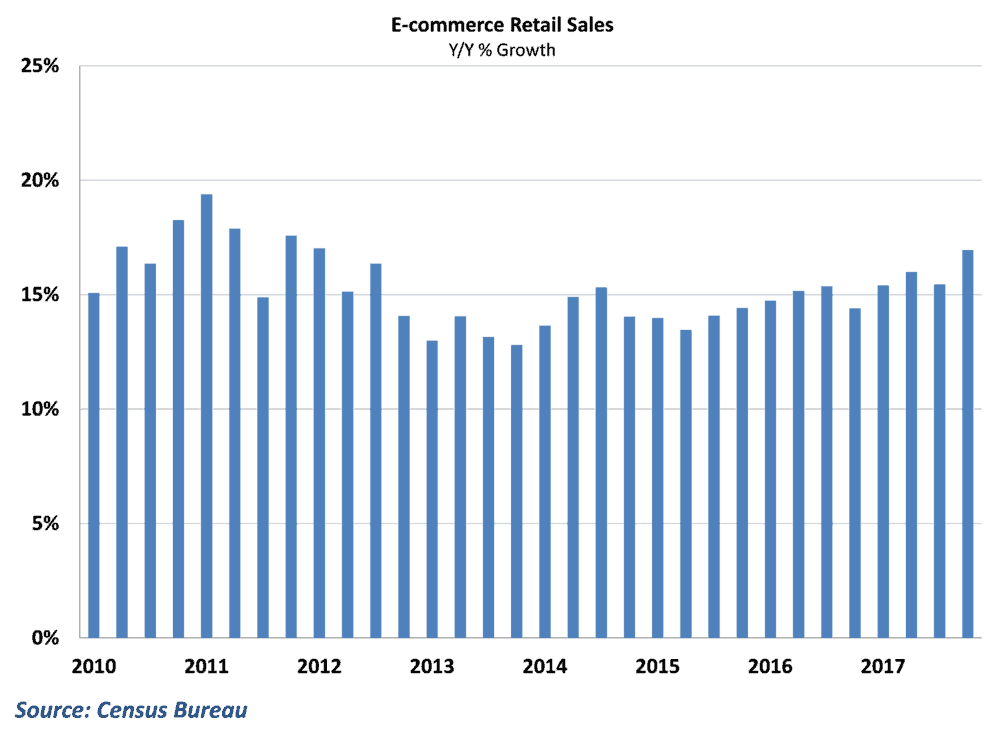

Last week, the Census Bureau released its quarterly e-commerce retail sales report for the 4th quarter of 2017, showing that online shopping grew a whopping 16.9% year-over-year at the end of the year. This marks the strongest quarter of e-commerce growth in nearly six years, and caps an impressive year of sales growth for online channels.

E-commerce sales have grown over 13% in each year since the recession ended, and show no signs of slowing down as more and more categories of retail spending open up to e-commerce channels. This has pressured retailers on multiple fronts as they scramble to find solutions for customers’ evolving shopping preferences.

Delivery costs

The most obvious way that retailers feel the effects of e-commerce is through additional transportation costs. Consider a traditional supply chain in the US, which involves goods that are either manufactured here or imported from other countries. These goods would get transported to large warehouses, often located in sparsely populated areas where land is cheap. From there, these goods would get shipped again to retail locations and the end customer would travel to purchase.

With most e-commerce purchases, however, the retailer must deliver directly to the customer. As it is more expensive to deliver a single good to many individual customers instead of a full shipment to a single retail location, this adds additional cost pressure to retailers and increases demand on freight and logistic companies.

In addition, speed of delivery to the end customer has emerged as one of the primary ways that these businesses compete in the e-commerce space. Largely spearheaded by Amazon’s Prime program, which allows unlimited two-day shipping for a set annual fee, customers have begun to expect free, fast shipping for online purchases. In its quarterly Consumer View released in early 2018, the National Retail Federation reported that nearly half of all online shoppers expect free shipping as part of their purchase, and 38% of average online shoppers expect free two-day shipping.

This speed comes at a cost for retailers, who now need to locate their products closer to the end customer in order to deliver them quickly. This means that instead of large warehouses where land is inexpensive, retailers are locating smaller distribution centers closer to population centers. This, in turn, has raised industrial land prices and incurred higher costs on retailers.

Returns

To make things tougher for retailers, online shoppers increasingly demand free return services associated with purchases. Indeed, the development of easy returns policies helped spread e-commerce into categories of goods such as specialty clothing and furniture, which previously customers shied away from buying online. In a recent survey, Optoro noted that 46% of shoppers abandoning full carts, did so because of a fee-based return policy.

Implications for carriers

The demand for fast, reliable shipping to the end customer and free return services has placed additional demands for carriers of all types in the economy. Parcel carriers such as UPS, FedEx, and the USPS have been at the forefront of the e-commerce boom, and have undertaken significant efforts not only to adapt their delivery networks, but also to understand the needs of the end customer.

But these trends are also changing business practices for truckload and LTL carriers, particularly as oversized and irregularly shaped goods such as appliances and furniture increasingly open to e-commerce. For example, truckload carrier Schneider acquired Lodeso and Watkins & Shepard to expand their services to last-mile delivery. Other major truckload carriers such as JB Hunt, XPO, and Swift also have expanded their last-mile capabilities to keep up with growth in e-commerce. Similar things are also occurring in the LTL space, as solutions such as uShip and Cerasis have the capability to match businesses with LTL carriers to facilitate e-commerce transactions.

Comparison shopping and the squeeze on retailers

All of these efforts to satisfy online customers come at additional costs for retailers. Ordinarily, retailers might try to pass some of these costs off on to customers in the form of higher prices to maintain margins. However, the rise of e-commerce also comes with an increased ability to quickly comparison shop across different retailers. KPMG reported last year that the largest determinant for online shoppers in deciding which product or brand to buy is the price. With the potential price transparency that comes along with internet access, retailers find themselves with significantly less ability to raise prices than they otherwise would. Competition through online channels can be especially fierce, as price transparency leads to aggressive discounting to capture price-sensitive customers. As a result, retailers find themselves pinched from both ends, with rising demands for service pushing up costs and increased price competition keeping prices low.

These trends appear to have affected retailers significantly during this past holiday season, as heavy discounting likely weighed on earnings despite generally strong spending growth overall. Yesterday, Walmart reported disappointing earnings growth for the 4th quarter to kick off the retail earnings season, sending shares tumbling as much as 9.5% in yesterday’s trading.

Many factors were at play in the soft results, but one of the key highlights was a decline of 61 basis points in gross profit margin during the quarter. Brett Biggs, Chief Financial Officer for Walmart, called attention to the challenges posed by rising online sales during the earnings call, citing “mix effect from our growing eCommerce business” as one of the main reasons for the decline in profit margin.

The retail apocalypse and trends in retail employment

In response to the many challenges posed by rising e-commerce, many major retailers have reevaluated their business models. With less foot traffic and weakening sales revenue in traditional brick and mortar stores in favor of online purchases, retail store closings have surged over the past few quarters. After over 5,000 store closings in 2017, current projections call for an additional 3,600 closings in 2018.

Dubbed the “retail apocalypse”, these store closings have begun to have a noticeable effect on jobs in the retail sector. While job growth in the overall economy has been strong over the past several years, retail employment has sagged since the start of 2017 and is now lower that it was at this point last year.

What does it all mean for the economy?

The pressure on retailers and the stagnation in retail job growth has certainly garnered significant attention, with some calling for the President to focus his attention on saving retail jobs. Some have even gone as far as to paint the entire trend of shifting to e-commerce as harmful for the economy and representative of a threat to overall activity.

While this channel shift for consumers will undoubtedly harm some workers and businesses in traditional retail sectors, this seems to be a narrowly-focused view of the overall impact. The rise in e-commerce has been a driving force behind making businesses reevaluate old business practices, finding new ways to address changing shopping preferences.

This trend is one of the reasons why the trucking, warehousing, and logistics industries have been fertile ground for new companies like FourKites, Deliv, and ShipHawk. It has also driven established delivery companies such as UPS and FedEx to find more efficient ways to transport goods to the end consumer. And in the end, there are untold gains in consumer satisfaction from having the ease of shopping from anywhere.

Small profit margins are a sign that competition is working in a market, not destroying it. Smart retailers will devise creative ways to create a satisfying consumer experience while limiting costs and will survive. Businesses that cannot adjust will fall to the wayside. When all of the major shifts have occurred, the end result may very well be a retail sector with fewer workers. However, I can think of at least one other area of the economy that has a shortage of workers. Efforts to deal with the aftermath of consolidation in the retail sector are better focused on retraining displaced workers instead of propping up old business models to preserve jobs.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.