EXPD well-positioned to protect margins in softening ocean market

A Panalpina deal wouldn’t necessarily be a bad thing

A week after Expeditors International (NASDAQ: EXPD) released its fourth quarter earnings results – a healthy earnings beat on cost control and spiking pulled-forward ocean volumes – Wall Street equities analysts have reissued price targets along a wide spectrum. Of the notes obtained by FreightWaves, Morgan Stanley’s Ravi Shanker was the most bearish, raising his 12-month price target to just $59; CFRA’s Jim Corridore led the bulls with an $81 price target. Since the market opened this morning, shares of EXPD have traded around the $75.70 mark.

Expeditors reported fourth quarter diluted earnings per share of $1.02, top line revenues of $2.24 billion (up 18 percent year-over-year), and net revenue growth of 8 percent year-over-year to $681 million.

The disparity in price targets (from 22 percent downside to 7 percent upside) reflects uncertainty, in FreightWaves view, about the growth of the Asian exports feeding the east-bound Transpacific lane and Expeditors’ opportunities and challenges in a consolidating freight forwarding industry.

Swiss forwarder Panalpina’s rebuff of Denmark-based DSV’s $4.1 billion acquisition offer, and subsequent reports that Panalpina was entertaining a merger with Kuwait-based Agility, had analysts wondering how consolidation among top-tier forwarders might play out.

“If a shake-up were to occur within the freight forwarding industry (an acquisition of Panalpina),” wrote Seaport Global’s Kevin Sterling in a February 21 note, “EXPD is well positioned to pick up additional market share. As we have seen in the past, Expeditors is adept at winning new business when industry consolidation occurs.”

“Expeditors’ foundation is built upon organic growth, not M&A,” Sterling explained. “Management believes large acquisitions are a distraction and business can be lost throughout the integration process, but the company likes M&A when others are involved as this is a chance to shine and take market share with superior service.”

Expeditors’ position to compete for those customers will depend on its service and ability to execute – and one of the biggest risks may be the company’s decision to incrementally update its legacy IT platform rather than investing in an overhaul.

“This strategy has allowed the company to take opportunistic market share, in our view,” wrote Stifel’s Bruce Chan on February 22, “but over time, may leave Expeditors with a generational technology gap as certain competitors optimize new cutting-edge platforms and services.”

“Certain competitors” – FreightWaves can’t help but notice that Flexport announced Softbank’s $1 billion investment in the digital freight forwarder just the day before Chan’s note and wonder if Flexport’s “Operating System for Global Trade,” which it promises will drive down supply chain costs, might be what the analyst meant.

Macro-economic fundamentals are tricky, too. Expeditors is trying to shift its mix of business to high-yield freight (implying more air and less ocean) but meanwhile faces price competition in its ocean business, which is already under price pressure. EXPD’s ocean freight yields went backwards in the fourth quarter, contracting by 2.5 percent year-over-year, Chan estimated.

Stifel thinks that the air freight market will grow in line with global gross domestic product in 2019 (about three percent), and also expects low single digit year-over-year growth in global container volumes.

Matthew Young at Morningstar agreed with the broad outlook for ocean and air freight markets.

“We think that underlying freight demand for the air and ocean modes can grow 2 percent to 3 percent on average,” Young wrote in a February 19 on Expeditors. “We note that airfreight demand can vary greatly across the economic cycle and depending on the need for expedited shipment on key east-west trade lanes.”

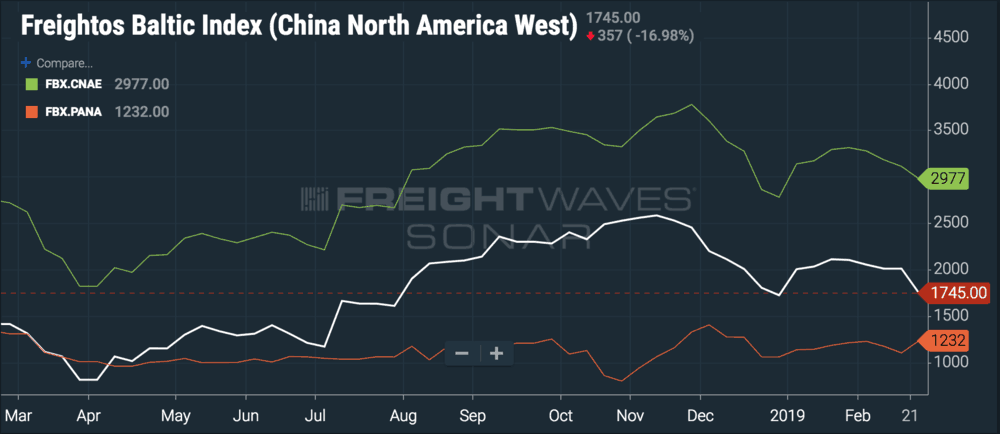

The chart below compares Freightos Baltic Index quotes for forty-foot equivalent container rates from China to North America – West Coast (FBX.CNAW) to rates from China to North America – East Coast (FBX.CNAE), with the spread in orange.

Falling rates should help EXPD stay ahead of the market, but FreightWaves has also noticed Trans-Pacific steamship lines canceling sailings and removing capacity from their services. The most recent round of void sailings was attributed to soft demand after the Chinese New Year, so industry observers are waiting until the next month to see how and if volumes return.

Any headwind to gross margins on the ocean side will not likely come from a capacity crunch in 2019, especially after President Trump tweeted on Sunday that the tariff hike on Chinese imports from 10 percent to 25 percent expected on March 1 had been indefinitely delayed. A reduction in tariff anxiety should smooth out freight flows, which were lumpy in the fourth quarter of 2018, positive for EXPD’s ocean revenues but negative for ocean yields.

More likely, in FreightWaves view, is a scenario where forwarders use softening container prices (their cost) to aggressively push down the prices quoted to their shipper-customers (their revenue) in order to take market share.