arrivals hit Southern California import volume

- How to make a billion when your ships are stuck at anchor

- $25B worth of cargo stuck on 80 container ships off California

David

While I like this article and agree about the “best kept dirty secret” more questions need to be asked and reported on to get to the root cause of what is causing the congestion. For example, What is the daily fill rate for the open job requests at the port? Has anybody ever reported on how these union jobs are distributed, matched up, and what happens if not enough members show up on a given day? What is the true capacity of the port workload given the # of berths, amount of necessary equipment, and labor supply? Are the ports operating at 50% 75% 100% or 125% of true capacity?

How Is California’s AB5 affecting the carriers involved in hauling containers to and from the port?

How do rates compare between hauling containers to and from the port to general short-haul freight in Southern California? In other words, can carriers make more money hauling general freight as compared to port freight? How does the appt system at the port help or hurt carriers and affect their bottom line?

How does the Port requirement to be a “California Clean Truck” to haul Port freight and other regulations like the TWIC card requirement affect capacity?

How are the Big retailers influencing port operations at smaller company’s expense or is that just a rumor?

Figuring out the entire system and where the many pinch points are is the only way to truly grow. Right now everyone just points fingers at each other.