One of the key themes within the trucking industry over the past several quarters remains the shortage of available drivers to carry increased demand for freight. The combination of stronger economic growth, demographic shifts, and tighter regulation has squeezed the industry from all sides. The results of this crunch are being felt throughout the supply chain, as rising transportation costs and delays in shipping have cause disruptions and backlogs in overall economic activity.

To combat this, carriers have begun offering higher wages and improved benefits to truckers in an effort to attract and retain drivers in the industry. Hourly earnings growth for trucking employees has outstripped the growth in the rest of the economy through March of this year, and survey evidence suggests that benefits have also improved.

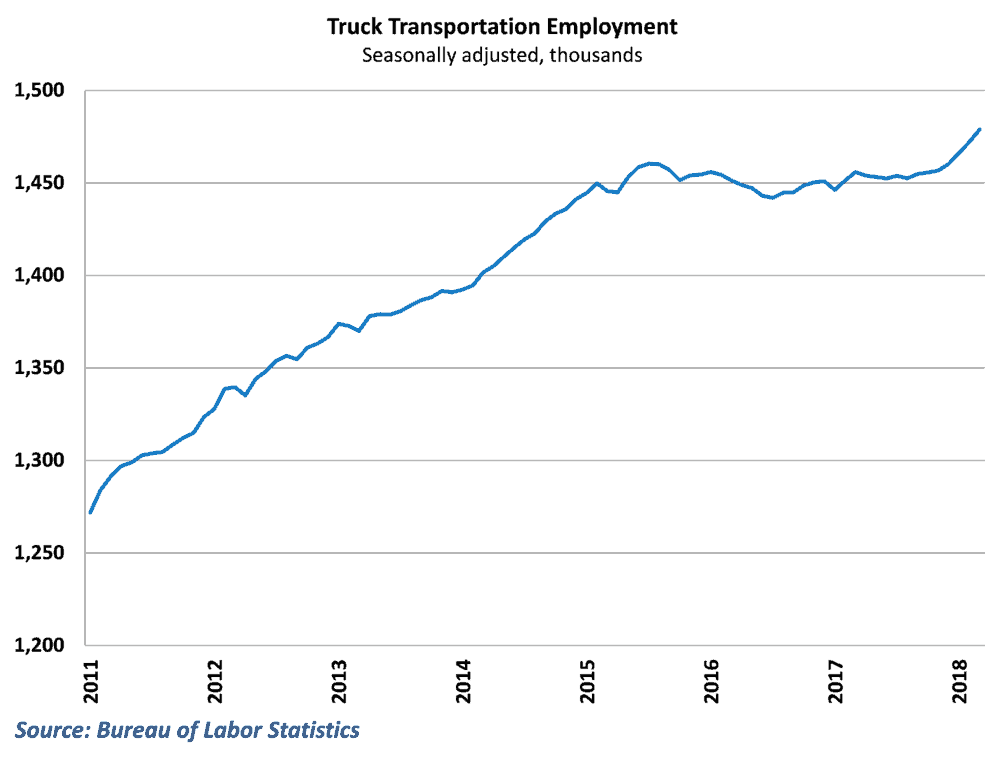

Recent evidence suggests that these moves are working. Employment data shows that the trucking industry added 6,700 jobs in March, capping an impressive 1st quarter of the year which saw 14,800 net new jobs added. To put this in perspective, consider that the industry added a grand total of 10,900 jobs combined from the 2nd quarter of 2015 through the end of 2017.

There is still considerable room for improvement, however, and the pace of hiring will need to accelerate further to address the industry’s issues. The ATA estimates that there will be a shortage of over 60,000 for-hire, over the road drivers by the end 2018. This shortage is projected to continue to rise as economic growth remains strong, reaching a whopping 175,000 workers by 2026. In addition, data from the Job Openings and Labor Turnover (JOLTS) survey suggests that the transportation industry remains plagued by high turnover and rising quits.

Other industries are also struggling to find labor

In addition, trucking is not the only area of the economy facing labor shortages. The unemployment rate in the economy has been stuck at 4.1% throughout the course of the year, below the level that most economists consider as full employment. This would suggest that most people who want to find a job can find one already. The number of job openings as a percentage of total jobs remains near record highs despite some recent pullback, indicating that there are plenty of businesses across the economy that are searching for workers.

Earlier this week, the National Federation of Independent Businesses released its monthly survey results on small business conditions. Optimism is still generally high, but small businesses have begun to note the lack of available qualified labor in the market. Thirty-five percent of small business owners across all industries reported having job openings that they could not fill during the month and 89% of those hiring or trying to hire reported few or no qualified applicants.

The construction industry provides an example of these challenges, where difficulty in finding skilled labor has likely played a role in tight housing inventory and generally disappointing housing starts. The National Association of Home Builders reported recently that over 80% of its members saw the cost and availability of labor as the number one concern in their industry.

Manufacturing is another are where labor shortages have become a problem. After activity sputtered in 2015 and 2016 due to the effects of a strong dollar and inventory overhangs, manufacturing has rebounded nicely over the past year. With this rebound comes a renewed need for labor and the reappearance of skilled labor shortages within the sector. The Federal Reserve released a study on labor availability within manufacturing last month, noting that measures of labor shortages have reached their highest point in the post-recession era.

What does it mean for trucking in the long-run?

The issues in the construction and manufacturing sectors present an interesting challenge for trucking recruitment going forward. Many of the skilled workers in these fields leave with a high school diploma and go to trade schools rather than universities to prepare for their careers. With each of these sectors desperately searching for workers to fill their needs, businesses owners in these industries are likely to compete aggressively for this pool of workers (at least as long as economic growth remains solid). The trucking industry will need to continue to improve its outreach to younger potential workers, and rethink the things that are necessary to make trucking an attractive career.

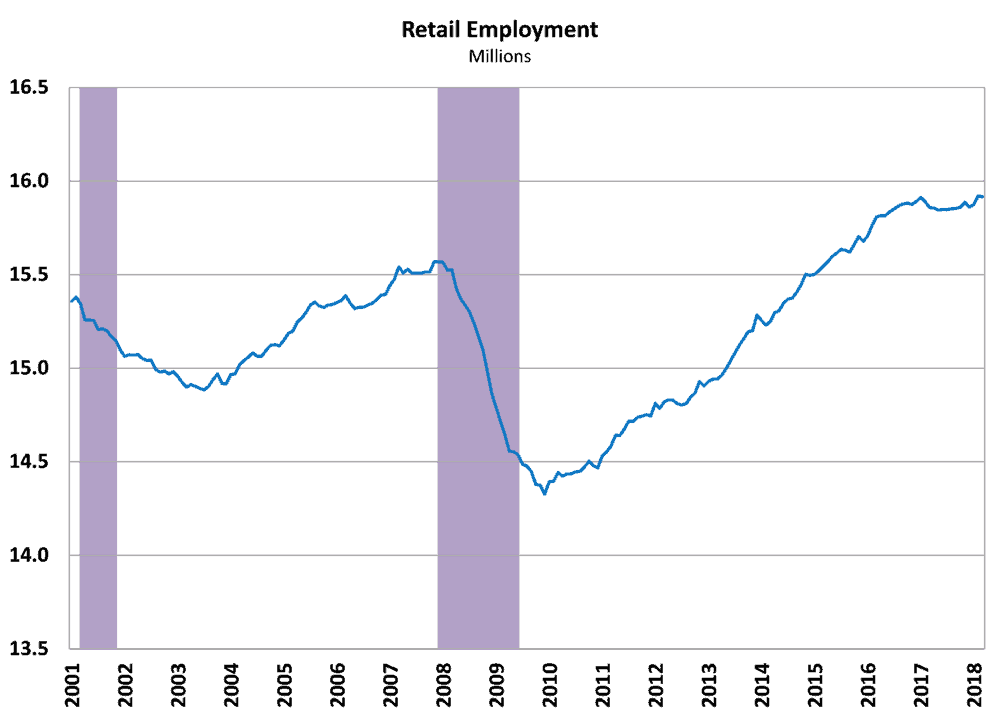

Of course not every part of the economy is adding jobs rapidly. Retail, for example, has seen employment growth plateau since the end of 2016, as struggling brick and mortar sales and store closings have forced workers off of payrolls. The problem is, there continues to be a lack of adequate retraining programs to make ex-retail workers useful in some of these other sectors.

In the end, addressing the driver shortage is likely to continue to be a challenge going forward. The recent pickup in trucking hires has been a good start, but the industry will need better efforts as more and more sectors find themselves fishing from the continually-shrinking pool of available workers.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.