There are multiple contrasting intermodal market outlooks for 2020.

One was posted by FreightWaves’s Mike Baudendistel on Feb 29th (Forecasting intermodal in 2020). His main points included:

- There are significant weaknesses in the imports of containers from China

- There could be a shortage of goods in the China-U.S. supply chain, thus negatively impacting U.S. intermodal volumes

- Outbound loaded data from one FreightWaves source shows a recent drop in outbound container volume from China to the U.S. market “from around 3,300 a day on a seven-day average to only about 1,830 a day”

- That is a significant volume change

- Intermodal organizers like the Hub Group “expect intermodal prices to be down for 2020” largely as a function of weak market demand for the rail services

- The railroad managers at the Class I companies are resisting cutting their rail rates to retain or to grow customer market share as the current market demand for rail movement decreases

- Experts from companies like TTX (the major railroad intermodal container railcar operator) admit that they know of only about 2,000 units of domestic sized 53-foot long containers being added to the North American fleet this year – fundamentally as a replacement of retiring units and not for growth

As on overall summary, the business sector sometimes referred to as “third-party intermodal organizers” overall don’t see their intermodal volume increasing year- over-year during 2020 by more than a low- to mid-single digit level.

Other sources referenced in preparing this commentary might be classified as even less optimistic about rail intermodal.

Yes, as Baudendistel points out in his article, railroad intermodal service quality appears to be improving year-over-year – and there is plenty of overall track and route service capacity across the core intermodal railway track network. So there is indeed capacity that could be used to gain market share.

So far in 2020, that market share gain isn’t happening. Why does this subject particularly matter early in March?

It matters because currently we are just over 18% through the year. By now we have a pretty clear sample size about how 2020 is trending.

Fundamentally, the grand plans crafted by senior Class 1 rail officers – approved by their boards of directors during the 4th quarter of 2019 – do not appear to be holding up in regard to volume – nor in regard to expectations of truck market share penetration.

Deep inside corporate railroad headquarters, new spreadsheets have calculated by now the actual versus expected 2020 revised volumes. The lower volume achievement has to be disappointing.

When questioned by investors during January and February, most rail executives’ comments have at best been “reserved.”

Bottom line – into the first week of March – there is little intermodal data excitement. Mostly a “hope and a prayer” growth outlook. No corrective tactics have been offered. A wait and see attitude seems to prevail.

But is this too harsh an assessment? What are other experts saying?

A second opinion was delivered this week by Ron Sucik. He is a semi-retired expert with a long and distinguished career at TTX. I wrote a commentary about the TTX pool railcar business recently.

With his permission, here are a few key slides and market takeaways from Mr. Sucik.

The first market takeaway is an admission of a missed forecast he made last year and why.

We anticipated a potential to capture motor carrier market share because of:

- Driver shortages

- Electronic logging device disruptions

- Fuel price increases

What we did not anticipate was:

- Precision scheduled railroading (PSR) adjustments

- Potential tariff implementation

Making a market outlook call and then adjusting to competitive moves by others (like trucking companies) doesn’t seem to be a competitive strength at many of the PSR rail headquarters.

There is a logical argument that suggests intermodal marketing seems primarily investor-centric.

Amidst the dynamic and deteriorating global market conditions of early 2020, supply chain constituents that depend upon inland rail transport – like the international ports – are worried. What is the long-term game plan of their intermodal “partners?” The railroad messages to Wall Street are not relevant to these port partners.

A year ago, Sucik asked, “Where is the next layer of fruit?” Translation – what is the next growth segment for senior rail managers?

Here is a bold challenge as he asks, “Should the industry take a bold step backward and go after short-haul traffic, even if the margins aren’t as great?”

Oh my! One year later, and we are still waiting for a clear answer from a Class 1 railroad in regard to its attack plan for short-haul intermodal.

Perhaps the railroads have cut their costs too deeply. There is an argument that railroad operating departments may no longer have enough crews or locomotives necessary to pursue large new business volume initiatives. They have more track time space. But perhaps no reserve movable assets.

Railroad financial departments might instead believe, “Why take the time and effort for low-margin traffic. Long-distance service more easily pays for infrastructure, and we need a lower operating ratio to satisfy the investors.” That corporate attitude might be the inhibiting cultural factor, suggests Sucik.

Instead, it appears that the Class I railroads are sticking to a pricing scheme that targets highest intermodal margin and cash flow. Collectively, they are not lowering prices to attract incremental customers. There appears to be a corporate fear that that action might lower their targeted quarterly margins.

Is this accurate? It appears so.

You the readers might disagree. If so, you should speak out and please present your logic.

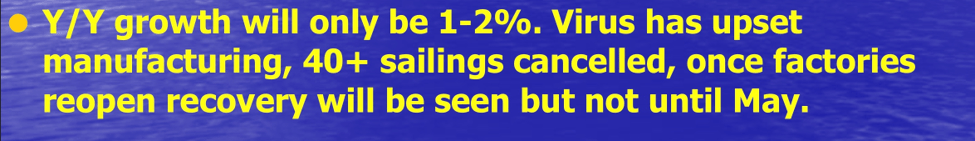

With this as background, the alternate year 2020 volume forecast as seen by Ron Sucik is this.

He predicts that “intermodal 2020 year-over-year volume will be flat.” That is not normal when we look at the past three or more decades of rail growth.

There might be a possible recovery in the second half of the year helped by the year-over-year comparisons to the low numbers recorded during the second half of 2019.

Orders for new intermodal cars and containers, if any, will likely be very small in 2020.

There is a significant excess of railcars in the intermodal fleet. That excess has to be worked off either through railcar retirement or by business growth.

Potential intermodal volume continues early in 2020 to remain with or shift to trucking.

As long as trucking has capacity and drivers – plus lower fuel prices – the railroads will face difficulty in capturing chunks of trucking’s market share.

Strategically, it is possible that as a consequence of trade policies some manufacturing activity might shift back to the United States. Yes, that would be good for the economy.

Ironically, that geographic shift might reduce intermodal rail market shifts, since long-haul movements of containers from ports to inland markets could be displaced by an increase in very short-haul inland trucking distribution changes – where intermodal has a smaller economic advantage.

Always looking for balance, what are other experts saying about intermodal? Who’s aggressive? I could not find a short-term aggressive spokesperson.

Sadly, it may be 2021 or possibly as late as 2022 for a turnaround in growth for intermodal – particularly if a recession should occur as a consequence of the global forces we are currently seeing. At this point that is a prudent reminder, and not a prediction.

Other outside experts like FTR offer these intermodal points

FTR Transportation Intelligence experts predict that over roughly the next two months, all international traffic will remain weak due to global supply chain disruptions.

The upside? FTR’s CEO Eric Starks described this week how some supply chains will see imported inventories turn from a surplus on-hand to a need for replenishment. That then could generate added rai- hauled replacement intermodal traffic.

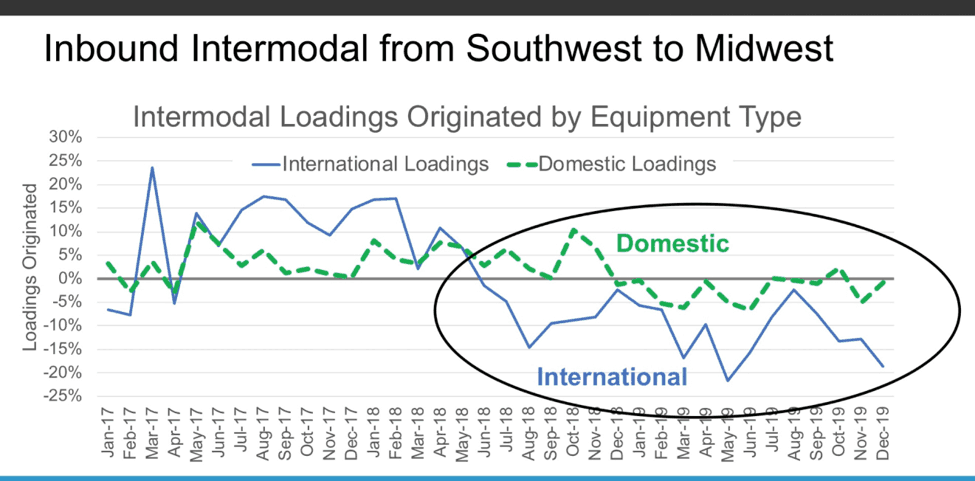

In this graphic, Starks points out how rail’s intermodal market share has stalled recently compared to trucking’s share in the long distance lanes. In part this FTR graph uses source data from the Intermodal Association of North America. The domestic 53-foot containers by rail are slightly negative as shippers are necessarily using rail as the first mode choice over the past year. And international maritime 40-containers are dropping on a percentage basis. Some of this pattern involves complex transloading logistics decisions by shippers – and shifts are based on lower spot rate truck pricing. Clearly, intermodal rail faces dynamic competition.

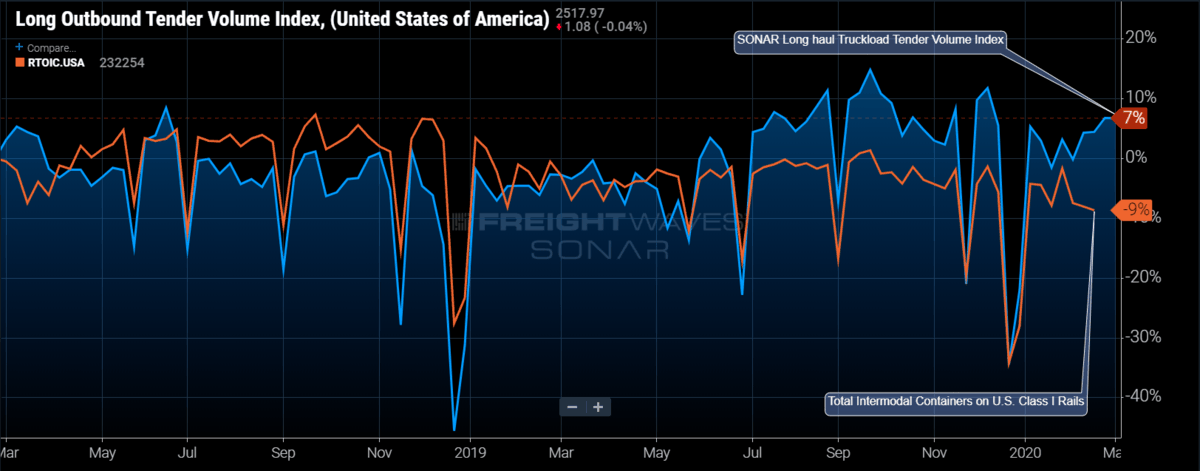

In addition, FreightWaves SONAR has a similar chart. It also illustrates that intermodal has lost share to long-haul trucking.

Meanwhile, there are many stored intermodal cars… like these in the southern California desert.

The downside risk is that if the coronavirus is not contained by mid-summer there may be no uptick in intermodal rail traffic volume for the year over the total intermodal units moved in 2019.

Therefore, intermodal year-over-year could be negative by the end of the year. This is not a prediction; just a heads-up alert.

There are other other market opportunities for the railroads beyond intermodal. There are solid carload traffic growth opportunities. The growth of railway freight need not depend solely upon intermodal.

Rod Case, a senior partner at Oliver Wyman, pushed an alternate theory this week at La Quinta, California, before about 400 financial investors and freight car experts. He suggested that selected carload traffic might actually represent a superior opportunity for securing rail freight growth. I will cover those carload opportunities in an upcoming commentary. A number are very probable prospects.

Instead of intermodal? Yes.

As a final alert, the smart play for railroads and intermodal partners is to realize that volume and car requirement cycles are a normal part of business decisions. An excess inventory of intermodal cars isn’t a good business strategy. However, there is a surplus of both trailer-on-flatcar (TOFC) as well as stack-container platform cars. Not a huge excess, but noticeable from a financial perspective.

How long might it take to work that surplus off? Sucik is my go-to guy. He thinks maybe 12 to 18 months. It’s hard to say.Readers – your contrary views are important. Please offer your thoughts.