There are still not enough containers in the right places to carry the world’s cargoes. The hope was that Chinese container factories would shift into ultra-high gear — that the industry would build its way out of the equipment crisis.

It hasn’t happened.

In fact, Chinese factories are intentionally not going into their highest gear, according to Tim Page, interim president and CEO of container-equipment lessor CAI International (NYSE: CAI). Instead, they are managing output to keep prices high.

The ‘building spree’ solution

“What’s happening now [with equipment shortages] is exactly the same scenario we saw in 2010 after the financial crisis,” explained Lars Jensen of SeaIntelligence Consulting during a webinar in late January.

“If you look at 2010, they went on a building spree,” recalled Jensen. “It took about three months from when the problem arose to when it was resolved. If we put that in the context we have now, this should be resolved by Chinese New Year.”

It is now Chinese New Year. During the quarterly calls of container-equipment lessors CAI and Triton International (NYSE: TRTN) on Tuesday and Textainer (NYSE: TGH) on Wednesday, executives confirmed that demand for new containers is as high as ever.

“The shipping lines are scrambling to grow the size of their container fleets because they’re being limited on volumes right now because of lack of equipment,” said Triton CEO Brian Sondey. “And we’ve been scrambling to place orders [with Chinese factories]. It has been a race between our ability to order and the demand from our customers.”

In January, Jensen emphasized that port congestion was the wild card that would “delay things somewhat.”

Congestion is definitely still delaying things. As of Wednesday, there were still 35 container ships at anchor off the shores of Los Angeles and Long Beach — near record highs.

But it’s not just congestion. Chinese factories are yet another wild card.

Factories ‘managing capacity’

Three Chinese companies — CIMC, DFIC and CXIC — produce about 80% of the world’s containers. Drewry Container Maritime Research estimates that global production will increase 6.5% this year.

Meanwhile, the price of a new container has risen from $1,800 per cost equivalent unit (CEU, a measure of the value of a container as a multiple of a 20-foot dry cargo unit) in early 2020 to $2,500 per CEU in late 2020 to $3,500 per CEU or higher today. Factories are sold out until July.

John O’Callaghan, head of global operations at Triton, called the current rate “the highest I can remember.”

According to CAI’s Page, “The manufacturers seem to have little or no interest in accelerating container production. They’re more focused on maintaining high container prices. So, I think you are not going to see a flooding of the market with containers. You’re going to see a very measured response by the manufacturers to control the tight supply-demand balance that exists today.

“The factories are behaving differently than they have in the past,” Page maintained. “They don’t have any interest in increasing production at the expense of price. I think it’s a new dynamic in our industry. And I think it’s going to stick.”

He implied that container factories could increase production further, but aren’t. “I wouldn’t say that they can’t increase production. I would say that they are managing their capacity to maximize revenue and profitability.”

According to Textainer CEO Olivier Ghesquiere, “Although manufacturers have increased production, additional capacity has been added very progressively and has been further constrained by shortages of certain components.”

Asked whether container prices could go higher still, Page replied, “The Chinese manufacturers are controlling what production levels are and what container prices are. And ultimately, if a shipping company has freight to move from China or someplace in Asia to Europe or the United States and they need containers to do it and they don’t have those containers, that’s a recipe for rising container costs.”

Replacement supply vs. incremental growth

As for the increases in production that have occurred, much is actually replacement supply for older containers. Everything factories produce is being quickly consumed by market demand.

“Container supply remains very tight despite factory production ramping up,” said O’Callaghan

He pointed out that for a 12-month period from Q3 2019 through Q2 2020, global production was below replacement requirements.

Page brought up the same point. “This ramp-up of production we’ve seen since the fourth quarter comes on the heels of container fleets shrinking over a 12-month period. In that context, a lot of what’s been going on is really replacement of the fleet just to stay even.”

Ghesquiere commented, “Our view is that there we will not see a situation where there will be an excess of containers, because the market was in short supply before this cycle really started.”

Add it all up and it does not paint a pretty picture for U.S. cargo shippers.

Yes, new container production is up. But a lot of that is just filling the gap left by prior underproduction. And the box building spree that came to cargo shippers’ rescue in the past looks less likely this time around — assuming the small number of Chinese factories that control the global market opt for price over volume.

Equipment-lessor earnings roundup

Crisis conditions in the global container system have been extremely challenging and costly for cargo importers. They’ve also been extremely profitable for container-equipment lessors — and their stocks are performing accordingly. Over the past six months, shares of CAI are up 88%, Textainer 83% and Triton 56%.

These three companies just beat earnings estimates across the board.

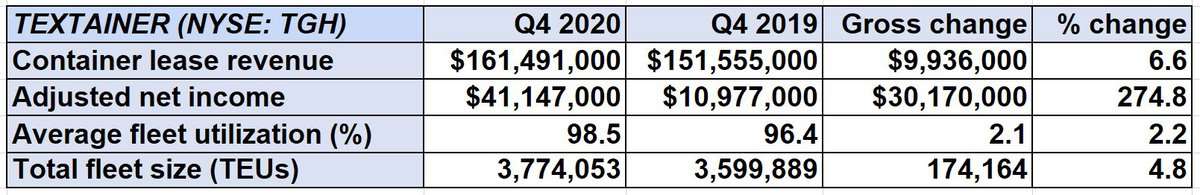

After market close on Wednesday, Textainer reported net income of $44.3 million for Q4 2020 versus $28.8 million in Q4 2019. Adjusted earnings of 81 cents easily topped the consensus for 50 cents.

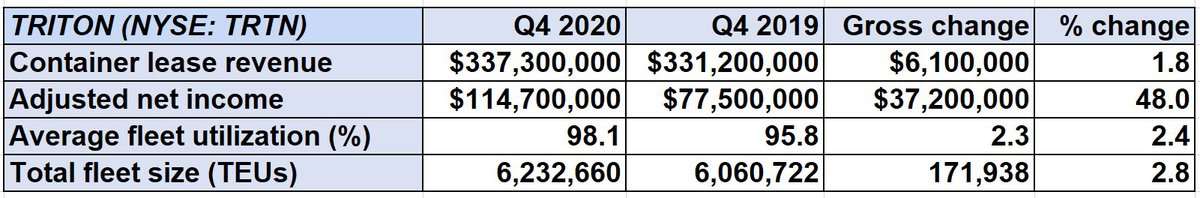

The day before, Triton reported record net income of $115.2 million for Q4 2020 compared to $77.2 million in Q4 2019. Adjusted earnings per share of $1.70 handily beat the consensus forecast for $1.43.

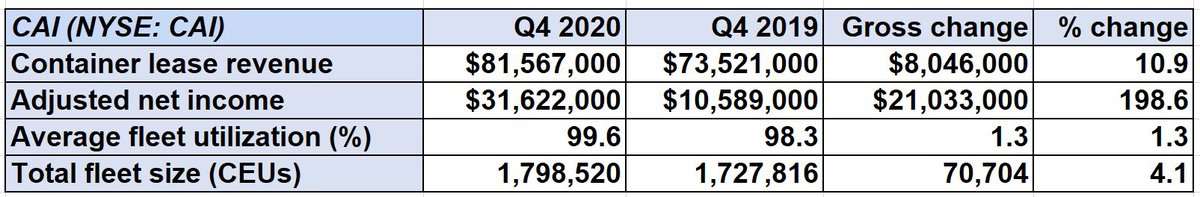

CAI reported net income of $12 million for Q4 2020 versus $10.5 million in the same period the year before. Adjusted earnings per share (excluding discontinued operations) came in at $1.81, well above analyst expectations of $1.13. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: New video shows massive scope of California box-ship traffic jam: see story here. Trans-Pacific trade crashes into ceiling: see story here. COVID outbreak could cripple ports: see story here. Inside California’s container-ship traffic jam: see story here.

Roy Lu

The freight rates dropped by more than 13%!

mrbigr504

We ship recyclable metal to China and then they flood the market with cheap steel and knock the US out of business with the same steel we shipped to them! I pull containers and I’ve picked up so much of that stuff going to China that it’s ridiculous! I’ve been hear this story for a while and wonder why we can use our own recyclable metal and make containers? I know there’s an environmental issue that comes into play with this but we have our own resources to keep it USA right? I may not be spot on but I know I’m not too far off the mark! We shouldn’t have to keep relying on China so damn much that is slows us down or takes business from us on a global scale! At least keep China’s hand out our pocket! I didn’t vote for that a–hole #45 but he was definitely on to sump’em with theses trade deals! US businesses shout USA but are the main ones outsourcing to China and India, etc!

Tcs53

Ocean freight ,air freight both are garbage. Neither one pays! You want to bring the cost of containers down? Quit buying overseas,BUY AMERICAN ‼️ China knows that they can control Sleepy Joe.

Company driver

Make boxes out of Fiber. Like maybe dirt

Rick

I’ll tell you how solve the container problem don’t buy overseas

mrbigr504

Right?