Manufacturing activity continues to expand in the 2nd quarter, and challenges with finding employees and tight freight capacity have made it difficult for producers in the economy to keep up with strong demand.

Data from the Institute of Supply Management (ISM) showed that US factory activity expanded at a faster pace in May, as the manufacturing purchasing manager’s index rose 1.4 points to 58.7. This slightly beat consensus expectations of an increase to 58.5 and marks the 21st consecutive month of expansion in the manufacturing sector (Story continued below)

About the ISM Index

Each month, the Institute of Supply Management surveys purchasing managers in the manufacturing sector or different aspects of business, asking whether or not their activity is expanding or contracting. Data is collected on things such as employment, production, prices, exports, inventories, and orders. Each sub-index value is the percentage of respondents that reply that activity is expanding. Five of the sub-indexes (Production, New Orders, Supplier Deliveries, Employment, and Inventories) are then weighted to create the ISM manufacturing index.

Readings above 50 signal that more than half of the respondents to the survey believe that overall manufacturing activity is expanding during the month, while readings below 50 are a sign that activity is contracting. Historically, index results over 55 are a sign of above-trend growth in the manufacturing sector.

ISM data also gives some insight into trucking freight conditions. Manufacturing production is one of the key supports for freight demand in the economy, and readings from the ISM index typically are a leading indication on the amount of truck tonnage growth in trucking markets.

Manufacturers continue to struggle to meet demand

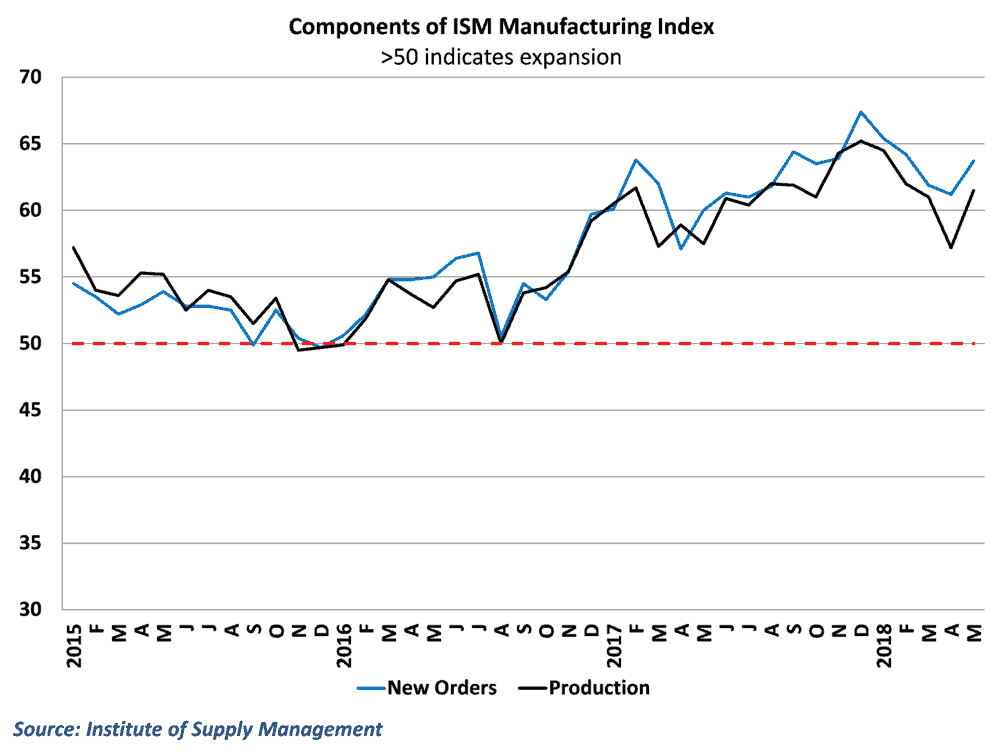

With strong business investment demand and rebounding consumer spending, demand appears to be gaining some momentum in the middle of the 2nd quarter. The Production component of the ISM index rose a whopping 4.3 points during the month, in a sign that activity in May picked up significantly. In addition, the New Orders sub-index rose 2.5 points in May and has now exceeded 60 in each of the last thirteen months. This would suggest that activity is likely to remain strong going forward, as orders in the current month typically turn into production in subsequent months.

Against this backdrop, manufacturers have found considerable difficulty in meeting demand. The Backlog of Orders sub-index pushed to a fresh 14-year high in May, rising to 63.5. Some of the difficulty in fulfilling orders stems from the difficulty in hiring workers. Manufacturing employment has posted solid increases throughout the year, but labor markets are currently very tight. One respondent from the food industry noted: “Very difficult to hire skilled and unskilled labor.”

In addition, manufacturers have been plagued by shipping delays as they often receive components and raw materials later than expected and are forced to delay production. One of the survey respondents called attention to this challenge, noting: “Severe allocation, long lead times and upward price pressure, particularly in the electronic components market, continue to hamper our ability to meet customer demand and our shipping schedule.”

Behind the Numbers

The results from the ISM index are consistent with other trends that have been released about the manufacturing sector and freight markets. The headline ISM number has bounced back after last month’s dip, but isn’t at the robust readings from the end of 2017 and early-2018, which has generally been the theme for freight markets over the past several months.

Almost everything coming from the manufacturing sector says strong growth should continue going forward. Even with all the uncertainty surrounding trade policy (which was again a theme in the responses this month), demand seems to be pouring in. Sixteen of the 18 industries covered in the ISM index reported expansion in May, with no industry saying they were experiencing a contraction.

In fact, the challenges associated with meeting demand seem to be more likely to derail growth than any fall in demand for products. The issue of labor shortages has been a worsening concern in the manufacturing sector, and the inability to find people to produce these goods or trucks to deliver the necessary supplies may place some constraints on how fast the sector can grow.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.