U.S. truckload capacity has continued to loosen in November as tender rejection rates fall and spot rates find a new floor.

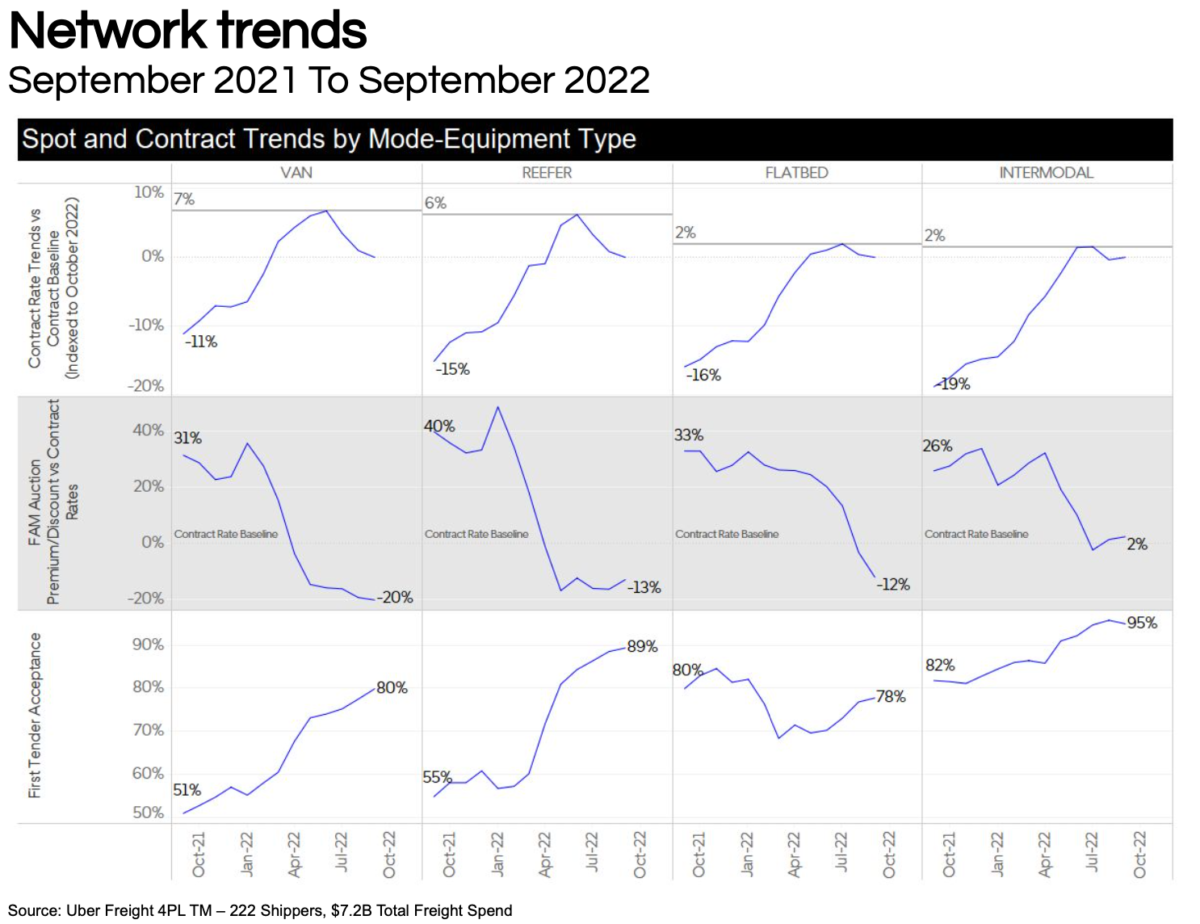

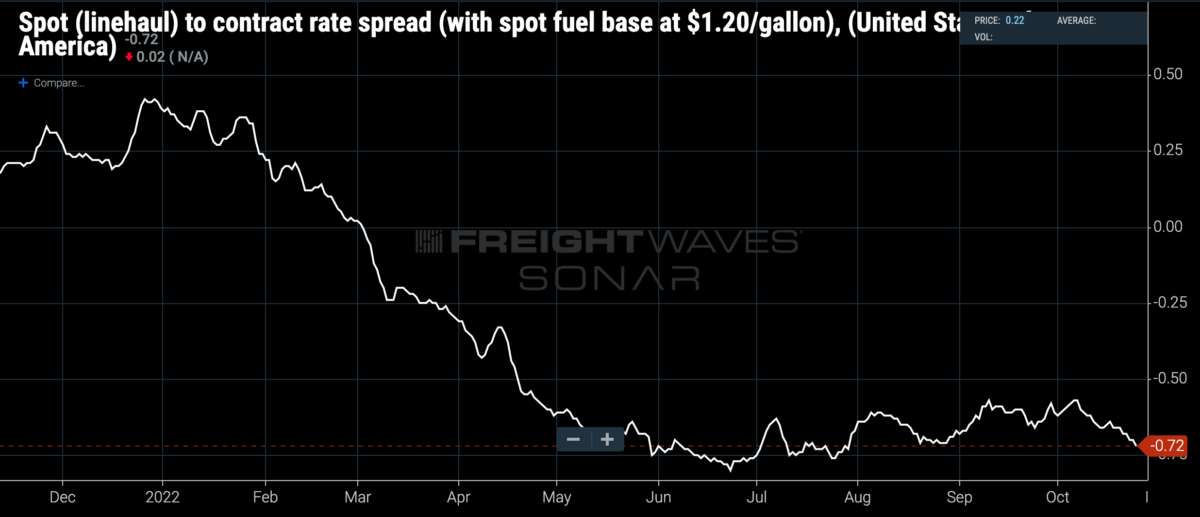

Freight brokers told FreightWaves that shippers are working contract rates down as the trucking industry enters bid season. For a few weeks in September and October, it appeared that contract rates were falling fast enough to start closing the gap between contract and spot, but spot carriers are again lowering their rates in lieu of a strong peak retail season materializing.

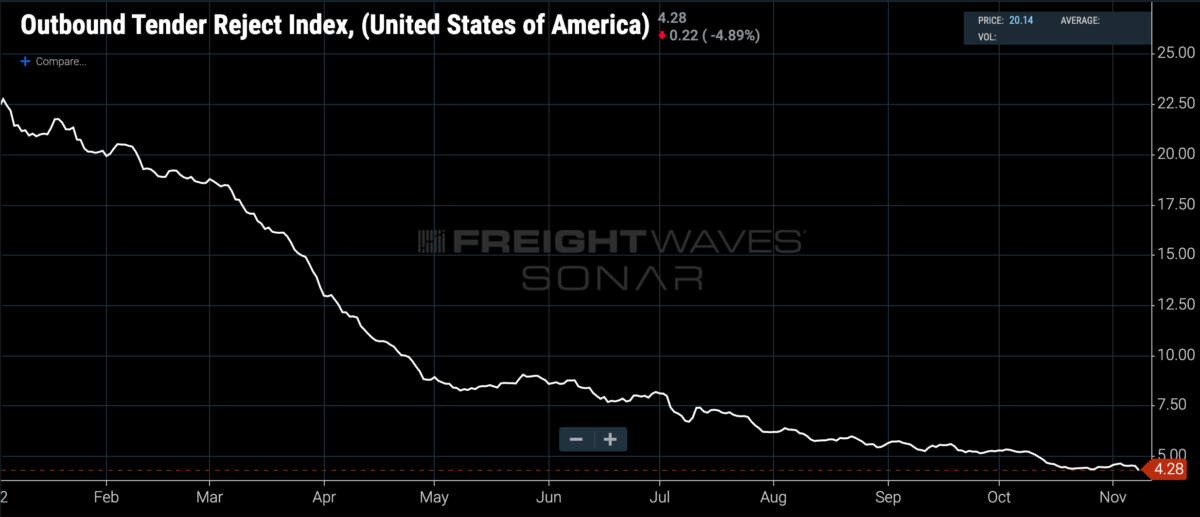

The national average outbound tender rejection rate fell to 4.28% Tuesday, a new low for the cycle that reflects a broad-based shift among asset-based carriers and freight brokerages alike from pricing strategies that maximize yield and margin to strategies to maintain asset utilization and volume.

‘We’ve seen an increase in the frequency of pricing events, which we welcome,” said Jamie Teets, CEO of Transportation One, a Chicago-based freight brokerage. “This allows for a fluidity in contract pricing that promotes higher levels of Primary Tender Acceptance (PTA), carrier performance and in turn overall shipper satisfaction. We still engage in annual RFPs but see the biannual or even quarterly model as more effective from an overall network management standpoint.”

In Uber Freight’s Q4 market update and outlook, the 3PL reported that contract rates continue to drop through the RFP process, but spot rates have mostly stabilized, and Uber Freight sees “continued pressure in incumbent carrier pricing as shippers look for cost savings. First tender accept[ance] has significantly improved as demand retreats.”

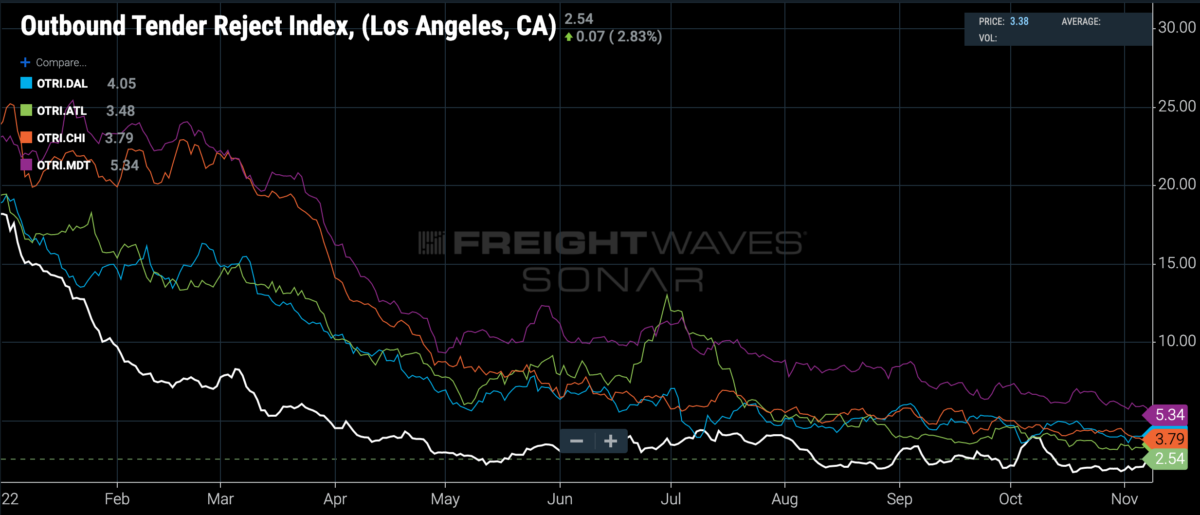

Loose capacity conditions appear to be prevailing across the majority of the U.S. trucking market, with little regional variation or troublesome “hot spots” where trucks are difficult to procure on a spot basis.

“There are no regions going against the grain as a whole,” a business analyst at a top 10 freight brokerage told FreightWaves, “maybe a little in the West, like the PNW, but it’s not noteworthy, just a little harder than in other areas.”

Indeed, of the five largest trucking markets by outbound volume — Los Angeles, Dallas, Atlanta, Chicago and Harrisburg, Pennsylvania — only Harrisburg has higher tender rejection rates than the national average.

It’s normal in a down cycle for Los Angeles to see lower tender rejections than the broader market because carriers tend to reallocate their assets to the most reliable sources of freight, which oversupplies those particular markets. But the fact that major markets, regardless of region, are all below the national average is striking.

Spreads between truckload spot and contract rates are deeply negative, putting downward pressure on contract rates, as reflected in recent bids. When spot rates are well below contract rates, shippers have pricing power and can move their shipments on the spot market and reduce their cost, denying volume to their contracted carriers. Shippers use their volume leverage to pressure carriers to reduce contract rates, compressing the spread.

On the other hand, when spot rates are well above contract rates in a hot market, carriers reject their contracted freight and redeploy their assets into the spot market to fetch high rates per mile, using their capacity leverage to pressure shippers to increase contract rates and compress the spread.

Despite contract rates trending down, spot rates have fallen at the same pace, maintaining a deeply negative spot-contract spread and putting further pressure on contract rates. That relatively wide spread keeps freight broker gross margin percentages healthy, even as net revenue dollars per load deteriorates. In other words, although the “take rate” may remain the same, total dollars of margin generated per load are falling.

“‘We expect spot and contract pricing to intersect at some point in 2023,” Teets said. “Regardless of market environment, we continue to focus on strengthening our long-term partnerships on all sides of the shipment. We understand the cyclical nature of the North American full truckload marketplace and how our partners are affected at all stages of a market cycle.”

During C.H. Robinson’s third-quarter earnings call, CEO Bob Biesterfeld suggested that even Robinson’s traditionally aggressive approach to pricing — especially in scooping up volume with low contract rates in soft markets — has not been enough to grow volumes meaningfully.

“In our NAST Truckload business, we grew our year-over-year volume for the sixth quarter in a row, albeit with a modest shipment growth of 0.5%,” Biesterfeld said. “Volume growth in drop trailer, flatbed and temperature control was partially offset by a decline in our dry van volumes. Within the quarter, we saw mid-single-digit volume increases in July turned to declines in August and September as freight demand weakened.”

As the largest freight brokerage in North America by far, C.H. Robinson has a harder time taking market share than other non-asset players.

A business analyst at a top 10 freight brokerage told FreightWaves that so far, on his boards, “volume is holding up for us, we’re just seeing more capacity willing to drop rates. Retail peak usually gets going by mid-November, but there are no signs of it.”

Stephen Romont Hardridge

The freight brokerage system needs to be abolished. If a shipper is lowballing feight brokers, then freight brokers lowball us. But if the shipper attempts to lowball a carrier,their feight will sit.

Chris Spicer

Paul, the brokers are in a bidding war with many other competing brokers to the point where their making the bare minimum on loads and sometimes losing money just to get the bid. The market to get freight is extremely competitive right now. My concern is to the point of how low brokers will go just to get the work? Shippers are getting the higher end of the market, that is for sure. But at what cost? Let’s say brokers bid on today’s market rate for next year and are stuck at these really low contracted rates for 2023 and the market flips to where the trucks won’t move freight for $3 a mile and the brokers have it bid at $2.50 for example for the year, are more brokers going to go out of business in 2023 than? I hope not but I am nervous of that happening next year.

Ed Shada

Ok, truck and trailer prices are going up. I just financed refers costing $87,000 plus $27,000 for thermo king at 6%. And interest rates rose after. Shipping rates have to go up or owners are out of business.

David bell

Evidently the morons in charge think they can raise rates to the point there’s no profit for the O/O and they will still get there freight moved. Now that he election is we are going to see fuel prices skyrocket since that’s the communist democrats goal. I’m to the point of parking the truck there’s no need to work for free.

Josh Allen

Paul Your ugly. Eliminate Deez Buddy!

Clint Stringer

I’m uncomfortable after reading this, Paul. Please don’t eliminate me.

Jeremy S

Dang Paul. Tell us how you really feel.

paul headley

this is false and misleading.it showes the evil lies of the people trying to destroy ower operaters in this country..for 1 rates have dropped 5 months ago.and there more like 50″%…i use to be able to make enough money to fix my truck pay my taxes.road taxes.tires pms ect now since i bring in enough to pay fuel and insurance.and maybe a extra 1000 bucks a week.cant upgrade this is putting american truckers in a position to loose everything we have .its a form of slavery..the bible says the anti christ will be in control of the economy.and thats what is going on brokers are saying manufactores our not paying its the brokers..if im put out of bussiness im gonna become the biggest cereal eliminator in history for stealing my famileys future..hell is coming to town watch for it