Manhattan Associates, Inc. (NASDAQ: MANH), a major supply chain solutions provider, reported first quarter 2019 GAAP (generally accepted accounting principles) earnings per share of $0.32, compared to analysts’ expectations of $0.34. The company’s adjusted non-GAAP earnings per share were $0.41, $0.04 better year-over-year.

The company reported total revenue of $148.4 million compared to the consensus estimate of $137.6 million. Total revenue increased 13.7 percent year-over-year as services revenue increased 12.5 percent year-over-year. The company saw license revenue increase $4.9 million and cloud subscriptions revenue increased $3.4 million compared to the same period last year.

“We’re very pleased with our start to 2019, delivering record first quarter total revenue and solid earnings per share growth on strong software and global services revenue, said Eddie Capel, Manhattan Associates President and Chief Executive Officer.

The company reported a 24 percent adjusted operating margin, a decline of 70 basis points year-over-year (adjustments for the period exclude the impacts of equity-based compensation). Increases in research and development and sales and marketing led to the decline.

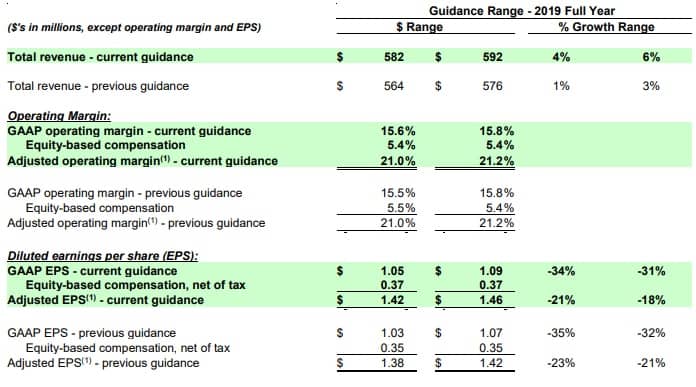

MANH increased its full-year 2019 revenue guidance, calling for revenue growth of 4 to 6 percent (from 1 to 3 percent), maintained its adjusted operating margin guidance of 21 to 21.2 percent and increased adjusted earnings per share guidance to $1.42 to $1.46 (from $1.38 to $1.42).