(Note: this article has been updated to reflect information from the analyst conference call)

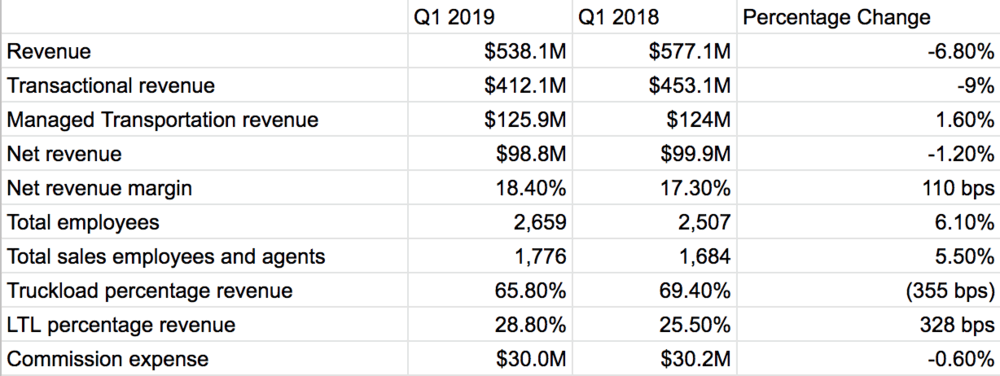

Echo Global Logistics (NASDAQ: ECHO) reported its financial results for the first quarter of 2019 after the markets closed on April 24. Gross revenue and net earnings contracted against very tough year-over-year comparisons – the first quarter of 2018 was historically hot in terms of freight demand – but ECHO managed to widen net margins by 110 basis points to 18.4 percent.

ECHO reported non-GAAP earnings per share of $0.38. According to Barchart, Wall Street analysts’ expectations for earnings averaged $0.29 per share. Gross revenue fell 6.8 percent to $538.1 million for the quarter, but net revenue dropped just 1.2 percent to $98.8 million.

Adjusted EBITDA fell 1.4 percent to $21.7 million while free cash flow increased 75.7 percent to $17.7 million.

“This was another strong quarter of profitability and cash flow for Echo,” said Doug Waggoner, chairman and chief executive officer at Echo, in a statement. “In an environment with lower truckload spot business and lower truckload rates, we improved net revenue margin, reduced SG&A [selling, general & administrative expense] costs, and increased free cash flow compared to the prior year.”

Echo slightly softened its guidance for 2019 gross revenue.

“We expect revenue for the second quarter to be between $560 million and $600 million and we are updating our full year 2019 revenue guidance to be in the range of $2.3 billion to $2.5 billion,” said Kyle Sauers, chief financial officer at Echo. During the company’s previous quarterly earnings call, ECHO offered 2019 revenue guidance of $2.35 billion to $2.55 billion.

The profound collapse of the truckload spot market in the first quarter of 2019 likely meant that ECHO had to pivot even more sharply to contract freight, bid aggressively and accept lower revenues per load. The freight brokerages’ contract-to-spot mix was not specified in the release but should be a topic of interest for the equities analysts on the earnings conference call.

The chart above tracks the truckload spot market crash year-to-date. Carriers happy to accept re-priced contract freight stopped rejecting loads and the outbound tender rejection rate plummeted (OTRI.USA). As the demand for spot capacity evaporated, spot prices for trucks (DATVF.VNU) also took a dive. While trucking spot rates are often thought of as a cost for brokers, in Echo’s book of business they account for about half of revenue as well.

In the fourth quarter of 2018, spot business represented 52 percent of ECHO’s total revenues, down from 59 percent in the fourth quarter of 2017.

So far in 2019, shares of ECHO have outperformed C.H. Robinson (NASDAQ: CHRW), likely due to C.H.’s higher valuation (19x trailing 12 months earnings vs. 15.2x for ECHO).

Analyst conference call

Several equities analyst on the conference call following ECHO’s earnings release asked about the contract rate environment and competition between non-asset players for contract freight. Echo executives confirmed a small shift toward contract — contract freight now makes up 49 percent of revenue, up from 48 percent sequentially — and said that, directionally, contract rates were neutral. Dave Menzel, Echo’s president and chief operating officer, noted that Echo’s view of contract rates as ‘neutral’ represented a slight softening from the company’s February investor presentation, when it expected ‘neutral to low single digit [increases].’

Echo management said that so far in the second quarter, net margins had held steady, and Bascome Majors from Susquehanna asked if that affected the outlook for the second quarter. The second quarter typically sees a spot rate increase driven by home and garden freight, as well as produce.

Kyle Sauers, Echo’s chief financial officer, said that “you’d normally see truckload margins compress a little bit throughout the second quarter,” but didn’t want to specify whether that typically occurs in April, May, or June, citing the volatility in recent historical data. Earlier in the call, Echo CEO Doug Waggoner said that colder weather may have delayed produce season.

Stifel’s Bruce Chan asked about the mergers and acquisitions environment, specifically how the entrance of large new competitors affected pricing discipline (EBIT multiples paid for 3PLs are exceeding 13-4x in some cases). Waggoner said that Echo is not looking at acquiring and integrating a large brokerage, but is looking for niches, whether in new service offerings or geographies, that are “adjacent” and “accretive.”

Chan also asked about the private load board that Echo is offering its preferred carriers, and Menzer said that while it’s too early to put numbers to adoption and penetration rates, he expects that in five to ten years, about 50 percent of the business will be automated.

Brian Ossenbeck from JP Morgan asked Waggoner about trucking freight futures.

“We’re excited about the concept,” Waggoner said. “We need to see some trading volume and data to see how it could or couldn’t play into a strategy, but it’s a very interesting concept, and we’re studying it very closely.”