Fossil-fuel shipping is going from strength to strength and shows no signs of peaking. Rates for some very large gas carriers (VLGCs) have now topped $100,000 per day. Liquified natural gas (LNG) carriers crossed into six-digit territory months ago. The most fuel-efficient very large crude carriers (VLCCs) have now crossed that threshold as well.

It’s always a sentiment boost when commodity shipping spot indexes cross from five to six figures, just as, in the opposite direction, it feels more ominous when the Dow drops 1,000 points than when it falls 900.

This sentiment boost is in spite of the fact that most ships on the water loaded cargo weeks before — in some cases many weeks before — at a time when rates were five digits. Major moves in spot indexes don’t show up in commodity shipping earnings reports until the following quarter.

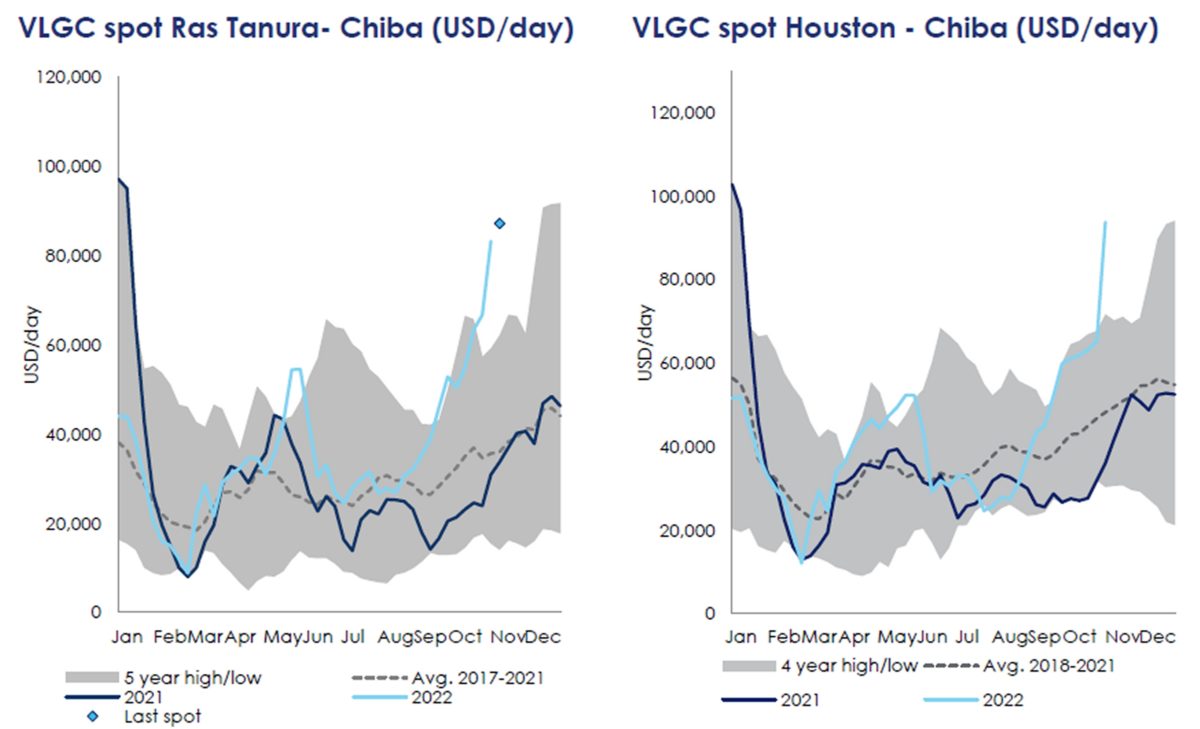

VLGC rates ‘increased dramatically’

VLGCs carry liquefied petroleum gas (LGP): propane and butane. The largest-volume trades are U.S.-Asia and Middle East-Asia, with flows to Europe becoming increasingly important.

On Monday, Clarksons Securities assessed the average spot rate for U.S.-Europe VLGC voyages at $103,000 per day, up 63% month on month. (Vessel owners earn in dollars per ton of cargo; this is then translated by index providers and analysts into a day rate based on assumptions on fuel costs and other factors.)

Clarksons put the global VLGC average at $93,700 per day, up 65% month on month. VLGCs with exhaust gas scrubbers — which can burn less expensive high-sulfur fuel oil — are earning a premium of $10,000 per day (because day-rate assessments are net of fuel costs). This pushes average global spot-rate assessments for scrubber-equipped VLGCs to six figures.

As is the case with crude and product tankers and LNG carriers, the Ukraine-Russia war is boosting VLGC rates.

During a conference call on Wednesday, John Hadjipateras, CEO of VLGC owner Dorian LPG (NYSE: LPG), explained, “In Europe, there is some substitution of LPG for LNG.” The company also noted in its quarterly release that Russian exports to Europe are “subdued” and being replaced by European imports from the U.S. Gulf.

Tim Hansen, Dorian’s chief commercial officer, said on the call that “demand in Europe, due to the unfortunate war in Ukraine, is helping our markets.”

LPG demand in Asia is also strong. Clarksons Securities analyst Frode Mørkedal said on Monday: “The VLGC market in the West increased dramatically last week. Healthy cargo levels and a tonnage shortage caused rates to skyrocket. A widening of the U.S.-Asian propane arbitrage and a seasonal increase in LPG demand have aided the surge.”

VLCC rates continue to climb

Clarksons’ VLCC index covers standard crude tankers, those with more fuel-efficient “eco” design, and those that have exhaust-gas scrubbers.

As of Monday, Clarksons assessed the average spot rate for an eco-design, scrubber-equipped VLCC at $101,600 per day, up 66% month on month. It put the global weighted average for all VLCC types at $90,800 per day.

Rate strength for VLCCs and other tanker segments has come even before the EU ban on Russian crude imports starting Dec. 5.

According to Mørkedal, “Although it is still unclear how the actual embargo will play out, it will inevitably result in greater voyage distances. The future appears incredibly promising for tanker owners,” he said, adding that VLCC resale prices are rising “week after week.”

Stifel analyst Ben Nolan commented: “Asset value momentum appears to still be accelerating, tanker rates are likely to move higher with sanctions, and the orderbook of new tankers remains extremely thin. So, asset values … could certainly and probably will continue to move higher, leaving room for similar acceleration in … share prices. So, we believe there is still some fire to go with the smoke.”

LNG shipping rates in uncharted territory

With the surge in LNG commodity prices that began with the run-up to the war and the limited number of available spot LNG ships, LNG shipping spot rates have soared far above other commodity shipping categories.

Average spot rates for benchmark tri-fuel, diesel-engine (TFDE) LNG carriers first topped $100,000 per day back in mid-September. As of Monday, Clarksons put rates for TFDE vessels at $455,000 per day. That’s up 37% month on month and marks the highest spot-rate average in history for any category of commodity shipping.

That said, the LNG shipping market is an extreme example of the disconnect between spot-rate indexes and shipowner earnings. The spot market for LNG vessels is extremely thin. The vast majority of LNG carriers are on contract rates at substantially lower — albeit still highly profitable — levels.

Click for more articles by Greg Miller

Related articles:

- Crude tanker owners see dollar signs as Russia ban draws near

- LNG shipping rates ‘shooting for the stars’ at $500,000 per day

- Sanctions could lift already booming product tankers to new heights

- Sanctions are about to slam Russia’s still-booming oil export trade

- Russian oil exports are still booming and EU is still reliant on Russia

- Russia oil sanctions: How conflict with EU rules threatens G-7 price cap