New technologies and recent volatility present an opportunity to de-risk

This week FreightWaves is launching a series of Freight Futures Road Shows in major financial and freight centers across the country, beginning with New York City today and Chicago on Thursday. With its partners DAT and Nodal Exchange, and event co-sponsors K-Ratio, Benzinga and TriumphPay, FreightWaves is explaining Trucking Freight Futures to potential exchange participants as well as making the case for why de-risking trucking spot rate volatility is so important.

Watch the live streams here.

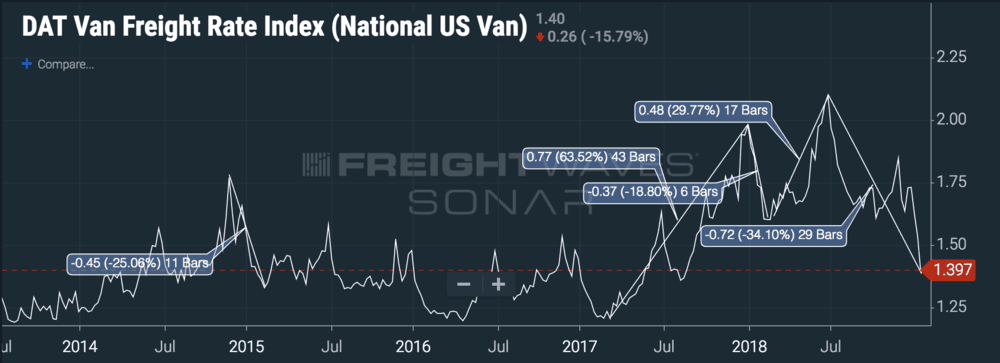

Trucking is a boom-and-bust industry with volatile pricing and frequent demand-capacity imbalances. Yet it’s also vital to the nation’s economy, moving more than 70 percent of all goods in the United States. Trucking spot rates can easily move up or down 40 percent in a matter of months, and it’s not just trucking companies that are exposed to this volatility, but also every company that has freight to move, and ultimately every consumer (because higher costs are often passed along). FreightWaves asserts that its Trucking Freight Futures contracts will allow transportation companies to protect themselves against downturns, as well as empower shippers to smooth out the peaks and troughs of their freight spend and more accurately forecast transportation budgets.

Supply chain participants often ask “why now?” Or, phrased differently, “if Trucking Freight Futures are such a good idea, then why hasn’t anyone done it before?”

There are two parts to the answer. The first part is that recent developments in transportation technology have produced more robust price discovery and market transparency, powering the information flows that a financial market needs to function. The second part is that trucking – and the broader economy – had its “OPEC moment” when the electronic logging device (ELD) mandate took effect in December 2017. The resulting capacity crunch generated articles about trucking capacity not only in specialized industry media but on the front page of the Wall Street Journal as well.

First, technology. Telematics are now ubiquitous in the trucking industry – drivers have smart phones, trucks belonging to enterprise carriers are more-or-less all connected, and the ELD mandate has put powerful devices in the cab of nearly every truck in the market. For the first time, trucking companies, third-party logistics providers (3PLs) and data aggregators know where capacity is currently located and where it’s needed. Capacity crunches and over-supply situations are easier to understand and measure, if not predict.

Drivers with smart phones can get instant price discovery in the spot market and make data-driven decisions in order to choose the most desirable freight. The availability of pricing information to a larger number of actors makes the market more tightly bound, forcing outlier quotes to converge towards a consensus price. When all of the prices for a given (freight) lane in a given day become more tightly range-bound, the shippers and carriers on that lane are all exposed to roughly the same price and should be able to trade against it.

Second, trucking’s “OPEC moment.” During the 1970s, two oil shocks introduced unprecedented volatility into global physical energy markets. In 1973, OPEC cut off oil exports to Western countries that supported Israel during the Yom Kippur War, quadrupling the price of crude oil globally. In 1979, the Iranian Revolution reduced the global oil supply only by about four percent, but panic in the market led to crude prices doubling. The following year, the International Petroleum Exchange was founded in London, and in 1988 Brent crude futures were introduced, providing oil consumers and producers a way to hedge against price volatility with financially settled instruments.

From FreightWaves’ perspective, the ELD mandate, which came on the heels of an unusually active hurricane season, was the transportation industry’s “OPEC moment.” Capacity disappeared in the middle of a very strong economic cycle, when freight demand was already quite elevated. Over the course of a long bull run, trucking spot rates rose as much as 62 percent. During late 2017 and 2018, 40 percent of Fortune 500 companies said on their earnings calls that transportation costs were a leading headwind to their earnings.

The U.S. Congress and agencies like the Federal Motor Carrier Safety Administration (FMCSA) began examining regulations to see how the capacity crunch could be alleviated, but the bureaucracies were far too slow. Driver wages increased by an average of 12 percent in a year when average wages across all industries grew about 2.5 percent. New truck orders broke records month after month. Meanwhile, major media outlets discussed the impact that transportation cost inflation could have on the economy, and General Mills raised the price of Cheerios in part to cover its freight spend.

As 2018 went on, unpredictable tariff negotiations distorted typical seasonal freight patterns, further confusing markets and driving spot rates higher. Finally, at the end of the year, before the FMCSA could revise hours-of-service regulations, the capacity crunch was over, just as fast as it started. Additional capacity added mainly by small- and mid-sized carriers coincided with a softening in the manufacturing sector of the economy (housing construction and business investment had already weakened). Rates plummeted even faster than they rose, crashing after the first week of January 2019.

Now is the time for a thoroughly whip-sawed industry to take a step back and think about how companies can protect themselves against unpredictable market fluctuations. It’s not that no one knows trucking rates peak in June and December; it’s that no one knows what the magnitude will be. And it’s increasingly the case that tighter delivery schedules and a structural challenge in sourcing drivers have made the market more sensitive to even small surges in demand.

New technology has finally provided the means for aggregating transactions, making data-driven decisions and increasing market transparency. Recent price shocks have demonstrated to the whole industry – and to anyone who pays attention to the economy– that spot rate volatility can be deeply damaging to all participants, including shippers, 3PLs and carriers. Beginning on March 29, by hedging against their natural exposure to price, shippers and carriers will be able to smooth out their expenses and revenues, making their businesses more predictable and sustainable and creating shareholder value.