- SaaS veteran Geoff Lochausen is FreightWaves’ new chief revenue officer

- Lochausen built/managed sales teams at Mulesoft, AppDynamics and BMC Software

- Appointment positions FreightWaves for an IPO within the next few years

- FreightWaves finishes Q2 2022 with 91% year-over-year growth, achieving an 82 on Rule of 40

- Company finishes Q2 with $44 million annual revenue run-rate

FreightWaves founder and CEO Craig Fuller announced the appointment of software-as-a-service (SaaS) veteran Geoff Lochausen as the company’s chief revenue officer. FreightWaves is the leading provider of market intelligence for the global supply chain industry.

“For the past nine months, we have been searching for the right leader to position FreightWaves for the next stage of growth. We also sought someone who can help establish the culture and infrastructure necessary for FreightWaves to be the category king of high-frequency supply chain market intelligence and position the firm for an eventual IPO,” Fuller stated.

Lochausen will oversee all customer-facing SaaS functions including sales, sales development, enablement and customer success for FreightWaves. A SaaS veteran with a successful background in building and running enterprise software sales teams, Lochausen brings an enormous amount of experience in building and managing hyper-growth commercial teams at both private and public companies in enterprise SaaS. Lochausen is a pioneer in building SaaS sales teams and has been a part of the commercial teams at Mulesoft (a Salesforce company), AppDynamics (sold to Cisco) and BMC.

(Photo: FreightWaves)

“Volatility in the supply chain is creating significant challenges for companies across the globe. Market developments, economic cycles, and geopolitical events have caused — and are causing — unpredictable shocks to global supply chains, which is why FreightWaves’ high-frequency data has become the ultimate resource in managing a logistics network,” Lochausen explained. “Companies want the freshest and most up-to-date information in managing their supply chain and often refer to FreightWaves as ‘the nerve center of the global supply chain,’” Lochausen said.

FreightWaves provides quarterly update

For the second quarter ending June 30, 2022, FreightWaves reports that the company ended the quarter with $10.9 million in GAAP revenue, up from $5.7 million in the same quarter of 2021. The 91% year-over-year quarterly increase was a result of accelerated growth in demand for FreightWaves’ high-frequency supply chain market intelligence. In addition, the company finished the quarter at a $44 million annual revenue run-rate.

FreightWaves’ SaaS offering, SONAR, which was launched in May 2018, quickly became the leading data platform for the global supply chain industry.

Fuller explained, “We are experiencing an unparalleled level of demand for SONAR, particularly among shippers. We expect this momentum to continue through the next few years as companies experience the value of high-frequency supply chain data in helping them benchmark, analyze, monitor and forecast market developments across the global supply chain.”

Supply chains operate best when firms have accurate demand, capacity and pricing data, analysis and intelligence that reflect current market conditions. Companies that implement SONAR gain an accurate reflection of market activity in the global goods economy — often weeks or months before competitors.

FreightWaves continues to make significant investments in SONAR, as evidenced by the recent introduction of Container Atlas, a high-frequency dataset that covers global ocean container markets, and continued scaling of FreightWaves TRAC, the trucking spot rate data platform.

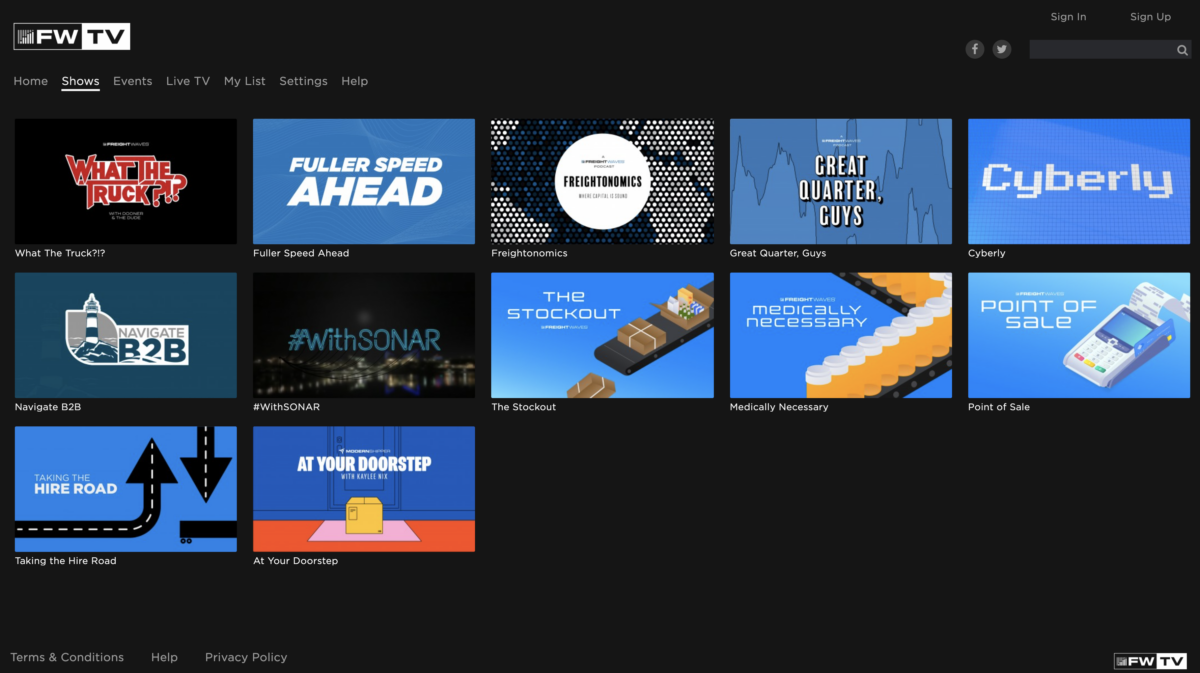

The FreightWaves Media division also had a banner quarter, achieving record levels of engagement, surpassing 5 million monthly pageviews on FreightWaves.com and 85,000 daily viewers on FreightWavesTV.

During the quarter, the company accelerated capital investment in product and go-to-market, but still kept an Efficiency Score (aka “Rule of 40”) of 82.