With import demand flagging, freight rates falling, the container ship orderbook at record highs and ocean carriers canceling voyages, you might think nobody would be chartering more ships. In fact, the container-ship charter market is far from dead.

Charter rates are well off their peaks. Gone are the days when a small container ship could earn $200,000 per day for three months, or a midsize ship could earn $60,000 per day for five years. Yet deals are still getting done.

“It’s not like there is no demand. There is ongoing demand. There is ongoing charter business,” affirmed George Youroukos, CEO of Global Ship Lease (NYSE: GSL), on a conference call Wednesday.

“Charter rates are stabilizing at above historical levels,” said Moritz Furhmann, CFO of Oslo-listed MPC Containers, during a conference call Tuesday.

The Harpex index, which measures charter rates across multiple ship sizes, stood at 1,059 points on Friday. That’s down 77% from the all-time peak in March 2022. But the pace of decline has lessened this year and the index has stabilized in recent weeks. The Harpex index remains more than double its level in February 2019, pre-COVID.

Alphaliner reported on Feb. 21, “Demand is picking up in the container charter market as Asia has gone back to work after the traditional Lunar New Year celebrations. The continued shortage of prompt tonnage across most size segments bodes well for charter rates, which … should continue to rise in the coming weeks.”

Charter activity focused on midsize, smaller ships

Charter activity is not evenly spread, however. Almost all of it is the midsize and smaller ship categories, vessels with capacity of around 10,000 twenty-foot equivalent units or lower.

The reason is that almost all of the larger vessels were put onto multiyear charters during the boom. Those contracts won’t expire in the near future. Furthermore, larger vessels whose charters were coming up for renewal this year were “forward fixed.” New charter extensions were already agreed to last year.

There are no more forward fixtures in any size category. “The forward fixture market is effectively on hold,” said GSL Chief Commercial Officer Tom Lister.

According to Youroukos, “Charterers now wait until two to three months before expiration to enter discussions for renewals. They want to see for themselves what the demand is from their clients, the shippers.”

Another big change: Charter durations have reduced sharply. No one is signing multiyear deals anymore. GSL has placed four of its ships on charters since October at an average duration of 10 months.

Among charters by top liner companies beginning this month reported by brokerage Braemar: MSC has chartered the 3,469-TEU Hansa Europe for two to four months at $17,400 per day and the 1,355-TEU Atlantic West for five to seven months at $13,000 per day. Hapag-Lloyd has taken the 2,506-TEU Maira for four to seven months at $17,750 per day.

CMA CGM, which has been particularly active, has just chartered four ships: the 3,434-TEU Hope Island (eight to 10 months; $17,250 per day); 2,754-TEU Atlantic Discoverer (10-12 months, $17,000 per day); 1,781-TEU Sheng An (six to eight months, $14,500 per day); and 1,355-TEU Atlantic West (five to seven months, $13,000 per day).

Orderbook risk higher for lessors of larger ships

The longer-term concern on ship-leasing companies relates to the record-high orderbook. These companies have most of their ships employed on charters through at least this year, but what about after that?

As new, more fuel-efficient ships are delivered from the shipyards, ocean carriers will presumably let charters of older ships expire. If lessors cannot find any new takers, or if rates become uneconomical, they would face either layups or, eventually, scrapping.

Both MPC and GSL emphasized during their calls that the orderbook — and potential impact on ship lessors — is heavily weighted to larger-ship classes. They maintained that lessors of midsize and smaller ships should escape the big capacity hit.

According to MPC CEO Constantin Baack, “What you see is that the very significant portion of the orderbook … is the very large ships. The smaller the ship, the smaller the orderbook in relative and absolute terms.”

Baack also pointed out that the more recent orders have heavily favored dual-fuel vessels capable of using liquefied natural gas or methanol. These orders are inherently for larger ships. Smaller vessels operate in regional trades where LNG and methanol fuel infrastructure won’t be available.

Alphaliner reported Tuesday that 92% of container newbuildings ordered this year and 86% of newbuilds ordered in H2 2022 were for either LNG- or methanol-capable vessels.

Lister of GSL noted that the overall ratio of container-ship tonnage on order to tonnage on the water is 29%. But that ratio is 52% for ships larger than 10,000 TEUs, and only 14% for ships smaller than TEUs. In the sub-10,000-TEU category that GSL focuses on, a high level of scrapping — which is expected — would actually lead to very minimal fleet growth, he said.

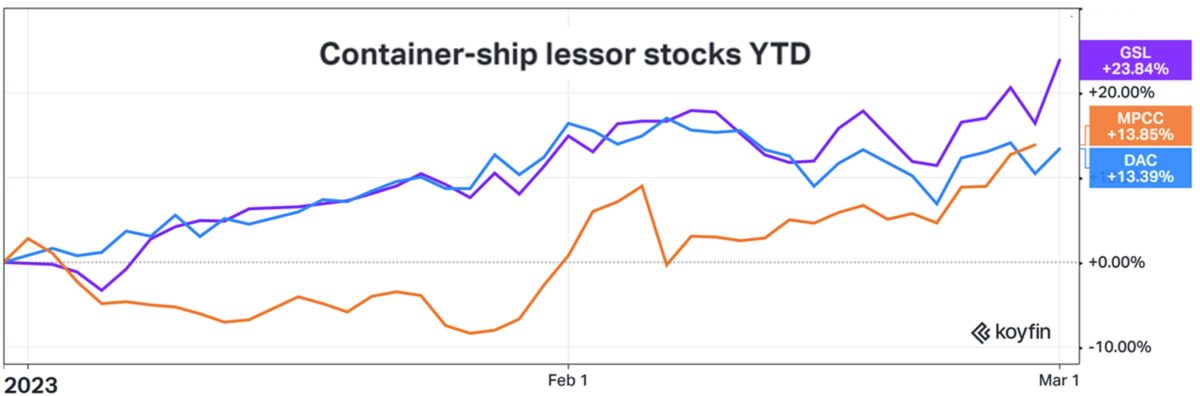

Ship-lessor stocks up YTD

The headwind for ship-lessor stock pricing is future expectations. Profits remain high due to charters booked during the boom, but eventually these charters will roll off and be renewed at lower levels. So, it’s all downhill from here.

The counterargument is that ship-lessor stocks have fallen too far. Share pricing does not reflect the current value of the existing charters plus the residual value of the fleet assets. As the market realizes it overshot to the downside, the stock prices will increase, at least temporarily.

According to Jefferies analyst Omar Nokta, “GSL’s revenue backlog stands at $2.1 billion. We estimate its EBITDA backlog at $1.6 billion. This is above its current enterprise value of $1.5 billion, meaning no value is being placed on the fleet’s remaining useful life or residual value.”

According to Deutsche Bank analyst Amit Mehrotra, “We believe the market fundamentally misunderstands Global Ship Lease.” As a result, GSL’s shares trade at a 40% discount to its net asset value, he said.

Container-ship-lessor stocks generally peaked in March 2022, fell through second and third quarters and stabilized in the fourth. Year to date, pricing of the pure container-lessor stocks implies that the “overshot-to-the-downside” thesis is gaining ground. GSL is up 24%, MPC Containers 14% and Danaos Corp. (NYSE: DAC) 13%. GSL’s stock rose 6% on Wednesday.

Earnings roundup

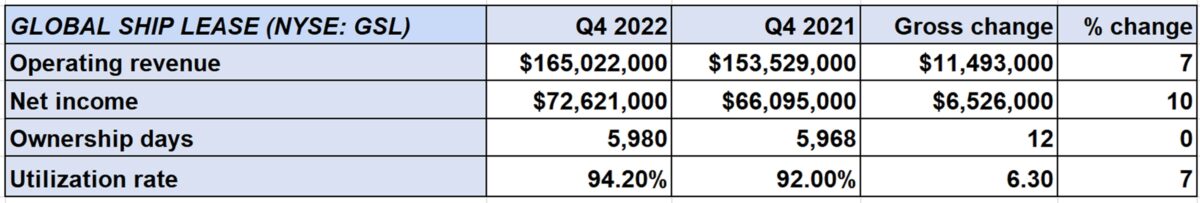

Legacy charters continue to translate into extremely strong earnings for ship-leasing companies, despite the worsening business prospects for their customers, the ocean carriers.

On Wednesday, GSL reported net income of $72.6 million for the fourth quarter of 2022 versus $66.1 million in Q4 2021. Adjusted earnings of $2.14 per share came in much higher than the consensus forecast for $1.70 per share. GSL has 93% of its capacity already employed on charters through the end of this year. In 2024, 72% of its capacity is already booked.

On Tuesday, MPC Containers reported net income of $103.6 million for Q4 2022 compared to $127.9 million in Q4 2021.

MPC has 86% of its available days already contracted for 2023.

Click for more articles by Greg Miller

Related articles:

- ‘Colossal’ tidal wave of new container ships about to strike

- Container trade’s next turn: Price wars, cheap contracts, new ships

- Maersk: Container shipping contract rates will sink to spot levels

- Lag effect: Why liner profits stay high much longer than spot rates

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels

- Here’s how container shipping lines can escape a crash in 2023