Growth in the US economy moderated in the 1st quarter of 2018 as consumer spending advanced at the slowest pace in nearly five years. Housing construction activity also fell short during the quarter, but a swing in business inventories and solid business investment helped maintain respectable growth to start the year.

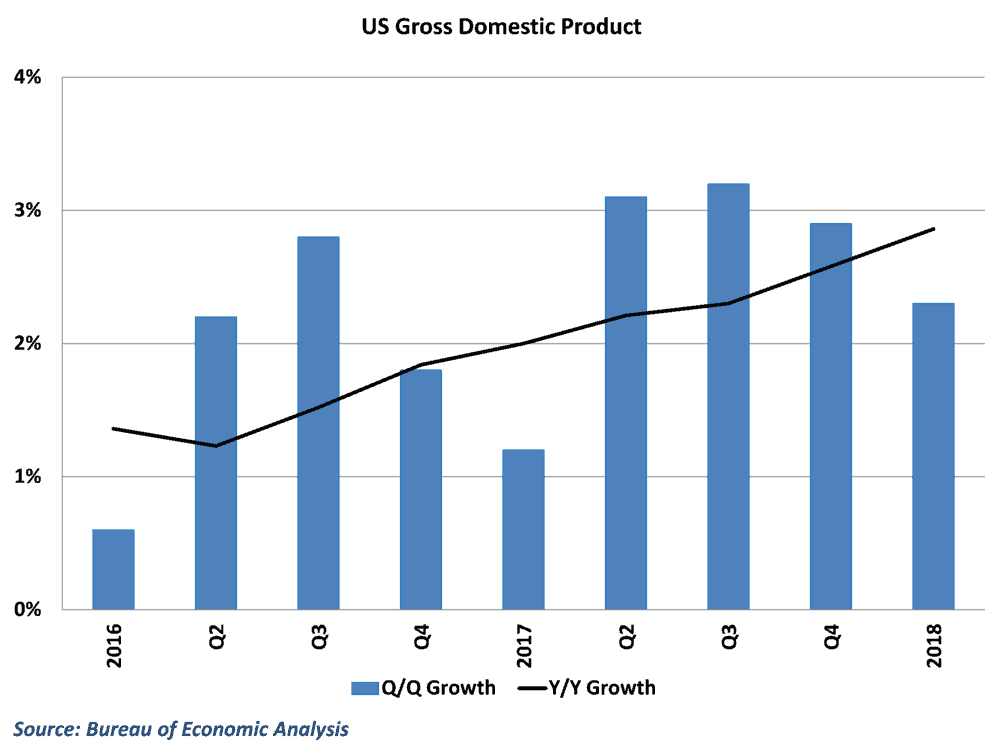

The Bureau of Economic Analysis reported that US gross domestic product rose at a 2.3% annualized pace in the 1st quarter, down from 2.9% growth in the previous quarter. This ends a string of three consecutive quarters of growth at or near 3% in the economy as temporary factors helped derail growth in some areas.

A slowdown in consumer spending was the primary culprit during the first quarter, as household purchases rose at a meager 1.1% pace and contributed less than a percent toward growth after robust growth at the end of 2017. In particular, goods consumption took a big hit in the 1st quarter, as a big reduction in auto purchases led to the first decline in consumer spending on goods since mid-2011.

Residential fixed investment growth, which tracks spending on home construction in the economy, also slowed significantly, remaining essentially unchanged after contributing nearly a half percentage point to growth in the previous quarter.

Other areas of the economy were more positive. Business investment grew at a healthy 6.1% pace during the 1st quarter and contributed nearly a full percentage to growth for the second straight period. International trade, which caused the biggest drag on growth in the previous quarter, actually made a positive contribution at the start of 2018 amid a drastic slowdown in import growth. In addition, inventories accumulated at a faster pace in the 1st quarter, reversing the drag on growth in the previous quarter. (Story continued below)

Outlook still optimistic

Despite the moderation in growth, there remain a number of reasons to be encouraged about the prospects for growth going forward. For one, much of the weakness in the 1st quarter is just payback for outsized gains in the 4th quarter in several areas. The end of 2017 was helped significantly by rebuilding efforts after hurricane season and an impressive holiday season. This boosted residential construction efforts and led to the strongest growth in consumer spending in three years. The retreat in consumer spending this quarter is likely just a return to normal after the post-hurricane bump in activity.

In addition, even with the dip in growth in the 1st quarter, the economy is still on a generally accelerating path. Gross domestic product is now 2.9% higher than it was at this point last year, and year-over-year growth has improved in each of the last seven quarters. There are likely to be some challenges ahead, as the era of low interest rates and unusually low inflation appears to be nearing its end, but the economy should still be helped by solid labor market conditions and the recent tax cuts.

GDP and freight markets

Without a doubt, gross domestic product is the most often utilized measure of the state of an economy. GDP measures the value of all goods and services produced within an economy during a given period, and provides the broadest measure of economic activity.

It is worth noting, however, that most of the activity in the US economy revolves around the production of services, which may or may not have ties to freight movements. Spending on things like health care, recreation, and financial services are a significant chunk of economic production, and headline GDP numbers may not accurately reflect the state of the freight market.

That is not to say that the GDP data releases are useless. Many of the components of overall GDP, such as goods consumption, residential investment, inventories, and goods exports and imports, are tied directly to the goods side of the economy and provide useful insight into which areas of freight are experiencing a healthy demand environment.

Behind the numbers

The moderation in growth in the 1st quarter has been expected for a while, as it was evident fairly early in the quarter that the economy was losing some momentum. The headline number was softer for sure, but it beat most expectations, helped by some late surprises on the trade deficit.

The bad news here is that the goods side of the economy fared worse than the headline number would suggest. The slowdown in consumer spending was almost all on the goods side, which is in line with the disappointing retail sales results throughout most of the quarter. Construction also didn’t perform well during the quarter, and the benefit from international trade all came from softness in imports. All of these things are not good for freight demand.

The good news, again, is that this is probably all temporary. Falling goods consumption after such strong growth in the previous quarter is probably all post-hurricane/holiday hangover effects. The absence of any gain in housing construction is also probably post-hurricane/weather effects. The effects of the tax cut are probably going to be eroded quite a bit by higher interest rates and rising inflation, but the labor market is strong and businesses and consumers feel confident, so the economy will likely grow at a healthy pace going forward.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.