The trade picture improved for the US economy in March, as healthy goods export growth and falling imports led to the largest narrowing of the goods trade deficit in two and a half years. However, declines in imports outweighed export growth, signaling softer conditions for freight movements.

The Census Bureau reported that the US economy’s goods deficit narrowed in March to -$68.0 billion dollars on a seasonally adjusted basis, from -$75.9 billion in the previous month. This ends a streak of six consecutive months of widening deficits and helps to put a more positive spin on an otherwise dismal quarter for international trade.

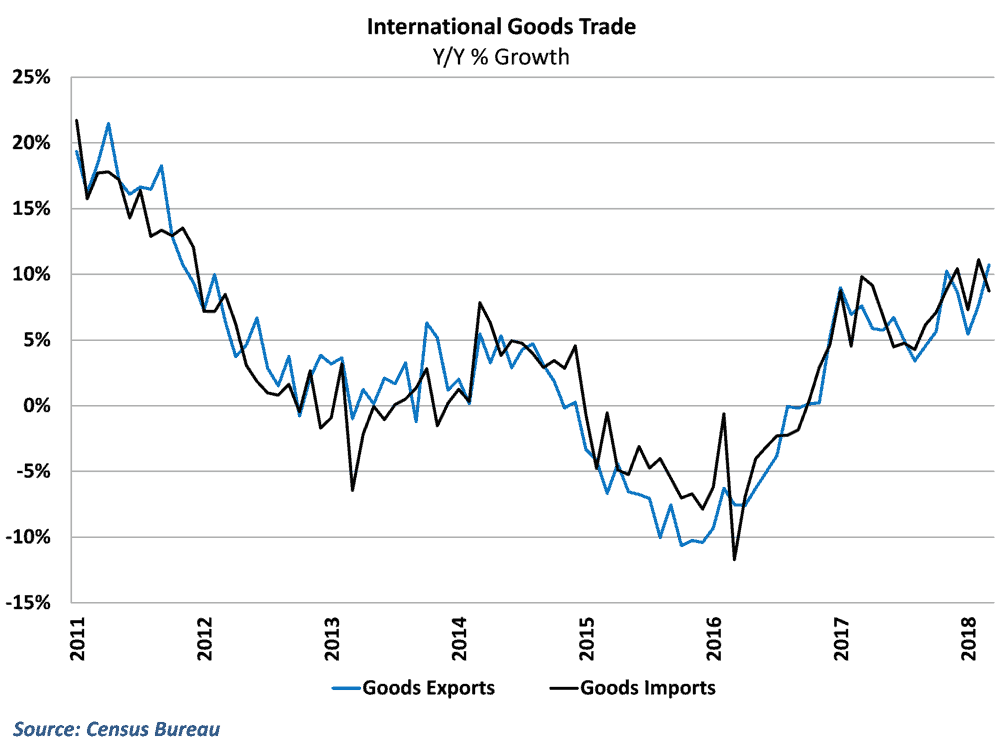

Goods exports enjoyed particularly strong growth during the month, rising nearly two and half percent for the second straight month. Goods exports are now 10.7% higher than at this point last year, marking the fastest pace of year-over-year growth since the end of 2011. Imports fell for the second time in the past three months as year-over-year growth fell to 8.7%. (Story continued below)

While this likely means that international trade will be less of a drag on growth than previously thought in the 1st quarter GDP numbers, from a transportation perspective the results are far less encouraging. The decline in goods imports in March was larger than the increase in exports, leaving the value of total goods trade lower than it was in February.

This total trade number plays a larger role than the state of the deficit in influencing freight markets. Ocean and air freight are impacted by the amount of imports and exports and stand to gain from increases in total trade even if the deficit widens. In addition, many domestic freight movements involve drayage or rail freight for goods either coming in from overseas or headed out to the rest of the world through the nations many ports.

Signs of tariff impacts

Many were watching this morning’s results for signs that recent tariffs were beginning to have an impact on the trade scene. President Trump officially implemented tariffs on steel and aluminum at the end of March and announced plans for tariffs on China soon after. Tariffs in general raise the cost of imported goods and would lead to a decline in imports for affected products.

However, the declines in goods imports seen in March were far more broad-based. Imports of industrial supplies (which would include steel and aluminum) declined, but so did nearly every other major category of goods imports. This would suggest that the decline in imports during the month was likely cause by the weakened US dollar and general moderation in the US economy, rather than any direct tariff effects.

Behind the numbers

It took a while for the weaker dollar to begin to play a role in the trade figures, but both the stronger export growth and the weaker imports are likely being driven, at least in part, by currency values. This is going to continually pressure import growth and boost export activity going forward, and big gains on the import side will hinge on just how strong underlying growth is in the US economy.

This month’s report serves as another reminder that there is a difference between what is good for economic growth and what is good for transportation and freight. Last month, there was a surging trade deficit (bad for growth numbers) but a big jump in total trade (good for transportation). The headline trade deficit numbers probably bode well for tomorrow’s GDP report, but this is the second time in three months that the total trade figures have declined. Even more concerning is that this flattening in trade has occurred before some of the changes in trade policy have had to chance to take hold.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.