C.H. Robinson (NASDAQ: CHRW), a leading third-party logistics provider and the largest freight brokerage in North America, reported third-quarter financial results after markets closed on Oct. 29.

Robinson’s business was finally hit hard by the industrial recession in the United States, slowing global trade and a contracting eurozone.

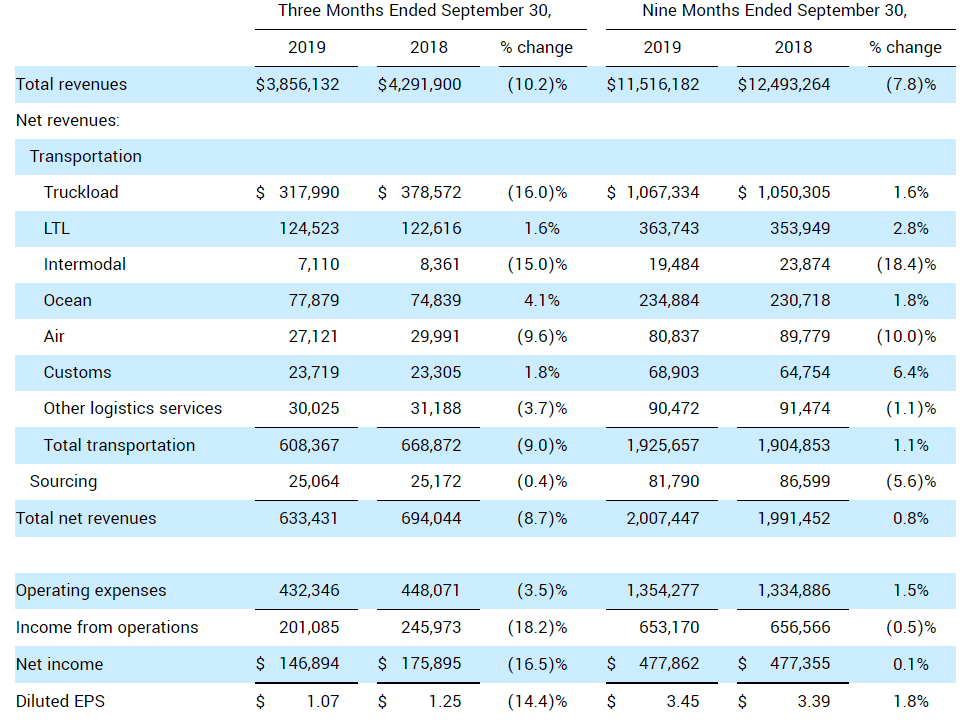

Total revenues were down 10.2% year-over-year to $3.9 billion; net revenues fell 8.7% from the prior year, to $633.4 million. Diluted earnings per share decreased 14.4% to $1.07, missing Wall Street’s expectations of $1.14.

Last quarter, Robinson managed to grow earnings by 8% and beat the Street by a penny, but the truckload cycle has started to shift against the 3PL. Spot rates — a freight brokerage’s cost to buy trucking capacity — have bottomed, while contract rates, which represent about 70% of C.H. Robinson’s revenue, are still being revised downward.

“The third quarter provided challenges in both our North American Surface Transportation and Global Forwarding segments,” Chief Executive Officer Bob Biesterfeld said in a statement. “Our net revenues, operating income and EPS results finished below our long-term expectations. We anticipated an aggressive industry pricing environment coming into the second half of this year driven by excess capacity and softening demand and knew we faced difficult comparisons versus our strong double-digit net revenue growth in the second half of last year. Our results were negatively impacted by truckload margin compression in North America.”

Still, Robinson’s North American Surface Transportation (NAST) division, the truckload brokerage, widened its gross margins slightly to 15.4% from 15.34% a year ago. The issue is that the brokerage’s top line revenue was down 12.4% to $2.82 billion and net revenue dropped 13.2%. NAST suffered from decremental margins, as its income from operations — a rough measure of the business unit’s internal profitability — fell even faster, by 21.3% on a year-over-year basis.

Global Forwarding was less sensitive to the downturn in ocean and air pricing and air volumes. Total revenues fell 6.5% year-over-year to $597 million, but net revenues were up 1.3% and income from operations climbed 3.5%. Ocean revenues in particular climbed on margin expansion, Robinson said in its earnings release (overall Global Forwarding gross margins were 22.7% for the quarter compared to 20.9% a year ago).

In Robinson’s “All Other and Corporate” segment, Robinson Fresh’s net revenues contracted slightly by 0.1% year-over-year to $23.6 million; Managed Services grew net revenues by 7.4% to $21.5 million; and other Surface Transportation grew net revenues by 13.6% to $15.9 million.

Biesterfeld gave pessimistic guidance for freight markets going forward.

“Looking ahead, we expect that North American routing guides will continue to reset at lower prices in response to the falling cost environment and decline in spot market freight opportunities,” Biesterfeld said. “While industry data suggests capacity continues to exit the North America truckload market, we believe capacity will exceed available shipments for the next few quarters. Despite the current freight environment, our long-term goals remain unchanged. We remain focused on taking market share, automating core processes while delivering industry-leading quality service to our customers and carriers, and improving operating leverage in our businesses.”

Noble1

I should have included this :

Louis T. McFadden (1876-1936): An American Hero by Richard C. Cook (google it)

The assassination of Louis T. McFadden

Quote:

“McFadden may have paid with his life for his outspokenness. After he lost his congressional seat in 1934, he remained in the public eye as a vigorous opponent of the financial system; that is, until his sudden death on October 3, 1936, of a “dose” of “intestinal flu” after attending a banquet in New York City.

Reporting his death in its October 14 issue, Pelley’s Weekly stated that it had “became known among his intimates that he had suffered two [previous] attacks against his life. The first attack came in the form of two revolver shots fired at him from ambush as he was alighting from a cab in front of one of the Capital hotels. Fortunately both shots missed him, the bullets burying themselves in the structure of the cab.”

Next, ‘He became violently ill after partaking of food at a political banquet at Washington. His life was only saved from what was subsequently announced as a poisoning by the presence of a physician friend at the banquet, who at once procured a stomach pump and subjected the congressman to emergency treatment.’

Evidently the third time the assassins succeeded, and the most articulate critic of the Federal Reserve and the financiers’ control of the nation was dead. He was 60 years old.”

A little over a century ago Henry Ford once said :

“It is well enough that people of the nation do not understand our banking and monetary system , for if they did, I believe there would be revolution before tomorrow morning ” .

Today it’s much worse , yet public ignorance perpetuates it .

Karen Secor

The rest of the US economy is booming. The only government body with a million exemptions to federal law is the one that’s failing. You know why? Because the United States is tried and true. We don’t need the separate nation called the DOT. They need to come back to the nation because the US is successful. They have proven they are not. They are so beleaguered in their funding, they even cannibalize the SSA to profit from public transportation. The DOT needs to drop their bizzare invasive practices and fall into lines with normal federal guidelines like wage and hour as well as working conditions and EEOC compliance. DOT nation sucks. God bless America.

Noble1

God bless America ???

You may want to read these quotes

Louis McFadden quotes:

“Some people think the Federal Reserve Banks are US government institutions. They are not… they are private credit monopolies which prey upon the people of the US for the benefit of themselves and their foreign and domestic swindlers, and rich and predatory money lenders. The sack of the United States by the Fed is the greatest crime in history. Every effort has been made by the Fed to conceal its powers, but the truth is the Fed has usurped the government. It controls everything here and it controls all our foreign relations. It makes and breaks governments at will.”

Louis McFadden quotes:

“The Federal Reserve (Banks) are one of the most corrupt institutions the world has ever seen. There is not a man within the sound of my voice who does not know that this Nation is run by the International Bankers.”

Louis McFadden quotes:

“(The Great Depression resulting from the Stock Market crash) was not accidental. It was a carefully contrived occurrence….The international bankers sought to bring about a condition of despair here so they might emerge as rulers of us all.”

Why did they ratify the 16th amendment in 1913 ? I’ll tell you why . It was important to create a “legal” income tax because the “FED” aka bankers finally had in place a system which would run up a virtually unlimited government debt . How would the interest on this debt be repaid ?

Remember a privately owned central bank creates the “principal” out of nothing . The interest payments had to be guaranteed by direct taxation of the people .

In 1895 the supreme court had found a similar income tax law to be unconstitutional , it also found a corporate income tax in 1909 unconstitutional . Therefore the 16th amendment had to be rectified to render taxing income legal . In order to do so senator Aldrich hustled a Bill for a constitutional amendment allowing income tax through the congress , and voila people in the US have been paying income taxes ever since .

God has not blessed America . Since the Federal Reserve Act in 1913 Americans have been sealed into slavery ! And American have been getting ripped of galore ever since in more ways than you can imagine .

And to quote Rep. Charles Lindbergh

“To cause high prices , all the Federal Reserve board will do will be to lower the discount rate, producing an expansion of credit and a rising stock market ,then when …. business men are adjusted to these conditions , it can check …. prosperity in mid-career by arbitrarily raising the rate of interest .

It can cause the pendulum of a raising and falling market to swing gently back and forth by slight changes in the discount rate variation and in either case it will possess inside information as to financial conditions and advance knowledge of the coming change , either up or down .

This is the strongest , most dangerous advantage ever placed in the hands of a special privilege class by any government that ever existed .

The system is private , conducted for the sole purpose of obtaining the greatest possible profits from the use of other people’s money .

They know in advance when to create panics to their advantage . They also know when to stop panic . Inflation and deflation work equally well for them when they control finance . – Rep. Charles Lindbergh

What he’s describing is what we term the “Business Cycle” which includes Booms & Busts .

The whole freaking thing is rigged ! Fiat currency , interest rates, THE BANKING SYSTEM , THE STOCK MARKET , FOREX MARKET ETC ETC ETC . Bitcoin ? They control its value too through exchanges ! And the general public is getting screwed up the wazoo and most don’t even realize it . They have grown to accept that it’s the way life is .

It’s not the way life is . WE’VE BEEN DUPED !

America is far from being blessed , it’s getting ripped off beyond belief !

AND THE ECONOMY ISN’T BOOMING ! It’s getting ready to BUST ! They slowed it down and they’re going to BUST it once again ! The general public think everything is fine and dandy due to new highs . THAT’S HOW THEY LURE YOU IN TO THE TILL ! Sentiment is currently at extremes . Funds and the public are all in ! Do you think for one second that the markets have been created for retailers ? It’s a rigged game to transfer wealth !

And speaking of “God” , these clowns are arrogant enough to have even stated such on THEIR hocus pocus currency : In God we trust ??? What the heck is that statement doing on a manipulated medium of exchange which the central banks keep on devaluing ? Ahhh perhaps they want you to have “faith” in their scheme ! LOL !

In my humble opinion ………..

J Ngo

Uber Freight is eating their lunch dinner and dessert.

MrBigR504

You got that right!

Michael Musser

As an o/o. I have to temporarily suspend my authority and lease on locally. 1.25 here, .95 there rates on loads. Hey CH, convoy, coyote, tql, etc… 700.00 on way to salt lake city where it costs 300.00 in fuel to get there does me 0. Goodbye freight world. Back to hauling crude oil locally. At least my family wont starve and I can avoid the OTR circus. I can spend 250 in fuel and clear 1200+ at end of day, put less that 175.00 miles on truck. Abolish all freight brokers. Let shippers and carriers hash it out. Brokers are dumb as dumb can get. When your motivation isn $$, your mind cannot absorb intellect.

Noble1

Here’s an update from my perspective on CHRW .

Based on all the current pessimism in this stock I’ll play contrarian , and make a call on a share price bounce upward on this one .

In my humble opinion .

Noble1

Price update : A reversal signal until negated .

The stock opened with a gap down in price which I will deem as an “exhaustion gap” . This implies that sellers are losing momentum and price could indeed potentially reverse upwards confirming my contrarian bullish call as indicated in my prior comment .

The gap down touched a floor pivot support point & ratio confluence , then proceeded to close the day above its opening price . Despite its relatively small tail below the daily open , the daily move can be labeled as a “bullish exhaustion gap” which printed an “inverted hammer”(daily price pattern)indicating a probable reversal until proven otherwise .

So far so good . However , when playing with fire , no matter how good one may be and or believe they are in that regard , steps should be taken to mitigate risk . And that’s where the proverbial word “hedge” comes into the picture . You gain wisdom from experience, knowledge , and good judgement . Knowing that nothing is perfect , one should not anticipate perfection despite how limited the contrary may appear to indicate according to one’s bias . In this game , being right is not as important as producing a capital gain . One can produce a capital gain even when their bias is wrong .

A simple example you can relate to :

No matter how limited the outcome of your house catching on fire may appear to be according to your bias , you wouldn’t take the risk of not mitigating the risk of the opposite occurring no matter how limited that occurrence may appear to be . Therefore you will have fire “insurance” on your house/asset based on “prudence” . Therefore you “hedged” a potential financial loss . Greed is good as long as one is not naïve in that regard .

Stay Tuned !

In my humble opinion ………….

MrBigR504

WoW, you are using that Degree huh? Just kidding, I’ve seen a few of your comments and you make a lot of sense. Keep up the good work!

Noble1

Update: Reversal signal confirmed .

As today’s action has revealed , support held followed by an increase in buying pressure on higher volume along with a higher close . Up .83(1.11%)

I’ll label today’s action and daily pattern as “bullish engulfing” .

In my humble opinion ……….