Atlas Air Worldwide Holdings (NASDAQ: AAWW), a global provider of outsourced aircraft and aviation operating services, held a conference call to discuss its first quarter 2019 results, earnings of $0.98 per share, which were ahead of the fourth quarter 2018 and the NASDAQ consensus estimate of $0.86.

The company reiterated its full-year guidance calling for block hours to increase to 340,000 units [an increase of 15 percent], revenue to increase to approximately $3 billion [an increase of 12 percent], adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of about $600 million [an increase of 11 percent], and mid- to upper-single-digit adjusted net income growth. The only change to guidance is that the company now believes that start-up expenses associated with 737-CMI (crew, maintenance and insurance) will be an incremental cost not assumed in the original 2019 guide. Without these start-up costs, management said that its guidance would have been raised.

There were several questions of interest asked on the call.

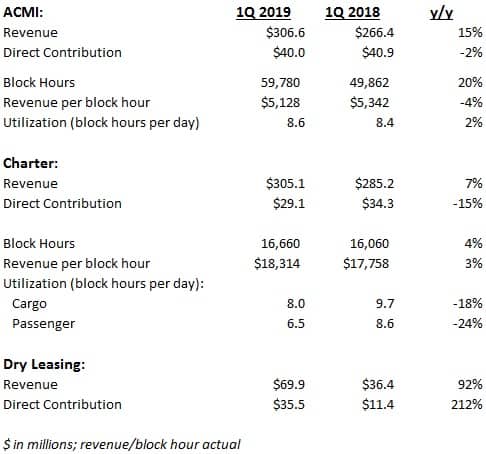

Many analysts drilled down on the company’s earnings guidance which is now 80 percent weighted to the back-half, up from roughly 75 percent when first issued during the company’s fourth quarter 2018 report in February, and why there hasn’t been a better direct contribution (AAWW uses the metric, “direct contribution,” which measures the income contribution from its separate units after allocation of direct ownership costs) from the Aircraft, Crew, Maintenance and Insurance (ACMI) division, which was down 2 percent year-over-year despite revenue growth of 15 percent.

Management explained that the first half of 2019 is being impacted by the timing of military cargo cancellations and a higher than normal proportion of scheduled heavy maintenance. The company expects a meaningful increase in military cargo shipments as it believes that recent cancellations are more likely delayed shipments versus true cancellations. Further, the maintenance and repair schedule for aircraft will be much lighter in the second half of 2019 ($26 million lower) with fewer engine overhauls than last year. Management noted that a good peak season is required to meet current guidance, but provided anecdotal support to its outlook. The company expects to benefit from increased opportunities with its Dreamlifter service because Boeing increased the production rate of the Dreamliner from 12 shipsets to 14. Additionally, management noted that most of Atlas’ business is e-commerce- and express service-related, which is growing at a faster clip than the general air cargo market. Lastly, the company expects to see incremental opportunities from the military as the government is working to lower the utilization rate of the C-17 fleet.

There were some questions about the company’s announcement that it has added five 737-800 aircraft on a CMI basis for Amazon with the potential to add up to 15 more by May 2021. While management wouldn’t comment on Amazon’s commitment to make one-day deliveries the new standard for its ‘Prime’ offering, they noted that Amazon continues to bolster its commitment to express delivery and could have a total of 70 aircraft in operation in a couple of years, 40 of which could be with AAWW as the provider.

When asked about recent lease agreement extensions between aircraft leasing and air cargo transportation company, Air Transport Services Group, and parcel and e-commerce shipper, DHL, as well as the potential for aircraft insourcing by DHL, management said that the Atlas relationship with DHL continues to grow. AAWW has more than 40 aircraft with DHL and said that it is DHL’s largest provider of lift capacity. Management said that they have a strong relationship with DHL and see continued growth with the company.

In response to a question about arbitration with employees at its fully owned subsidiaries, Atlas Air and Southern Air, management said that it is expecting to get a decision soon from arbitrators as closing briefs have been filed. While the arbitration decision will be binding, management said that it continues to work with union representatives to negotiate a new contract.

Pilots of Atlas Air and Southern Air are represented by the International Brotherhood of Teamsters. Including flight dispatchers at Atlas and Polar Air Cargo, a joint venture AAWW has with DHL, approximately 58.5 percent of the Atlas workforce is under collective bargaining agreements.

All of AAWW’s first quarter 2019 key financial metrics were ahead of management’s prior quarterly guidance. AAWW reported $679.7 million in revenue, a 15 percent increase year-over-year as total block hours increased 16 percent to 77,061. Adjusted EBITDA was up 29 percent to $121.1 million, which was $11 million better than guidance and adjusted net income of $27.2 million, up $3.5 million, was better than management’s flat guide from the first quarter 2018 result of $23.8 million. Total direct contribution for all of AAWW’s segments increased 21 percent to $104.7 million.

ACMI reported a 20 percent increase in block hours, which was partially offset by a 4 percent decline in revenue per block hour. Increased flying time, albeit at a modestly lower rate, produced a 15 percent increase in revenue for the division. The company attributed the volume growth to an increase in 767-service for Amazon, additional 777 shipments for DHL and the 747-400 start-up for its new customers. Direct contribution was 2 percent lower year-over-year at $40 million even with increased volumes. Management cited higher crew costs, increased maintenance and repairs and increased amortization costs as the reasons.

Revenue from the charter segment increased 7 percent as both block hours and rates increased. Higher block hours from military passenger and increased commercial cargo demand drove the increase. Direct contribution for this division was 15 percent lower at $29.1 million.

Direct contribution from the dry leasing division (which provides aircraft and engine leasing solutions only) more than tripled year-over-year to $35.5 million. The division benefitted from $17.9 million (after tax) in maintenance payments related to 777 freighter service that resumed in March 2019. Also, incremental aircraft placements took place in the quarter.

Management opened the call offering condolences to the families of the crew of Flight 3591, which claimed the lives of three pilots, two of whom were with Atlas. The flight was en route to Houston from Miami on February 23 when it crashed into Trinity Bay in Anahuac, Texas.