Asset-light transportation solutions provider Landstar System, Inc. (NASDAQ: LSTR) reported first quarter earnings per share (EPS) of $1.58, $0.21 higher year-over-year and $0.07 better than the consensus estimate.

On its earnings call, management said that the overall freight brokerage market feels much like 2015 to 2016 and acknowledged that some incremental capacity has shown up in the dry van truck market with a better supply-demand balance being seen on the flatbed side.

Roughly 30 percent of Landstar’s business is flatbed (platform or unsided trailers) and the company doesn’t see as much brokerage competition in this market because it believes that the barriers to entry are higher and that some degree of human involvement is required to match loads with carriers.

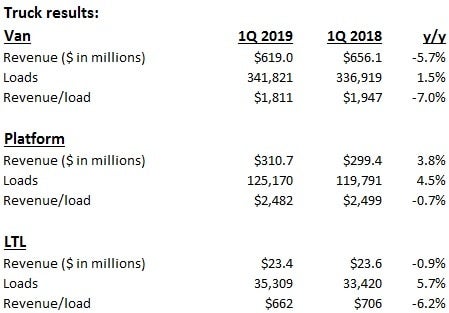

Total truck revenue declined 2.7 percent year-over-year. Dry van revenue was down 5.7 percent as a 1.5 percent increase in loads was offset by a 7 percent decline in revenue per load. Platform revenue increased 3.8 percent as loads were up 4.5 percent with revenue per load down 0.7 percent.

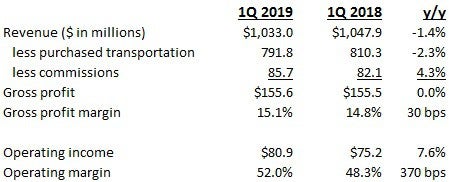

Total revenue was down slightly year-over-year to $1.033 billion with gross profit (revenue less the cost of purchased transportation and commissions to agents) basically flat at $155.6 million. The company’s gross profit margin increased 30 basis points to 15.1 percent and its operating margin (calculated as operating income divided by gross profit) increased 370 basis points to 52 percent. Management called out favorable insurance and claims activity as well as lower selling, general and administrative expenses as the contributors.

Landstar’s President and Chief Executive Officer Jim Gattoni said that he is “comfortable” with the current full-year consensus EPS estimate of $6.41. He said that the market is a little bit softer than the company had originally anticipated entering the year as loads are largely on track with their prior expectations, but stated that revenue per load has been modestly weaker than originally thought. Additionally, he noted that the first nine months of 2019 present tough comparisons for the company.

LSTR’s official guidance for the second quarter of 2019 calls for flat truck loads with truck revenue per load declining in the high single-digit percentage range year-over-year. On the call, management said that LSTR is seeing very slight revenue per load improvement so far in April. Management is forecasting revenue to be $1.075 billion to $1.125 billion, with earnings per share of $1.56 to $1.62. The current consensus estimate is $1.60 for LSTR in the second quarter 2019.

When questioned on the impact of automated freight matching competition, Gattoni said that there was no discussion about Uber Freight or Convoy at the company’s recent agent convention and that he believes that Landstar benefits from its knowledge of specific markets, especially in the tougher to navigate flatbed market. However, he said that everyone wants to see where there freight is all the time, no matter how well you have delivered it for them in the past. The company plans to have its freight tracking platform ready by summer.

Landstar purchased 124,481 shares of its common stock during the quarter and is authorized to purchase up to approximately 1.876 million shares under its share repurchase program. The company maintained its $0.165 per share quarterly dividend.