Daimler Truck launched Rizon, a new U.S.-focused medium-duty electric truck brand, on the eve of California regulators voting whether to require fleets to purchase 5%-10% EVs beginning in 2024.

The coincidental timing expands Daimler’s battery-powered portfolio to cover Class 4 to 8 trucks. The production version of the Class 6 Freightliner eM2 is expected at the Advanced Clean Transportation Expo in Anaheim, California, next week.

Rizon trucks debut at the ACT Expo. Daimler made Rizon its ninth brand.

Daimler introduced a new version of its medium-duty Mitsubishi Fuso EV at the IAA Transportation show in Germany in September. Executives said if the Japanese-built truck ever came to the U.S. it would be without the Mitsubishi Fuso name.

The Rizon vehicles look remarkably similar to the new eCanter. Executives did not address rebranding questions submitted by FreightWaves on a Thursday evening conference call.

Rizon arrives 3 years after Mitsubishi Fuso pulled from US market

Daimler, which owns 89.3% of the Fuso brand, pulled Fuso medium-duty trucks from the U.S. market at the end of 2020. An electric version called eCanter completed two-year test leases in 2022. Daimler is providing maintenance services through 2028.

Rizon will be distributed in stand-alone locations through the Velocity Vehicle Group, which has 80 locations. Initial sales of trucks imported from Japan begin in the fourth quarter in California and New York. Velocity operates in eight states and plans to add eight more, most in the Northeast, and Texas by the end of the year. Rizon production begins in Q3.

The new brand could hit a sweet spot in the U.S., where medium-duty electric vehicles are quickly reaching total-cost-of-ownership parity with diesel trucks. Few established competitors are in the game yet.

A class 5 Blue Arc entry from the Shyft Group is coming next year. Workhorse is selling a Class 4 model it is purchasing from Canada’s GreenPower Motors while its Class 5 EV enters production around the same time. A host of startups are retrofitting existing chassis with electric chassis.

Rizon also could benefit from purchase incentives including $45,000 to $60,000 from California’s Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project. Federal grants under the Inflation Reduction Act also could apply.

Rizon offers 3 model variants

Three model variants, the e18L, e16L and e16M, will be the first trucks available under the Rizon brand. The Class 4 and 5 medium-duty trucks range from 15,995 pounds to 17,995 pounds in gross vehicle weight.

With three lithium iron phosphate (LFP) 124-kilowatt-hour battery packs, L-model variants can run from 110-160 miles. M-size variants with two 83 kWh battery packs can cover 75-110 miles on a single charge. The ranges cover varying use cases. Daimler officials said LFP chemistry was chosen because it has double the life of other cathode materials and has better reliability.

Two types of battery-charging systems are available: Level 2 alternating current and direct current fast charging. Level 2 AC charging takes five to six hours. DC fast charging takes 45 to 90 minutes.

The Rizon warranty covers the powertrain, chassis and cab for five years or 75,000 miles. The high-voltage batteries are covered for five years or 120,000 miles.

Infrastructure joint venture takes Greenlane as its name

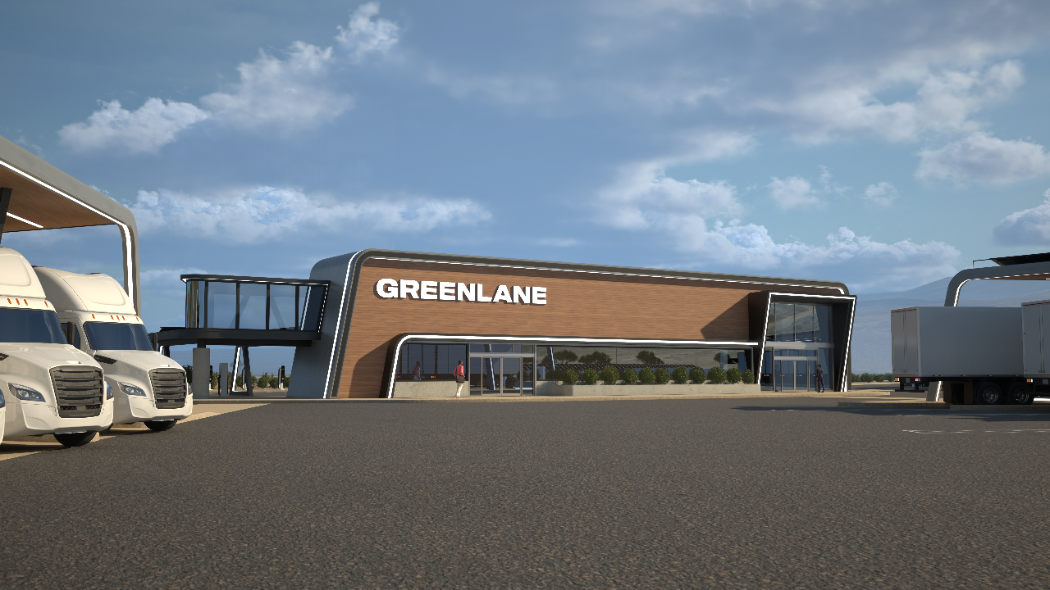

Separately on Thursday, Daimler Truck North America, NextEra Energy Resources and BlackRock announced Greenlane as the name of their $650 million joint venture to develop a U.S. network of high-performance, zero-emission public charging and hydrogen fueling stations for medium- and heavy-duty trucks.

Greenlane’s first site will be in Southern California. Multiple additional sites are being acquired along various critical freight routes along the East and West coasts and in Texas.

“The nation’s fleets can only transform with the critical catalyst of publicly accessible charging designed to meet the needs for medium- and heavy-duty vehicles,” John O’Leary, DTNA CEO, said in a news release.

Related articles:

Mitsubishi Fuso ending truck sales in US and Canada

Daimler Truck, BlackRock and NextEra Energy’s $650M bet on electric infrastructure

Million-mile-tested Freightliner eCascadia goes into production