Leading North American third-party logistics provider C.H. Robinson (NASDAQ: CHRW) reported fourth-quarter adjusted earnings per share of $1.74 before the markets opened on Wednesday, up 61% year-over-year but missing consensus estimates of $1.85 per share. The stock traded down 10% premarket at approximately $93.72 per share.

Total revenue grew 42.9% year-over-year to $6.5 billion, while gross profits increased 33.7% to $850.7 million.

“In the face of some of the greatest disruption and tightest capacity the logistics industry has ever seen, C.H. Robinson demonstrated strength, resilience and commitment to our global customers in 2021,” Bob Biesterfeld, president and chief executive officer of C.H. Robinson, said in a statement.

Robinson is organized into three business segments: North America Surface Transportation (NAST), which includes domestic truckload and less-than-truckload freight brokerage and intermodal; Global Forwarding, the international ocean and air cargo division; and All Other and Corporate, which includes legacy produce broker Robinson Fresh.

NAST fourth-quarter revenue grew 26.1% year-over-year to $3.89 billion, but income from operations fell by 1.4% on thinner margins and lower productivity. Adjusted gross profits rose 19.7% to $475 million, implying a gross margin in the brokerage of 12.2%, which continued a multi-cycle downward trajectory.

The majority of NAST’s revenue growth came on the back of higher rates. Truckload volume was up 7.5% but LTL volume was down 2.5%, netting out to an overall volume growth rate of 1.5% year-over-year.

Although NAST shipment volume grew by just 1.5%, NAST operating expenses grew by 32.7% year-over-year, “primarily due to higher incentive compensation and higher headcount and also due to the benefit realized in 2020 from our short-term, pandemic-related cost-reduction initiatives,” Robinson management said in the earnings release. NAST headcount, meanwhile, was up 7.5% year-over-year. Income from operations fell 1.4% to $148.4 million.

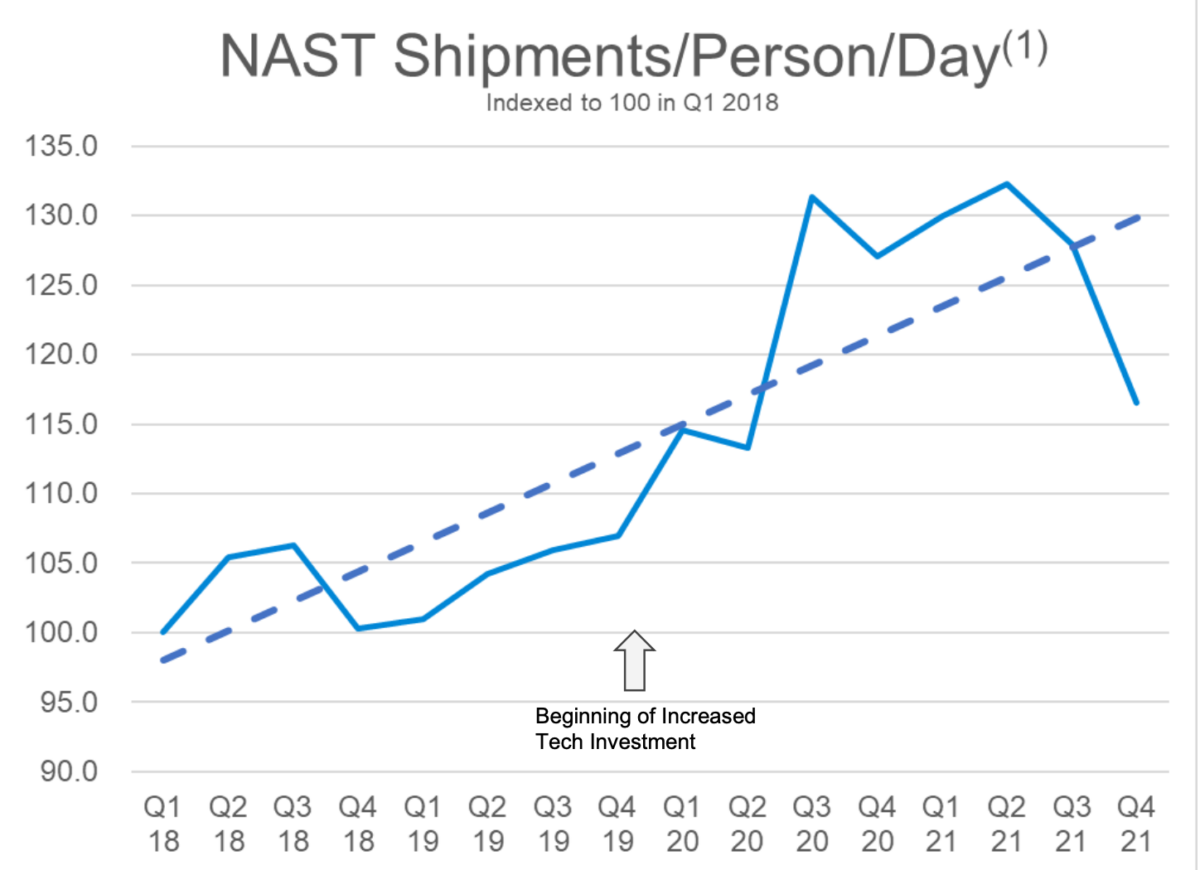

Robinson in recent years has leaned into volume growth in LTL, a mode that freight brokers have long automated given the highly consolidated LTL carrier landscape, and boosted a key productivity metric, NAST shipments per person per day. But productivity in the fourth quarter fell sharply, erasing a year’s worth of progress.

Yesterday, FreightWaves reported that C.H. Robinson had delayed the rollout of its carrier-side digitization initiative, Project Infinity, after technology issues and skepticism from brokers on the floor.

Wall Street analysts reacted negatively to NAST’s results.

“It’s true the company should benefit as spot rates plateau and even moderate over the course of 2022, but it’s clear CHRW’s net revenue debate is now moving further down the income statement to an opex debate,” Deutsche Bank transports analyst Amit Mehrotra wrote in a client note Wednesday morning.

Robinson’s growth engine during the pandemic has been Global Forwarding, with revenues more than doubling in the past year, growing 108.1% in the fourth quarter to $2.14 billion. Adjusted gross profits grew 71.9% year-over-year to $309 million, and income from operations jumped 151% to $146 million.

Ocean volumes were up 5% year-over-year, and metric tons shipped by air grew 37.5% compared to the fourth quarter of 2020. But those volumes were far more profitable in Q4 2021 than Q4 2020: Gross profit per ocean shipment was up 78%, and adjusted gross profit per metric ton of air cargo increased 39.5%. Operating expenses in Global Forwarding increased 33.9% year-over-year, while headcount was up 17.4%.

In All Other and Corporate, total revenues grew 7.5% year-over-year to $461 million; Robinson Fresh grew its revenue by 10.2% to $26 million.

Robinson returned $222.8 million in cash to shareholders, split between $154.5 million in share buybacks and $68.4 million in dividends.