Rates for regional moves in the Southeast and Midwest are relatively stable

As FreightWaves reported Tuesday, trucking rates are plummeting across the country as shippers and brokers begin to exploit the unusually loose capacity side of the market. Aggressive brokers are playing a game of ‘how low can you go?’ and quoting prices well below DAT seven day averages in an attempt to test the market.

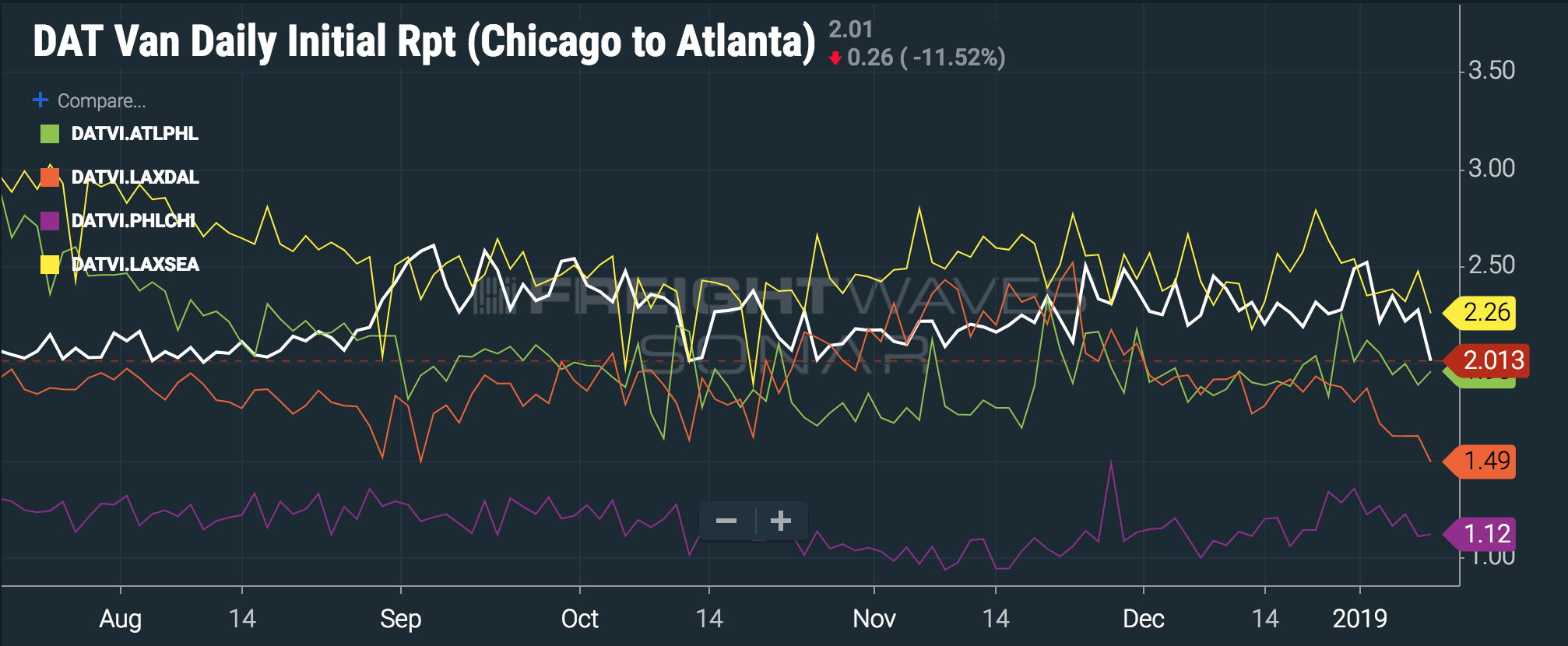

Trucking carriers can expect six weeks or more of carnage until produce season ramps up in March, but there are some lanes in which prices have not completely collapsed. DAT’s initial reports on the Los Angeles to Dallas lane (DATVI.LAXDAL) show a 40.7 percent drop in price from the late November peak to $1.49/mile over the past five days, so that is definitely not one of those safe havens.

Instead, carriers should try to position their assets in the Chicago to Atlanta lane. The high-density route connecting two major headhaul markets has been more stable than other lanes, losing only about 18 percent since late November to $2.01/mile over the past five days.

In general, running back and forth between headhaul markets with plenty of freight for $2 per mile in this market is one of the best ways to use your assets.

Another strategy for carriers trying to balance asset utilization and rates is to look for short- and mid-haul moves within strong freight regions like the Midwest and Southeast. According to DAT’s RateView tool, over the past seven days spot rates for dry vans from Texas to Louisiana averaged $1.90/mile exclusive of fuel, and rates from Texas to Oklahoma were $2.10/mile net of fuel. Alabama to Georgia paid an average of $2.17 net of fuel, while Georgia to Alabama paid $2.28.

Carriers with experience driving in winter weather might consider richly priced regional moves in the Upper Midwest – Wisconsin to Michigan paid dry vans an average of $2.58/mile net of fuel over the past seven days, according to DAT’s RateView.

According to government data, the number of people employed in truck transportation in the United States (EMPN.TRUK) has grown 5.5 percent since January 2017. This January’s volumes have been robust, but not as exceptionally strong as January 2018, exacerbating the imbalance of demand and supply in the freight market.

In FreightWaves’ opinion, when there are too many trucks in the market, there is no natural bottom for rates. Some truckers will only take loads that pay at least their fixed and variable costs (loan payments, insurance, fuel, etc.), but they will be undercut by others willing to take even lower rates in lieu of deadheading or sitting.

The national freight market at the current moment is just as volatile as it was in the rapidly tightening period during the second half of 2017, when shippers could not source capacity, spot rates outran contracts, broker margins went negative, and carrier revenues shot up. It’s just that the volatility is in the other direction, and now rates are spiraling downward.

Again, FreightWaves believes that the market will find a bottom by early March, but for now, it’s best for carriers to minimize losses, keep the tires rolling, and play defense on lanes where there’s plenty of freight. Going forward, there may be opportunities in the Northeast created by severe winter weather, but deciding whether to head into a snowstorm is another calculation entirely.