Retail sales rebounded in January despite big declines in motor vehicle and gasoline sales. Gains in core sales helped to stabilize the retail sector during the month, erasing much of the decline from December 2018.

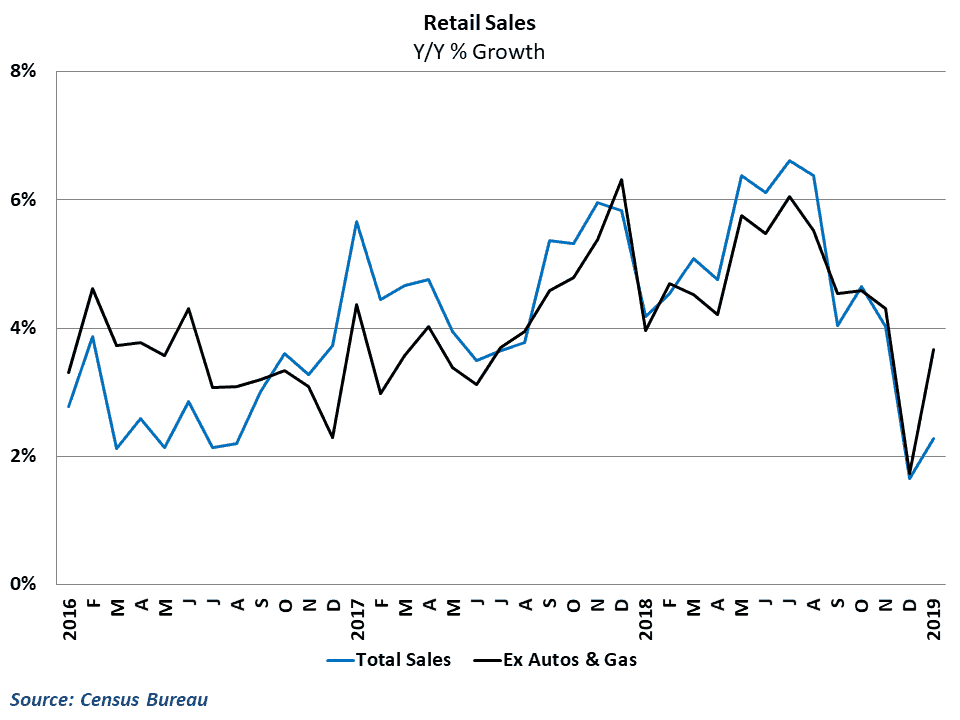

The Census Bureau reported that total retail sales rose 0.2 percent in January on a seasonally adjusted basis from December’s levels. This slightly exceeded consensus estimates of a 0.1 percent gain, but comes on the heels of downwardly revised sales figures from both November and December. Year-over-year growth in the retail sector improved to 2.3 percent in January after tumbling to a nine-year low of 1.6 percent in the previous month.

The gain in sales came despite large declines in motor vehicles & parts sales and gasoline sales, which fell 2.4 percent and 2.0 percent, respectively. Core retail sales, which excludes these categories, rose by an impressive 1.2 percent during the month as year-over-year growth climbed to 3.7 percent. Growth during the month was boosted by sharp rebounds in sales at sporting goods, building materials and health care stores, which each saw monthly growth topping 1.5 percent. Nonstore (mostly online) retailers also had some success in January, reversing more than half of December’s decline by rising 2.6 percent.

This improvement in core spending is encouraging, though it was not enough to completely reverse the decline seen in December’s disastrous report. Core sales growth has been trending downward sine hitting multi-year highs in the third quarter of 2018. January’s results indicate that things may have stabilized some at the start of 2019, but if job growth continues to slow as it did in February, the retail sector could still be facing significant headwinds.

Behind the numbers

The January retail report got more attention than it normally does after December’s results were met with quite a bit of skepticism. Another month of weak retail sales, combined with February’s shock from payroll employment would have raised real questions about the state of consumer spending going forward and the health of the economy overall.

In that vein, the January results were good enough to ease some of these concerns even if they did not completely erase the plunge in December sales. It is worth noting that retail figures are nominal and do not take into account any price changes that may have occurred during the month. As a result, the large declines in auto and gas sales are likely being driven by heavy discounting at auto dealers and lower fuel costs rather than drops in economic activity. This means that the total retail environment is already likely stronger than the headline number would suggest.

Going forward, FreightWaves had already been predicting slower consumer spending and retail sales in 2019, after impressive growth for nearly all of 2018. The combination of higher interest rates, reduced pent-up demand, and the fading effects of the Tax Cut and Jobs Act point to a deceleration in the retail sector. Core sales growth hit 6.0 percent in July 2018 and has moderated fairly steadily since then. December’s results remain a mystery given the anecdotal reports of strength during the holiday season, but January’s rebound puts the retail sector back onto its decelerating path.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary bysubscribing.