Maersk and other ocean carriers posted their best numbers ever in the first quarter, but those records are almost certain to be quickly eclipsed.

Early disclosures from carriers confirm that the second quarter will be an even bigger blockbuster for liners.

During the first three months of this year, congestion negatively impacted volumes for several liners, yet surging rates more than offset any decline in loadings.

Even though congestion worsened in the second quarter — due to the Suez Canal accident and the COVID outbreak in Yantian, China — freight rates were much stronger than in the first quarter, setting the stage for new highs in revenues and profits.

OOCL

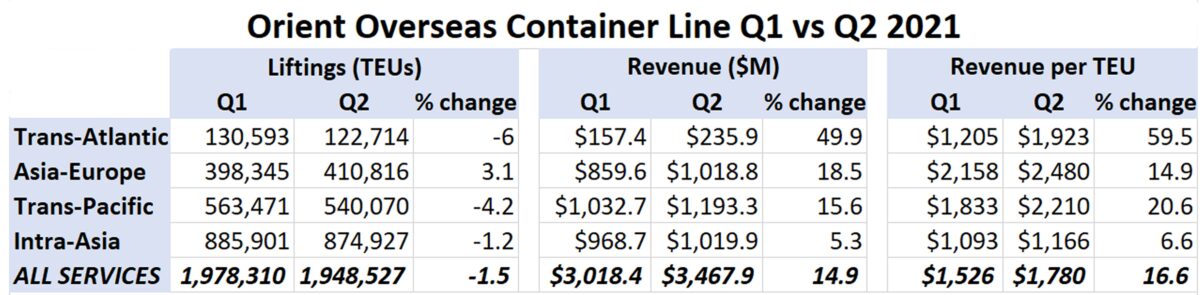

OOCL, a division of China’s COSCO, revealed data on Wednesday on Q2 liftings and revenues. American Shipper analyzed the changes versus the first quarter and calculated OOCL’s revenue per twenty-foot equivalent unit (TEU).

The carrier’s total liftings dropped 1.5% quarter-on-quarter, including a 4.2% decline in the congestion-stricken trans-Pacific. However, revenue per TEU jumped 16.6% in the second quarter versus the first, to $1,780 per TEU. There was a particularly sharp rise — 20.6% — in revenue per TEU in the trans-Pacific.

As in the first quarter, rate tailwinds trumped congestion headwinds. OOCL’s overall shipping revenue in the second quarter rose 14.9% compared to the first three months of the year, to $3.47 billion.

COSCO Group

The COSCO Group announced preliminary Q2 profits on Wednesday. COSCO disclosed that first-half revenues will be approximately RMB 37.093 billion ($5.7 billion). This means that Q2 2021 net profit will be RMB 21.641 billion, up 40% from the previous record period in Q1 2021.

During the first half of this year alone, COSCO will post profits that are 3.7 times the profits earned in full-year 2020.

Matson

After market close on Thursday, Matson (NYSE: MATX) released preliminary results that trounced analyst expectations. The consensus forecast was for Q2 2021 net income of $2.21 per share. Matson said that net income will be $156.9 million-$163.6 million or $3.58-$3.73 per share — 62%-69% above what analysts expected.

“We WAY underestimated the earnings capacity of Matson once again,” admitted Stifel analyst Ben Nolan in a client note.

Matson CEO Matt Cox stated, “Currently, in the trans-Pacific trade lane, supply chain congestion continues and consumption trends remain elevated. We expect these conditions to remain in place and lead to a high level of demand at least until Lunar New Year in the first quarter of 2022.”

Evergreen

Taiwan-based Evergreen has not pre-reported profits, but it has just posted its monthly operating revenues through June.

Last month, Evergreen posted all-time-high operating revenues of 37.72 billion New Taiwan dollars (NT$). For Q2 2021, operating revenues totaled NT$99.89 billion ($3.6 billion), up 11% from Q1 2021.

Carriers’ public relations deficit

U.K. consultancy Drewry estimated this week that the ocean carrier sector as a whole could post aggregate profits of $80 billion-$100 billion this year.

“Carriers’ only account in deficit is public relations,” said Drewry. “Lines are in danger of being cast as profiteering villains, unsympathetic to the needs of their customers.”

On Thursday, The Wall Street Journal reported that the Biden administration will use an executive order and urge the Federal Maritime Commission “to confront consolidation and perceived anticompetitive pricing” in ocean shipping.

According to Stifel analyst Ben Nolan, “From our perspective … ocean shipping pricing has been consistent with overall market supply dynamics. Furthermore, virtually all large container shipping companies are not U.S. domiciled, listed, etc., so there is very little influence that could be brought to bear.”

However, Nolan warned, “Despite no meaningful means of intervention, we do expect the risk of increased regulatory oversight to be negative for container-shipping equities.”

Click for more articles by Greg Miller

Amirul I chowdhury

Shipping lines are making windfall gain at the cost of global trade putting poorer countries economy in jeopardy