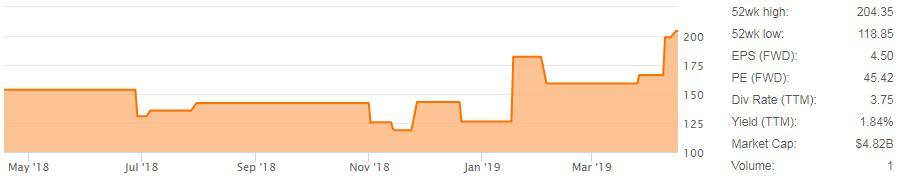

Panalpina, an international freight forwarding and logistics company, reported $0.82 (Swiss Francs, or CHF) per share in earnings for the first quarter of 2019 compared to $0.72 CHF for the same period last year. This is an “in-line report” for the Swiss company according to Seeking Alpha’s estimate.

This is the first report from the company since the announcement earlier this month that Panalpina would be acquired in a $4.6 billion deal by Danish competitor DSV.

“In the first quarter of this year, Panalpina generated 15 percent more EBIT [earnings before interest and taxes] and profit than in the same period of last year. We improved profitability despite a challenging market environment and during a time when considerable management resources were absorbed by the M&A topic. This demonstrates the underlying quality and strength of our organization,” said Panalpina Chief Executive Officer Stefan Karlen.

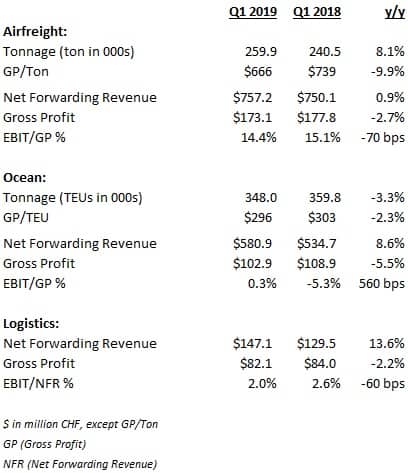

The company saw a 5 percent year-over-year (y/y) increase in net forwarding revenue to $1.485 billion as airfreight volume increased 8 percent y/y, which was partially offset by a 3 percent y/y decline in ocean freight volume.

Airfreight. Growth in the airfreight division outperformed the market (which management believes was down 2 percent during the quarter), due to organic growth initiatives and acquisitions made last year (75 percent of volume growth was acquisition-related). That said, gross profit (GP) for the division was down 3 percent y/y to $173.1 million CHF.

Panalpina saw firm demand in its airfreight lanes, but said that the higher concentration of perishable shipments led to lower gross profit per ton, which declined 10 percent y/y. Gross profit was down 3 percent y/y, driving its EBIT-to-gross profit margin 70 basis points (bps) lower to 14.4 percent. In sum, operating income in airfreight was down 7 percent y/y to $24.9 million CHF.

The airfreight volume result is impressive at first blush given the weakened demand market, but after stripping out acquisitions and then considering the gross profit per ton decline, the quarterly result is probably more reflective of the overall market, which remains depressed.

Ocean. Panalpina’s ocean freight offering saw a 3 percent y/y decline in volumes, which management explained was due in part to the loss of a customer in Australia and lower volumes in the inter-Asia trade lane. This division underperformed the rest of the market, which the company believes was flat in the quarter. Gross profit declined 5 percent y/y to $102.9 million CHF, due in part to a 2 percent decline in GP per twenty-foot equivalent unit (TEU) to $296 CHF. Management believes that a level of $300 GP per TEU is required to remain profitable given their current cost basis. The division was slightly in the black at $0.3 million CHF in operating income, a more than $6 million CHF improvement from the period a year ago.

The ocean freight result is not all that bad given a stagnant demand environment and declining pricing levels.

Logistics. Logistics gross profit declined 2 percent y/y to $82.1 million CHF. Management called out seasonality and a downturn in the automotive and technology sectors as the reasons for the decline. Operating income from the division was $2.9 million CHF, down $0.5 million CHF y/y.

Consolidated gross profit was down 3.4 percent y/y to $358.1 million CHF. Operating income increased 14.9 percent y/y and profit improved 15.8 percent y/y, which led to the $0.10 CHF per share increase in the quarter.

Panalpina management said that they were limited on what they could discuss in regard to the market outlook given the pending merger with DSV. They did reiterate their February guidance, calling for the global airfreight market to remain flat and the ocean freight market to increase 2 percent y/y.

Management provided no commentary on the DSV acquisition, but were questioned about issues with employee retention on the call.

They said part of the issue with headcount was the overall volume reduction, which has a correlating reduction in headcount. Further, they said that the new operating system has provided some operational efficiencies as well. Management said that the headcount reductions “were not due to uncertainty [regarding the merger]”.