There’s an old adage: “Forecasting is the art of saying what will happen and then explaining why it didn’t.”

Remember those dire warnings that container carriers could suffer catastrophic losses and go bankrupt en masse, crippling the global container-transport system? Today, carriers are obtaining very high spot rates on the China-to-West Coast route — and could theoretically end the year with big profits.

Copenhagen-based Sea-Intelligence laid out two scenarios back on April 6. In one, container carriers lost 10% of volume and kept rates stable, leading to 2020 losses of $800 million. In the other, both volume and rates fell 10%, leading to a staggering loss of $23 billion.

On Monday, Sea-Intelligence CEO Alan Murphy, in line with the old adage, explained why neither of those forecasts will happen. “The carriers have shown that they did not maintain stable freight rates. They have actually increased them quite substantially,” he said.

Sea-Intelligence has now introduced two scenarios that are completely different than the original two. In one, container lines start a pricing war in the second half and rates fall, with carriers losing $7 billion. In the other, carriers keep rates at current levels and pocket over $9 billion in profits.

Rates are surging

Carriers “blanked” (canceled) an unprecedented number of Asia-U.S. and Asia-Europe sailings in the second quarter to balance vessel capacity with reduced shipper demand in light of coronavirus lockdowns and social distancing.

As it turned out, cargo demand exceeded unblanked vessel supply, causing rates to rise, particularly in the Asia-West Coast trade.

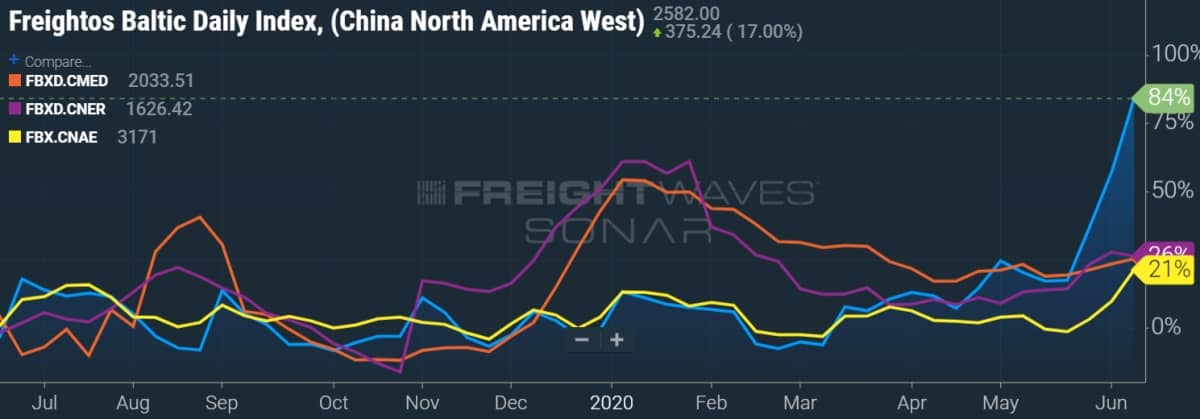

According to the Freightos Baltic Daily Index for this route (SONAR: FBXD.CNAW), rates were up to $2,582 per forty-foot equivalent unit (FEU) on Friday. Over the prior three weeks, rates shot up 57%. They are now back up to where they were in late 2018 when U.S. shippers were front-loading import cargoes to beat tariff deadlines.

Trans-Pacific rates to the West Coast are up 84% year-on-year. Other mainline east-west trades are doing better as well. Rates from China to the East Coast (SONAR: FBXD.CNAE) are up 21% year-on-year, with China-North Europe rates (SONAR: FBXD.CNER) up 26% and China-Mediterranean rates (SONAR: FBXD.CMED) up 25%.

Carrier-shipper tensions to rise

Tensions will inevitably escalate. Beneficial cargo owners (BCOs) are in the midst of a recession and are paying higher transport costs as a result of carriers’ decision to artificially restrict capacity, with vessel capacity largely under the control of just three large global carrier alliances.

Asked for comment by FreightWaves, National Retail Federation (NRF) Vice-President of Supply Chain and Customs Policy Jonathan Gold replied, “We remain very concerned about the ongoing issues that are impacting the ocean carrier industry right now.

“As NRF members continue to focus on reopening their stores and ensuring the protection of their workforces and their customers, the extra costs and uncertainty around the supply chain further complicate these issues.

“While we understand that the uncertainty about the holiday season is a challenge, carriers must work with their retail partners to ensure that service levels remain high to ensure that the supply chain does not become a barrier to ongoing economic recovery,” said Gold.

Steve Ferreira, founder and CEO of Ocean Audit, told FreightWaves, “With less capacity, ocean carriers are able to, de facto, create not only a target-rich environment to hold general rate increases, but also, in effect, gain a peak-season surcharge — all in one.

“BCOs — those that did not sign lucrative contracts back in April — don’t have much to push back against, and in effect, this is going to cause many BCOs to move to NVOs [i.e., NVOCCs, non-vessel-operating common carriers], so short term, the high spot rate environment is great for per-TEU [twenty-foot equivalent] unit profitability [for carriers], but long term, clients have great memories for who gave them rates and space,” he said.

According to Henry Byers, maritime market expert at FreightWaves, “Most NVOCCs that have more than 10,000 TEUs of volume on a given trade lane normally sign large space commitments at fixed-rate levels with the ocean carriers every year regardless of what BCOs choose to do. NVOCCs signed fixed-rate deals with carriers when contract rates were being offered at the end of April.

“Since the spot rates were depressed and looked like they might dip even further, BCOs chose to hold off on signing contracts because they thought that these fixed rates could have ended up being much higher than what the spot market would be if rates had continued to decline,” said Byers.

“Ocean carriers have been able to cut capacity in a way that has led to large spot-rate increases now that demand has been picking back up on the trans-Pacific. So, with spot rates increasing, BCOs are able to get a better deal by booking with NVOCCs who are now able to offer better rates than the BCOs can get in the spot market from carriers.”

According to Byers, “This really pisses ocean carriers off because BCOs didn’t choose to sign contracts like they had in years past, so carriers are looking to get all of the extra profit that they can from these shippers in the spot market.

“The BCOs inevitably start shifting volume to the NVOCCs at cheaper rates than they could get in the spot market from carriers. As a result, NVOCC profitability is looking quite good on this trade lane at the moment.

“But as time goes on, carriers will begin going back to BCOs and offering more competitive short-term fixed-rate contracts on a quarterly basis or something similar. The BCOs have the volume. They can do whatever the hell they want, and ultimately, ocean carriers can go and undercut NVOCCs if they really want the volume directly from the BCOs.”

There’s fallout from the container carriers’ capacity strategy on the U.S. export front, as well. Peter Friedmann, executive director of the Agriculture Transportation Coalition, told FreightWaves, “The higher rates achieved by ocean carriers reducing sailings and the number of containers coming into the U.S. from Asia are worrisome for exporters. Export volumes have stayed strong, and thus demand for containers remains high. In parts of the country, shortages of empty containers are creating significant challenges for exporters.”

Major changes ahead in 3Q

Major changes are in store for the trans-Pacific lane in the third quarter. On the vessel supply side of the equation, carriers do not appear likely to blank nearly as many sailings as in the second quarter.

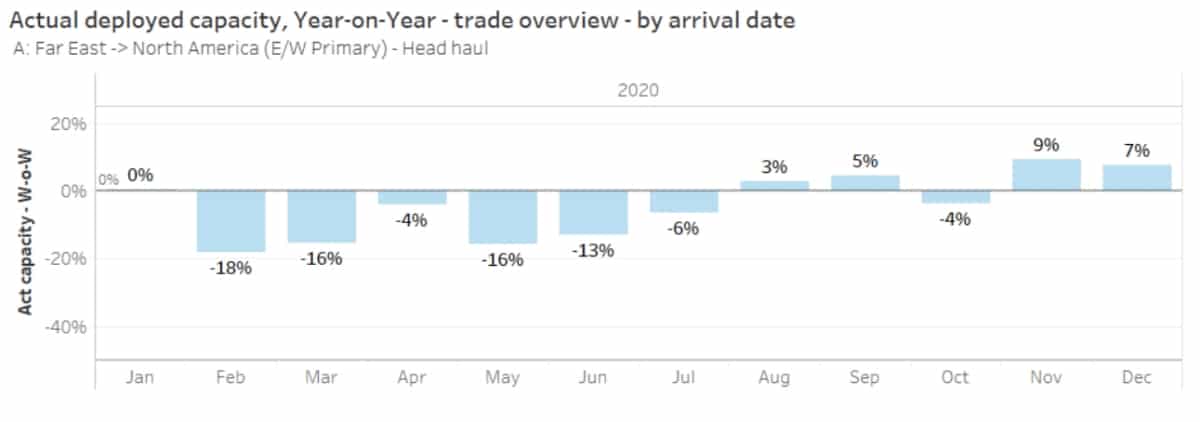

Data provided to FreightWaves by Copenhagen-based eeSea shows that only 3% of arrivals in the U.S. from China have been canceled so far for the third quarter, versus 14% for the second quarter.

Of course, container lines could announce more cancellations. But assuming they don’t, schedules are set to normalize starting in the second half of July. Scheduled capacity for August and September is actually up year-on-year, by 3% and 5%, respectively, according to eeSea data.

Meanwhile, the demand side of the equation remains a giant question mark. Will the rebound in U.S. import demand accelerate further during what is usually the peak season, or will back-to-school and holiday-season orders be curtailed by coronavirus fallout despite states reopening?

If demand falls short and the market reverts to having too much vessel capacity versus too little because fewer sailings are blanked, will container lines seek to woo BCOs away from NVOCCs and from other carriers by engaging in a price war, as they have in the past?

Murphy at Sea-Intelligence believes it’s more likely that carriers will continue to hold the line in the second half. If so, carriers could end up in the black during a year when BCOs are deep in the red. Click for more FreightWaves/American Shipper articles by Greg Miller