Manufacturing activity lost some momentum in April, but remains generally strong despite rising prices for raw materials and increased difficulty in meeting available demand.

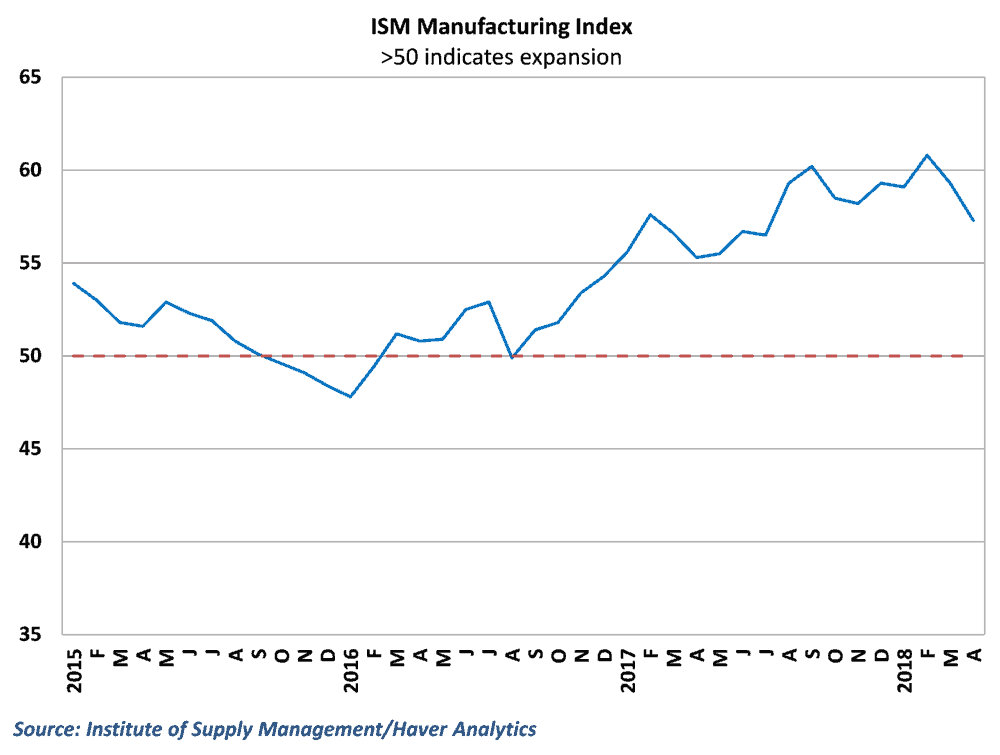

Data from the Institute of Supply Management (ISM) showed that US factories expanded at a slower pace in April, as the manufacturing purchasing manager’s index fell 2.0 points to 57.3. This falls short of consensus expectations of 58.6, and marks the lowest reading in the manufacturing index in nine months. It is worth noting, however, that any reading above 50 signals growth in the manufacturing sector, and readings above 55 typically signal healthy growth. As such, the month’s results serve as a disappointment, but are still consistent with strong growth in manufacturing activity. (Story continued below)

Freight capacity issues affecting manufacturing

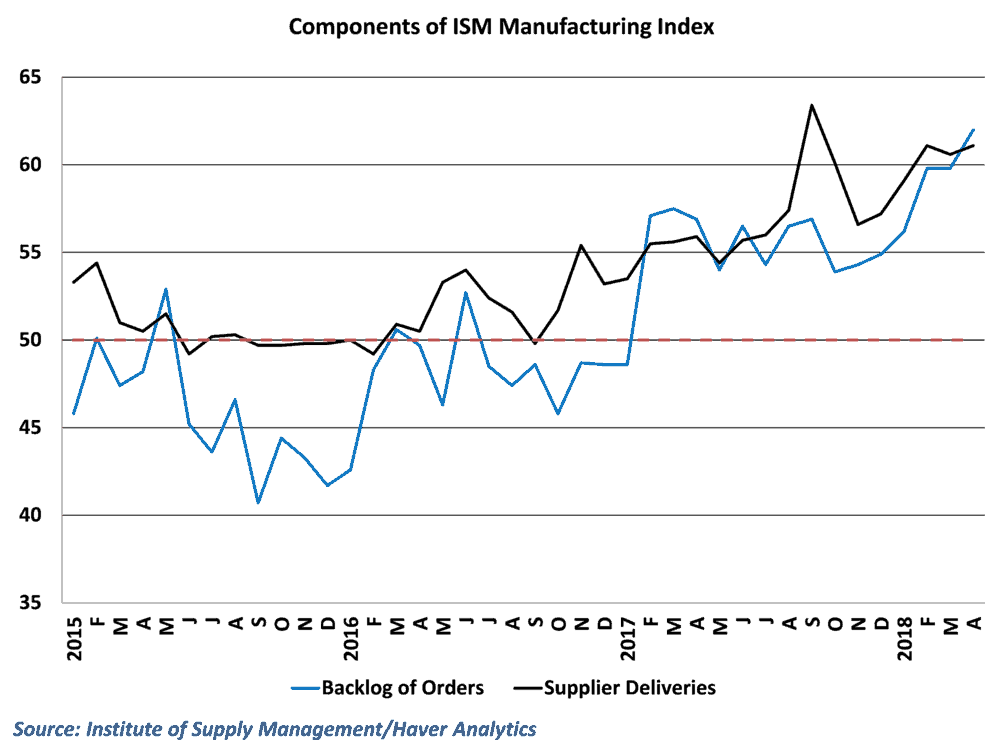

For the second consecutive month, details in this morning’s report point to the difficulties that manufacturers are having trying to meet existing demand. With solid global growth, strong business investment demand, rebounding consumer spending, and a generally weak value of the dollar, demand fundamentals remain robust for domestic manufacturers. The Backlog of Orders subcomponent of the ISM index rose to 62.0 in April, setting a near 14-year high and indicating that businesses have had trouble fulfilling existing orders for goods.

The challenges from the current shortage of truck drivers appear to be contributing to struggles in the manufacturing sector. The Suppliers Deliveries subcomponent rose for the fourth time in five months in a sign that manufacturers continue to face delays in receiving supplies for production. Aside from hurricane-related disruptions last September, April’s value of 61.1 marks the highest reading in this subcomponent since 2010.

Once production has been completed, manufacturers have found it difficult to deliver their products on time. A respondent from the food and beverage industry called attention to the trucking capacity crunch, saying: “Shortages of trucks and drivers has impacted delivery times.” Another respondent from the transportation equipment industry noted: ”Business is off the charts. This is causing many collateral issues: a tightening supply chain market and longer lead times. Subcontractors are trading capacity up, leading to a bidding war for the marginal capacity. Labor remains tight and getting tighter.”

Input prices continue to climb

In addition, details in the ISM report suggest that surging commodity and other input prices remain an issue for domestic manufacturers. After reaching a multi-year high in last month’s report, the Prices subcomponent of the ISM index pushed even higher in April, rising to 79.3. Price increases in aluminum, steel, corrugate, diesel fuel , and caustic soda were all highlighted in this morning’s release, pressuring margins for manufacturers in several industries. Again, some of the individual responses to the survey provide valuable insight on the driving forces behind the price increases. Not surprisingly, tariffs again took center stage, with one respondent from the machinery industry saying: “The recent steel tariffs have made it difficult to source material, and we have had to eliminate two products due to availability and cost of raw material.” Outside of price increases, the recent tariffs have introduced additional uncertainty in industries, with one respondent noting: “Business planning is at a standstill until they [tariffs] are resolved. Significant amount of manpower [on planning and the like] being expended on these issues.”

Behind the Numbers

This marks the second straight sizeable decline in the headline manufacturing index, which is consistent with the general theme that things are beginning to normalize after some really gaudy numbers at the end of 2017 and early part of 2018.

What is interesting here is that everything on the demand side seems to be fine for the manufacturing sector. Individual survey responses almost universally mention healthy to outstanding demand conditions across industries. Capacity numbers that the Federal Reserve produces show that factory utilization has picked up in recent months, but not the point that would suggest that manufacturing plants are maxed out in the economy.

The challenges now almost all appear to be coming from the supply side, and would suggest that manufacturers are being increasingly bothered by the scarcity of transportation and rising freight costs. This theme has been around anecdotally since hurricane season in 2017 brought some of these issues to the forefront, but it appears now to manifesting itself in some of the economic data.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.