Covenant Logistics Group told analysts Tuesday the freight market has been up and down in recent months due to inflationary pressures and softening freight demand but remains optimistic about its future.

“We’re going to get a [back to] school rebound and then get into the Christmas season shortly thereafter,” said David R. Parker, Covenant chairman and CEO, during the earnings call. “I do think there’ll be an uptick. So far, we have not seen a downtick, or let’s say this — the business that we’ve lost, we’ve replaced every bit of it with new business. That’s kind of the tale of the tape so far.”

Parker also said the company should be able to get a better read on the freight market after August as hundreds of trucks exit the industry.

“I think that August will start telling us about this recession that we’re in and what it’s going to do to trucking,” Parker said. “One thing we do know: There’s hundreds of thousands of trucks that are coming out of this market. The trucks that lived on the spot market the last two years are leaving and shutting their doors, and that’s going to be a nice little tailwind from a capacity standpoint.”

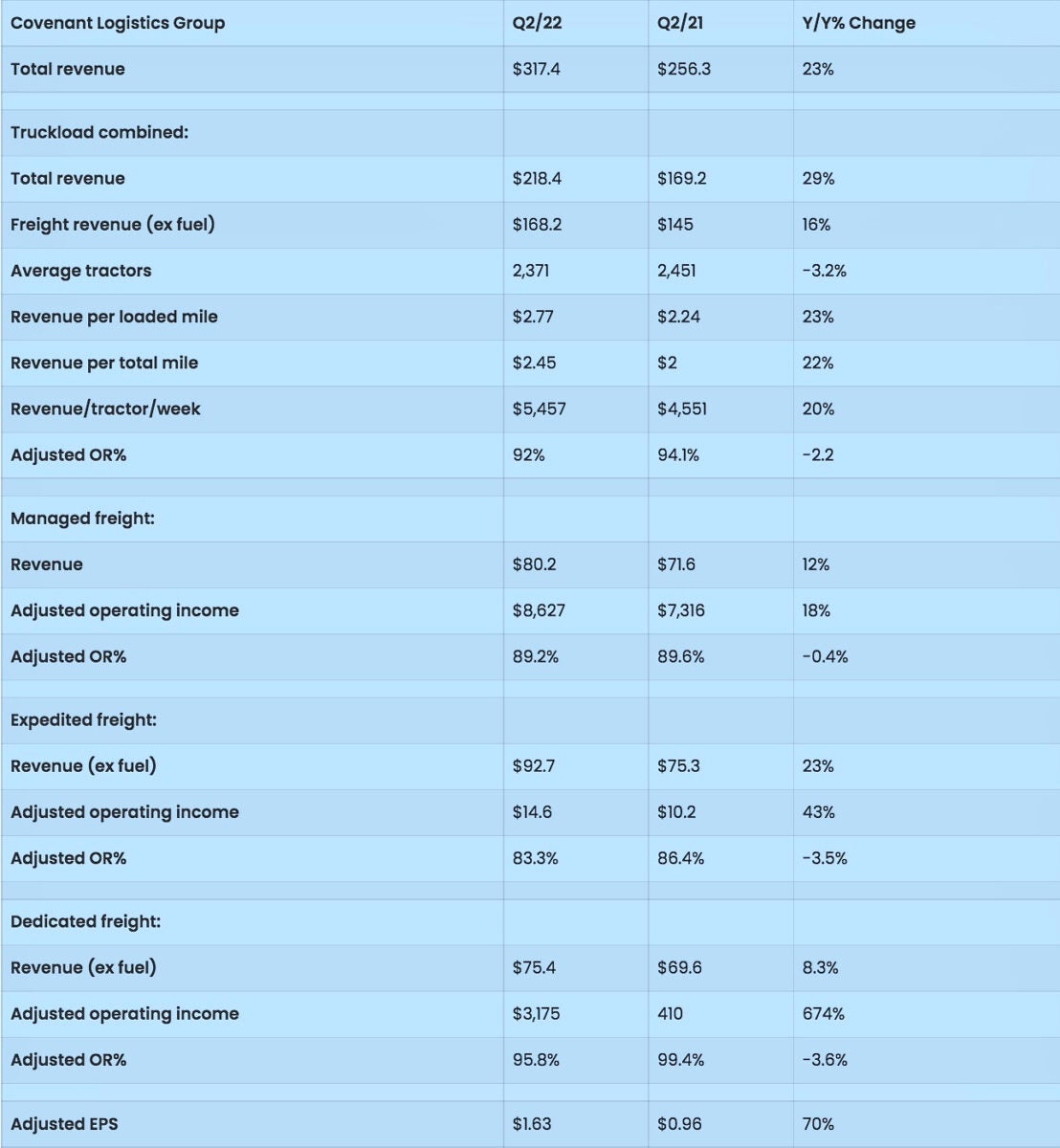

Chattanooga, Tennessee-based Covenant (NASDAQ: CVLG) reported Monday second-quarter earnings per share of $1.63, 70% higher than the same year-ago period. Revenue for the quarter came in at $317.38 million, a 23% increase from last year.

The company’s freight revenue grew 15% on a year-over-year (y/y) basis during Q2 to $267 million. The expedited truckload segment revenue increased 39.2% to $121.6 million, and the dedicated segment revenue rose 18.2% to $96.7 million.

Covenant’s managed freight segment boasted revenue of $80.2 million, an increase of 12% from the same time last year. The warehousing segment saw revenue of $18.3 million during the quarter, a 20% y/y increase.

Covenant also completed a $30 million stock repurchase plan (1.3 million shares) initiated in the first quarter and the addition of a $75 million (2.4 million shares) stock repurchase plan initiated during Q2. Officials said the plans demonstrate creating value for shareholders.

“We’ll continue to keep [the stock repurchase plan] in play and be opportunistic about repurchasing shares in the future,” said Tripp Grant, Covenant’s chief financial officer. “It might just slow down in the second half of the year.”

One analyst discussed how Walmart — a Covenant client — on Monday cut its quarterly and full-year profit guidance, contending inflation is causing shoppers to spend more on necessities and less on higher-margin items like clothing and electronics.

Parker said Covenant’s business with Walmart continues to go “very well.”

“We really concentrate on the Walmart produce that comes off the West Coast, so our business with Walmart has gone extremely well,” Parker said. “Has there been hiccups? Yes, because of employment, we can’t get everybody to the warehouses. But the freight itself has been just as strong as it was six months ago or eight months ago. We expect that to continue.”

Covenant officials still expect 2023 to be a “breakout year.” The company has worked to move its customer base from less cyclical industries into ones that are more full-service logistics focused, said Paul Bunn, Covenant’s executive vice president and COO.

“Based on company-specific factors, the investments we have made in the sales team, the [AAT Carriers] acquisition, the share repurchase, returning insurance costs to a more normalized level, we are confident in the second half of 2022 and planning for 2023,” Bunn said. “We said last quarter that 2023 will be a breakout year for Covenant and we remain firm on that statement and competent we will continue to produce cash and maximize opportunity for our shareholders.”

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

Covenant beats Q2 earnings estimates despite ‘softening’ freight market