Asset-light less-than-truckload provider Forward Air said Monday that its decision to swap out “inefficient freight” over the past year continues to deliver the returns it had hoped. The company reported a 16% year-over-year (y/y) increase in revenue per shipment for the first two months of the third quarter, a sizable increase considering the easy comps have faded.

Many LTL carriers used a very strong trucking market to replace lower-margin customer accounts. However, there likely isn’t another carrier that has overhauled its book of business like Forward (NASDAQ: FWRD).

Last summer, the company began purging shipments with lighter weights in favor of heavier, higher-valued goods across its expedited freight segment, which includes LTL, truckload and final mile. The move included more direct selling into high-tech industrial verticals requiring time-definite delivery with minimal damage.

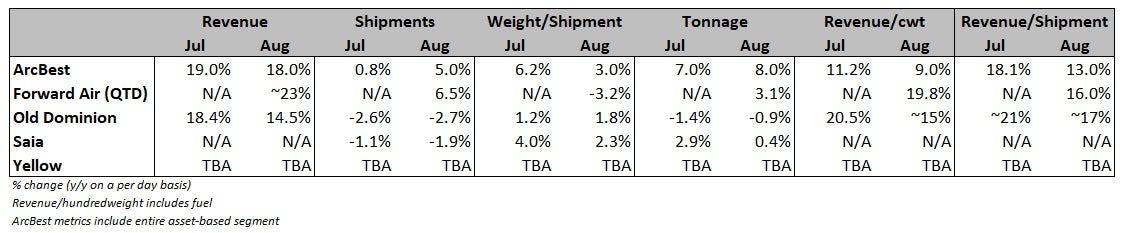

Shipments were up 6.5% y/y during July and August, implying revenue growth of approximately 23% for the unit. Tonnage was up 3.1% in the period, with revenue per hundredweight, or yield, up 19.8%. The y/y growth rates for shipments and tonnage also accelerated in August from July, which was likely closer to flat y/y. During the second quarter, shipments were down 12.3% y/y, with tonnage up 0.3%.

“In July of the prior year, we completed a process to cleanse inefficient freight from our network,” Tom Schmitt, chairman, president and CEO, stated in a news release. “We have more than fully replaced the inefficient freight with higher-quality freight in the network as evidenced by the positive trend in August with an increase of 5.2% pounds per day and 13.8% shipments per day.”

The easier comps for weight per shipment, down 3.2% y/y so far in the third quarter, are over now that a full year of the freight swap has occurred. However, the headwinds to shipment growth from the process are over as well.

Forward is also benefiting as highly profitable freight tied to trade shows, concerts and cruises has become more prevalent. The mix change back to these shippers, which traditionally accounted for a larger piece of the company’s revenue book before COVID, was part of the reason management raised earnings guidance again in conjunction with the second-quarter report.

“As we replaced lower-quality freight with higher-quality freight in our network, we executed upon our strategy to penetrate the highly profitable, more traditional airfreight, which by nature has a lighter weight per shipment,” Schmitt continued.

Forward’s implied revenue growth rate for its expedited unit was ahead of those reported by other carriers.

Last week, Old Dominion Freight Line (NASDAQ: ODFL) and Saia (NASDAQ: SAIA) were the first to issue third-quarter updates on Wednesday, reporting results light of analyst expectations. Higher yields pushed Old Dominion’s revenue up by mid- to high-teens percentages but shipment and tonnage trends were slightly negative. Saia’s volume metrics also showed moderation from the record growth rates achieved in prior quarters.

LTL stocks traded 2% lower that day compared to the S&P 500, which was up 1.8%.

The following day, ArcBest (NASDAQ: ARCB) said revenue was up y/y by high-teen percentages in both July and August. Tonnage increased by 7% and 8% y/y, respectively, with higher yields bridging the gap to the revenue growth percentages. The carrier did have the benefit of a negative tonnage comp to August 2021.

It was a similar result for LTL stocks, which fell 1.7% on Thursday compared to a 0.7% gain by the S&P.

By midday Monday (1:12 p.m.) the group had regained the losses, up 1.8% since the intraquarter updates were first issued on Wednesday, but still lagging a 5.1% gain in the S&P over that stretch. Shares of FWRD were up 3.6% on the day compared to a 1% gain by the S&P.

More FreightWaves articles by Todd Maiden

- Carriers weigh in on peak season and contract rates

- ArcBest update shows signs of moderation; Saia EPS estimates cut

- LTL stocks sag on weaker-than-expected Q3 updates