Freight demand is likely to remain solid as orders for durable goods rebound

Advance readings show that orders placed for durable goods in the economy rebounded nicely in February, in a sign that manufacturing activity should continue at a solid pace in upcoming months. The Commerce Department reported this morning that new durable goods orders rose a healthy 3.1% during the month, nearly reversing the 3.5% decline in orders in January.

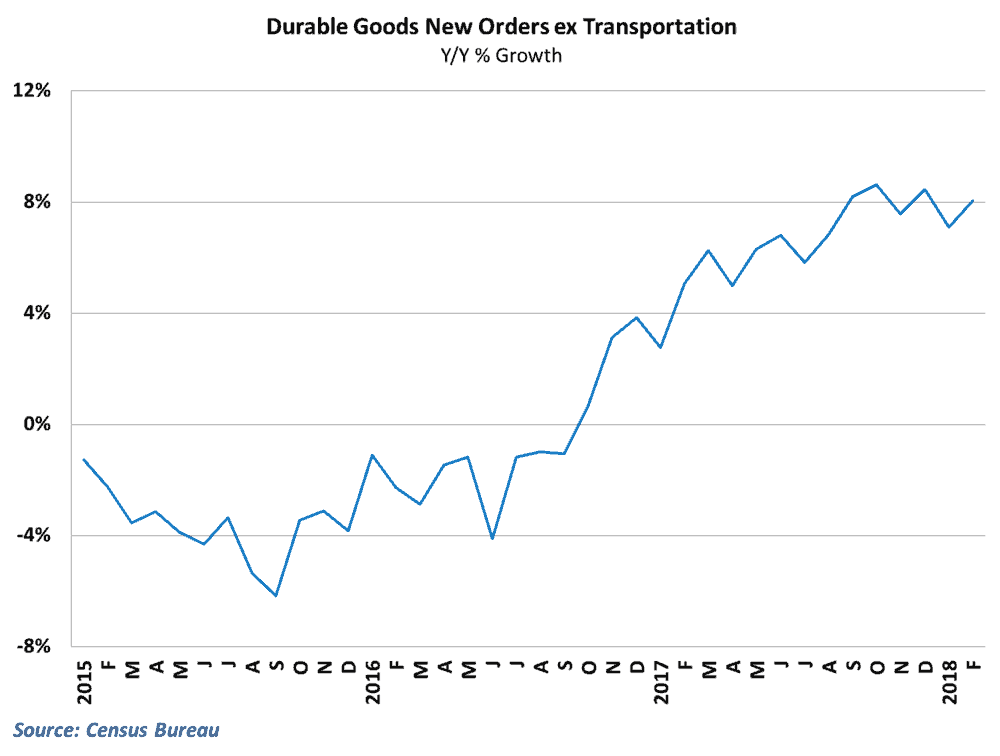

Much of the volatility in recent months has been driven by wild swings in transportation equipment orders, particularly for aircraft and parts. February’s results were no different, as transportation equipment orders jumped 7% from January’s levels. Excluding transportation, orders rose 1.4% during the month and are now 8.1% higher than this point last year. Year-over-year growth has moderated somewhat from the rapid pace seen in the 4th quarter of last year, but remains solid by historical standards.

(Story continued below)

The details for this report were also encourage and showed broad-based gains in orders in February. With the exception of computers and electronics equipment, every other major industry saw orders grow in February.

Durable goods orders serve as a proxy for upcoming manufacturing demand, as the orders that are placed in this month turn into shipments in upcoming months. These manufactured goods ultimately provide part of the foundation for truck and rail freight movements in the economy. As such, this morning’s report would suggest that manufacturing activity and freight demand should be solid going forward.

Behind the numbers

The results this morning serve as some reassurance that manufacturing activity will continue to be strong in upcoming months. The year-over-year growth rates in orders may have moderated some, but keep in mind that orders growth hit the fastest pace since 2012 in October of last year. As a result, any slight moderation that occurs isn’t necessarily a sign of real weakness.

Again, the swings in transportation equipment orders lead to some gaudy headline numbers. Unlike last month, however, this wasn’t entirely a commercial airlines story, as orders for motor vehicles and trucks saw a big jump in orders in February.

Results on the nondurable side, and additional detail for durable goods, will be published in early-April and should give a more complete picture at an industry level for orders growth and upcoming freight demand.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.