Job growth rebounded in October after Hurricane Florence disrupted hiring activity in the previous month. Within the transportation and logistics industry, trucking payrolls expanded for the sixth consecutive month, though growth lagged behind the pace of hiring among parcel companies and warehouses.

The Bureau of Labor Statistics (BLS) reported that the economy added 250,000 workers to payrolls during the month, up from a downwardly-revised gain of 118,000 in the previous month. This beat out consensus estimates of a 208,000 gain and marks the fourth time in the last six months that job growth has topped 200,000.

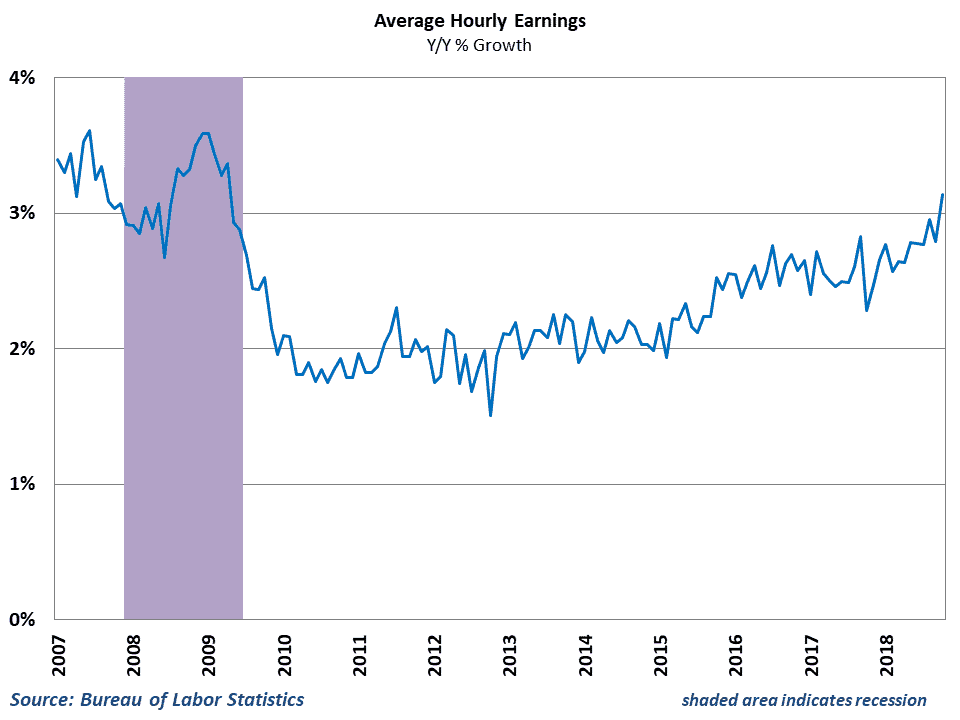

The strength in hiring has kept labor market historically tight throughout the year. The unemployment rate remained at a near 50-year low of 3.7% in October, and the number of job openings continues to exceed the total number of unemployed people in the economy. This has put upward pressure on wages in the economy, as businesses continue to boost pay to compete for scarce available labor. Average hourly earnings growth also beat expectations during the month, rising 0.2% from September’s levels. This pushed year-over-year growth to 3.1%, which is the fastest pace of wage growth since the recession ended in mid-2009.

A rebound from Hurricane Florence likely accounted for part of the strength in this morning’s results, as payrolls in September appeared to be hurt by the timing of the storm. Notably, the BLS reported no adverse effects from Hurricane Michael, which hit the Gulf Coast during the month. Every major industry category reported gains during the month, with education & health services, manufacturing, and construction leading the way with each recording job growth over 30,000.

Trends in freight hiring

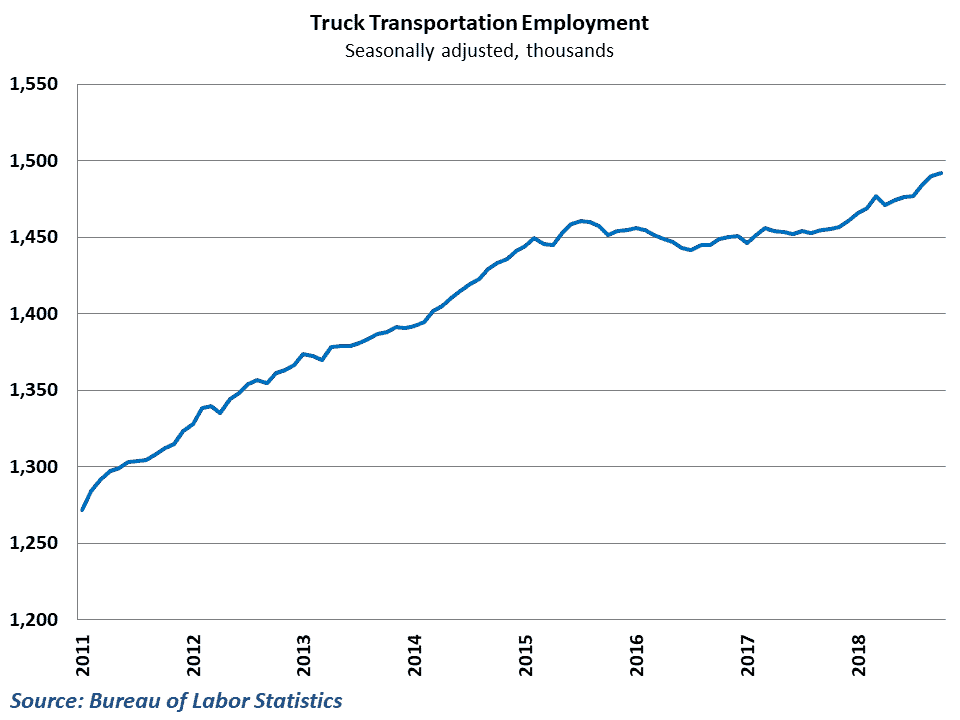

The transportation and logistics sector also experienced impressive job growth in October. Transportation & warehousing jobs grew by 24,600 during the month, marking the biggest gain in over a year. Much of the growth was driven by hiring by couriers & messengers and warehousing, each of which saw 7,600 additional workers added to payrolls in October. The trucking industry continued to expand, adding 2,400 workers during the month. This is a slightly slower pace compared to recent history, but the previous two months were revised up by a combined 4,600. Total for-hire trucking employment is now 2.5% higher than it was at this point last year, which is the fastest pace of year-over-year growth since 2015

This serves as further evidence that capacity continues to expand in the freight market. Trucking hires continue to be outpaced by parcel and warehousing jobs, but have seen a noticeable acceleration over the past year in response to the rise in freight demand.

Behind the numbers

The headline numbers were largely expected after last month’s hurricane-related slowdown, especially given the strong ADP employment numbers a couple of days ago. The real surprise was that the BLS reported no noticeable negative effects from Hurricane Michael, even though Michael also hit during the BLS’ survey reference week. The wage numbers were also encouraging, and the move into the 3% hourly earnings growth territory is likely to continue going forward.

On the transportation side, the rapid pace of hiring among parcel companies and warehouses in general is driven by the surge in e-commerce. The trend over the last few years has been for retailers to expand their distribution networks and locate close to population centers to get e-commerce shipments to the end consumers quickly. This requires more warehouses, more warehouse workers, and more demand for parcel companies to conduct last mile delivery.

The particularly strong results in October like reflect some stronger-than-normal seasonal hiring. Hiring typically begins to ramp up for parcel companies around this time, before surging in November and December. Both UPS and FedEx have said they expect a strong holiday e-commerce season, with plans to add record numbers of seasonal employees. October’s results suggest they may have already started.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.