U.S. job openings rose in July to a new record, adding to signs of labor-market tightness that may push wages higher. Within the transportation and logistics sector, openings continue to outpace hiring as businesses are finding considerable difficulty trying to fill positions.

Job openings pushed to a fresh record high in the 3rd quarter, indicating that labor market conditions remain healthy in the overall economy. The openings rate in the transportation and warehousing sector continues to outpace the rest of the economy, and the pace of hiring provides further evidence that the industry is struggling to find workers.

The Bureau of Labor Statistics released results from the monthly Job Openings and Labor Turnover Survey (JOLTS) this morning, showing job openings in the economy rose to 6.9 million in July. This is up from an upwardly revised 6.8 million in the previous month and sets a new record for the series. The job openings rate, which measures openings as a percentage of total employment plus openings, remained at a record high of 4.4%, indicating that job opportunities remain plentiful in the economy overall.

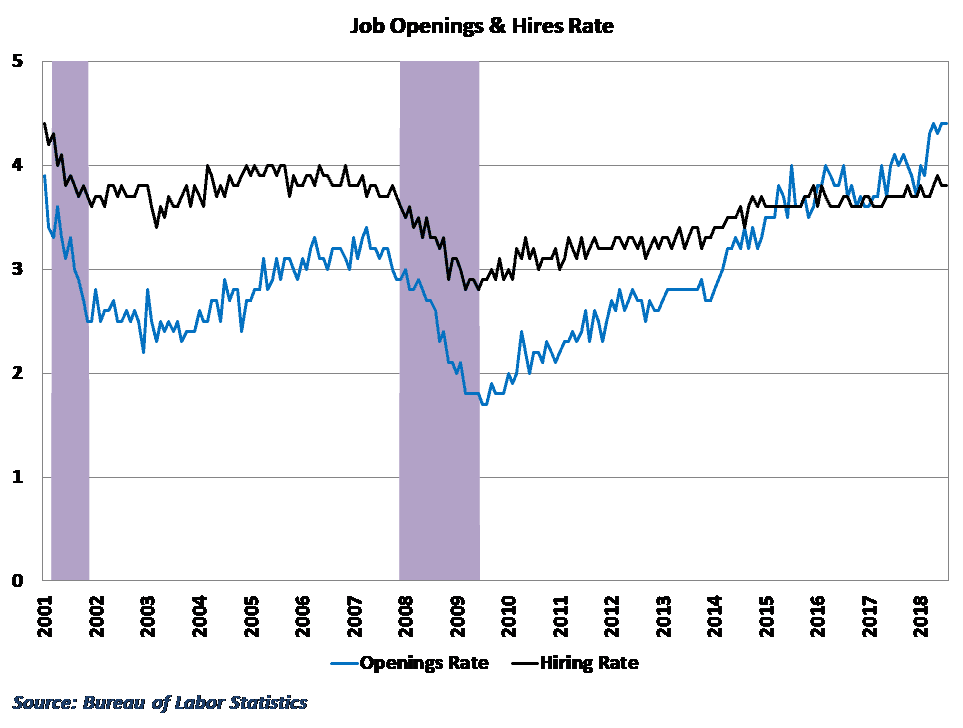

The pace of hiring in the economy has failed to keep up, however. While openings, and the job openings rate have increased throughout the year, the pace of hiring has hovered slightly below 4% in 2018 and remained at 3.8% at the start of the 3rd quarter. Historically, the openings rate has been below the hiring rate by about 1%, driven by the fact that the openings rate is calculated off of a larger base. However, the gap between the two narrowed over the past few years, and the openings rate has consistently exceeded the hiring rate since late 2016. This is a sign of extremely tight labor market conditions, and while demand for work is high and rising, businesses are having a tough time finding workers to fill positions.

Historically tight labor conditions

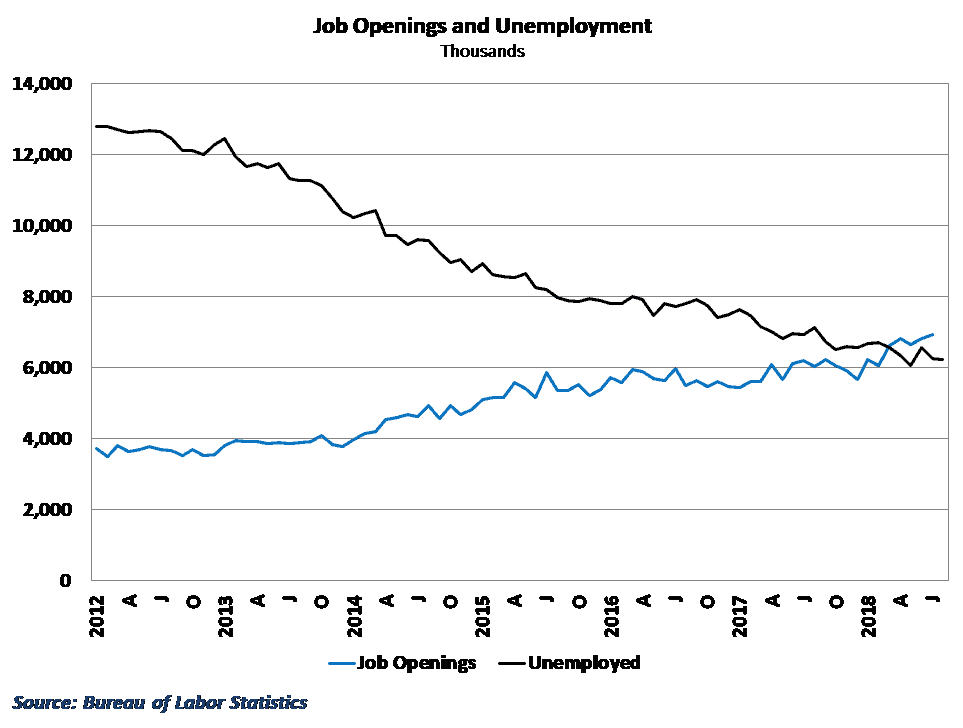

Much of the problem stems from the already low levels of unemployment in the economy. The unemployment rate in the economy has hovered around 50-year lows throughout the year, registering 3.9% in August of this year. In fact, since March of this year, the number of job openings in the economy has exceeded the number of unemployed people in the economy. This means that even if all of the people looking for work were able to find work tomorrow, there would still be approximately 660,000 additional positions that businesses wanted to fill in the economy.

Like many other things related to this survey, this marks the first time in the history of the JOLTS data (dating back to late-2000) that this has happened, and further underscores just how scarce labor is the economy in the 2nd half of the year. The lack of available workers is playing a role in some of the better wage data that has emerged in recent months, as businesses compete for a shrinking labor pool.

Transportation openings surge as hires fall

Of course, this phenomenon is well known in the transportation and logistics sector. The job openings rate in transportation, warehousing, and utilities increased in July to 4.8%, up from 4.6% in the previous month. While this is not quite at the record highs set a few months ago, it remains well above the overall openings rate for the US economy. Moreover, it outpaces the pace of hiring in the sector by over a full percentage point.

The size of the gap between hires and opening would suggest that businesses in the industry are having a particularly tough time filling available positions. This sheds further light onto the challenges in the industry, particularly in freight transportation where demographic shifts and difficulties in recruiting and retaining employees have led to a shortage of labor.

Behind the numbers

The JOLTS survey is another in a string of releases that show just how tight things have become in the labor market. The combination of JOLTS data, employment, and jobless claims helps to paint the overall picture of employment trends in the economy. Right now, all of these indicators are signaling a tight labor market.

This, of course, is especially true within the transportation sector. Details from the JOLTS release do not get as detailed as to dig into trends in specific modes of transportation, but it is a sure bet that the driver shortage experienced by trucking carriers is playing a role here.

As the unemployment rate hovers around 4%, there will be questions about where the additional supply of labor is going to come from. For much of the past year, the answer has come from previously marginalized workers who have rejoined the labor force and found work, while the headline unemployment rate has made some small improvements. However, broader measures that include marginally attached workers are also getting close to normal levels, indicating that most that were on the sidelines have already come off. Many forecasters project that the unemployment rate will continue to trend downward and approach all-time lows slightly above 3%, but wages will likely have to pick up much faster in order to induce this kind of outcome.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.