Survey data shows the impact of driver shortages on manufacturing activity

Manufacturing activity remains strong in the US economy, but mounting evidence from survey data suggests that trucking shortages, capacity constraints, and recent tariff announcements have had an effect on domestic manufacturers.

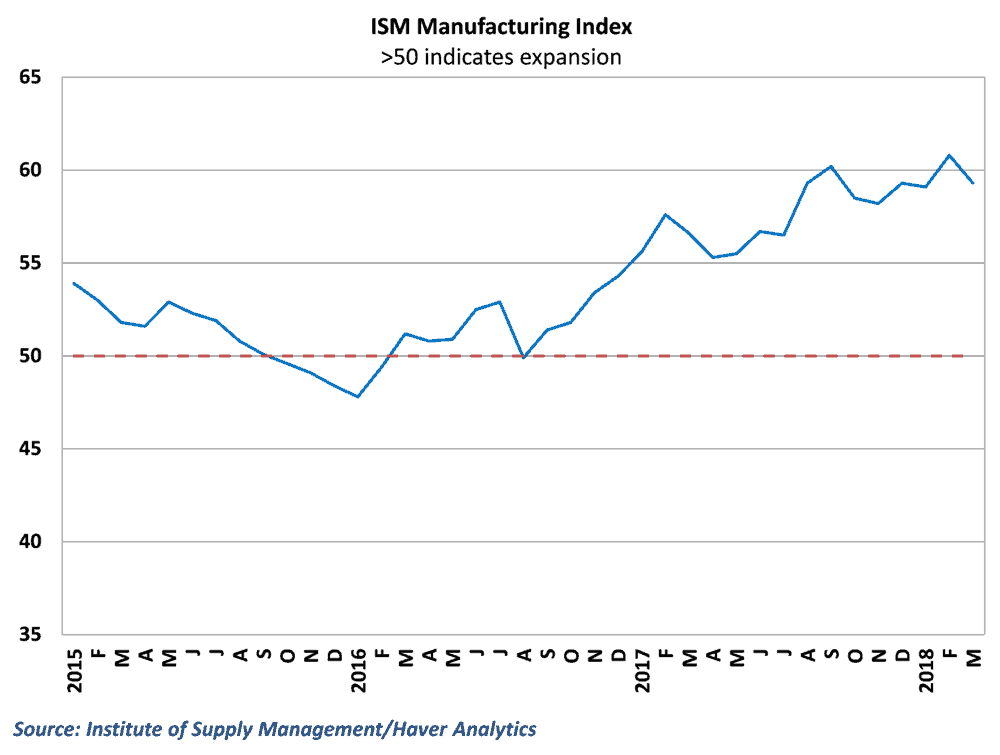

Data from the Institute of Supply Management (ISM) showed that US factories expanded at a slightly slower pace in March, as the manufacturing purchasing manager’s index fell 1.5 points to 59.3. This falls short of consensus expectations of 60.0, but remains solidly in expansionary territory. (Story continued below)

Freight capacity issues affecting manufacturing

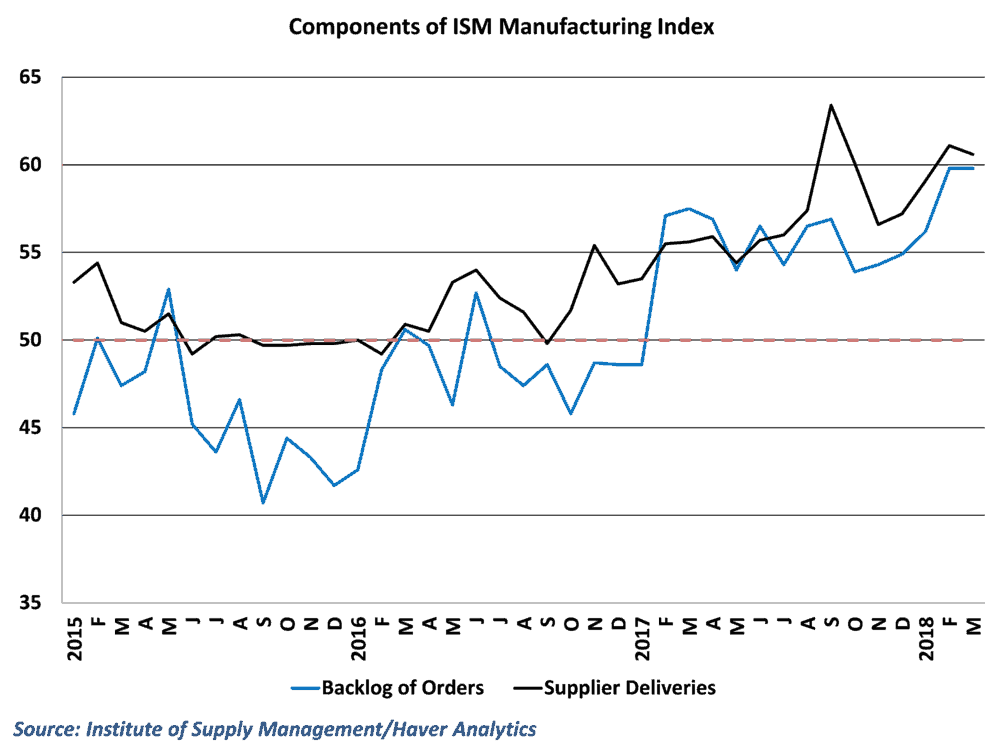

Details in this morning’s report show a sector that is struggling to meet up with existing demand. The combination of healthy growth in consumer and business spending, solid global growth, and a relatively weak dollar has bolstered the environment for domestic manufacturing, and businesses in the sector face challenges trying to keep up. The Backlog of Orders subcomponent of the ISM index remained at a near 14-year high for the second consecutive month, indicating that businesses have had trouble fulfilling existing orders for goods.

The capacity crunch in freight markets has helped contribute to this problem. The Suppliers Deliveries subcomponent pulled back slightly in March but remained well above 60 in a sign that manufacturers have had difficulty getting the necessary supplies for their production processes in a timely fashion. One respondent from the computer and electronics industry noted, “Supply constraints, extended lead times, capacity constraints [and the like], particularly in the electronics components markets, continue to frustrate and drain needed resources, have delayed production schedules and, in some cases, caused missed or delayed sales opportunities.”

On the other end, manufacturers have found it difficult to get their products out to their customers once they have been produced. A respondent from the food and beverage industry called attention to the current driver shortage, noting, “In the U.S., we continue to struggle with finding carriers and drivers for shipments.”

Tariffs also taking their toll

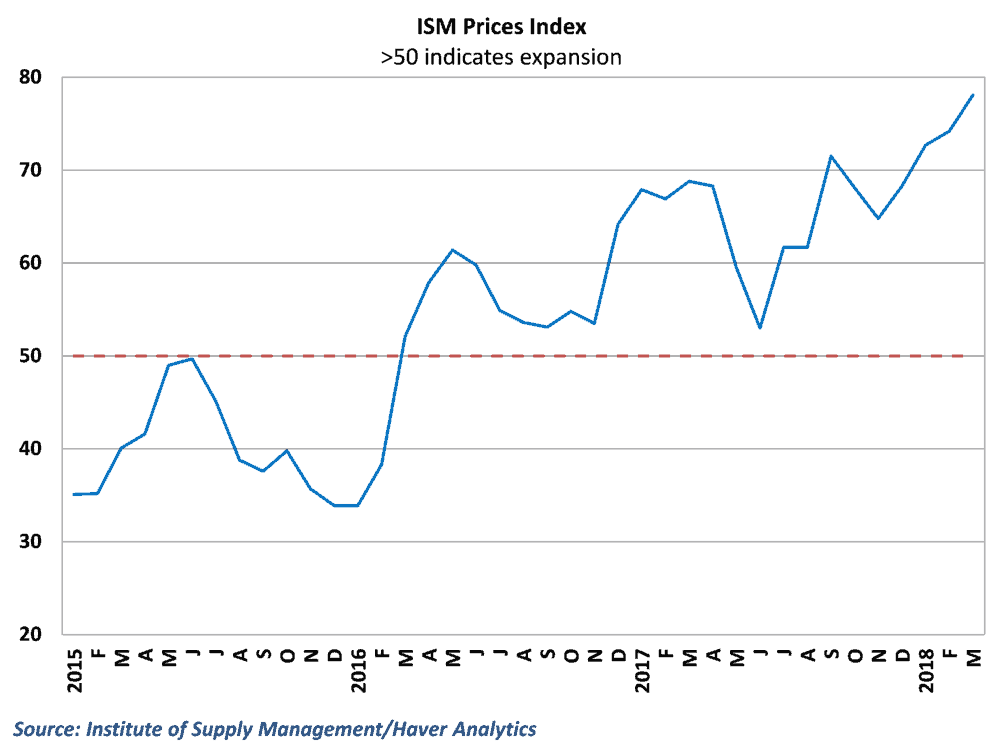

In addition, details in the ISM report suggest that recent tariffs are beginning to have an effect on domestic manufacturers. Similar to the regional results from Dallas and Richmond, the Prices ISM index surged in March, reaching the highest level since 2011. This signals that prices for raw materials have become an issue for domestic manufacturers. Several respondents mentioned the impact that steel and aluminum tariffs are having on their business, with one respondent from the machinery industry mentioning, “…much concern in the industry regarding the steel and aluminum tariffs recently [imposed]. This is causing panic buying, driving the near-term prices higher and [leading to] inventory shortages for non-contract customers.”

Behind the Numbers

The pullback in manufacturing during the month is not terribly surprising, as the ISM index hit a post-recession high in the previous month. In addition, some slowdown was clearly in the cards after the regional surveys from the Dallas and Richmond Federal Reserve Banks experienced sharp downturns. Keep in mind that for the ISM index, any reading above 50 signals expansion. Readings over 55 typically signal growth in manufacturing activity, so the current result of 59.3 is still positive for the economy despite the decline.

As was the case with the regional surveys, some of the impact from the steel and aluminum tariffs may just be initial shock from the announcements. Most of the US’ major trade partners in steel and aluminum were granted exemptions to the tariffs when they were finally implemented late last month.

The commentary on supply chain disruptions and shipment delays serves as an illustration of the interconnectedness of freight markets and the broader economy. Typically, we think of freight as following general movements in the macroeconomy; when the economy does well, freight markets will see rising volume. Recent results serve as a useful reminder that the health of the transportation sector can play a critical role in how the economy performs.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.