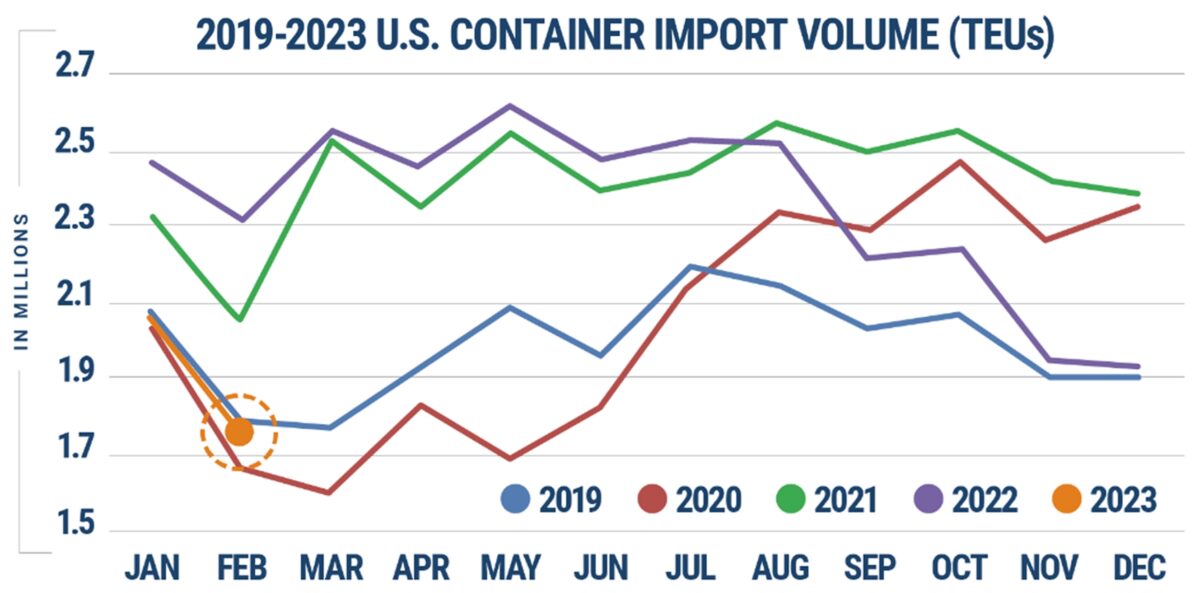

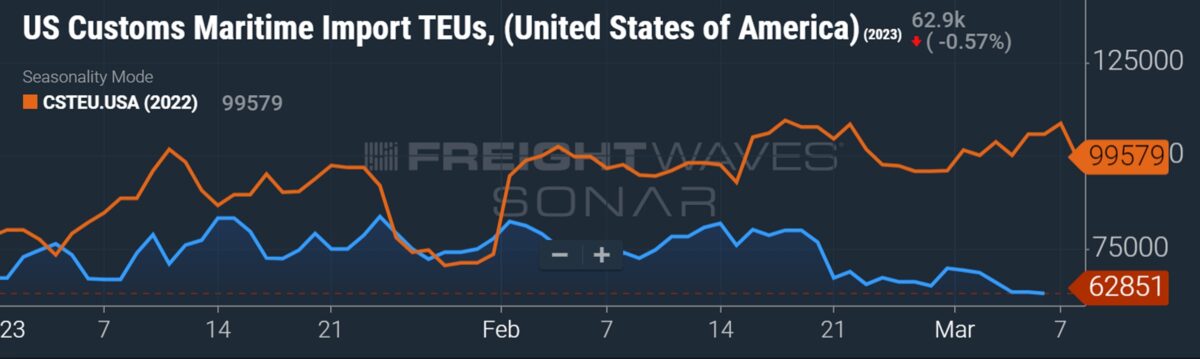

February is typically a bad month for U.S. imports. This February was particularly rough, as the effect of the early Lunar New Year holiday collided with a giant U.S. inventory overhang.

Signals are mixed on where imports go from here.

The National Retail Federation (NRF) believes a moderate rebound in imports is around the corner. But new Census Bureau data on January wholesale inventory-to-sales ratios implies more trouble ahead.

In line with pre-COVID volumes

On Tuesday, Descartes reported that February imports to all U.S. ports totaled 1,734,272 twenty-foot equivalent units. That’s down 16.2% from January, 25% year on year and 0.3% versus February 2019, pre-COVID.

Imports from China were particularly weak, given COVID issues and the Lunar New Year break. Imports from China fell 118,442 TEUs or 32% in February versus January, said Descartes.

U.S. ports have not released their own February numbers yet, but Descartes’ port-level data showed double-digit declines versus January.

According to Descartes, imports to Los Angeles slumped 32% month on month, with Baltimore down 22%; Norfolk, Virginia 18%; Oakland, California, and Houston 17%; Long Beach, California 15%; Savannah, Georgia 14%; Charleston, South Carolina 11%; and New York/New Jersey 9%.

Heading back in the right direction?

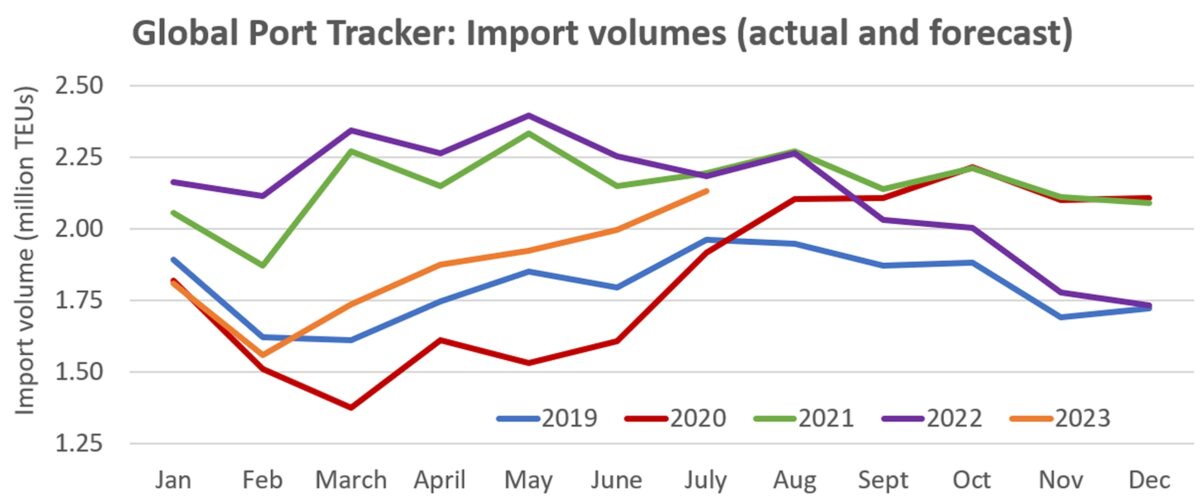

Global Port Tracker, published by the NRF and Hackett Associates, predicts the import trend will finally turn positive this month.

Global Port Tracker covers 12 U.S. ports. Its estimate for February, released Wednesday, was for imports of 1.56 million TEUs, down 13.6% from final port stats for January.

It projects imports for the ports it covers will increase month on month to 1.74 million TEUs in March, then climb to 2.13 million TEUs by July as volumes rebound above pre-pandemic levels.

Volumes through January 2023 are actual; February-July 2023 projected. (Chart: American Shipper based on data from Global Port Tracker)

“There are many uncertainties about the economy, but we expect imports to show modest gains over the next few months,” said Jonathan Gold, the NRF’s vice president of supply chain and customs policies.

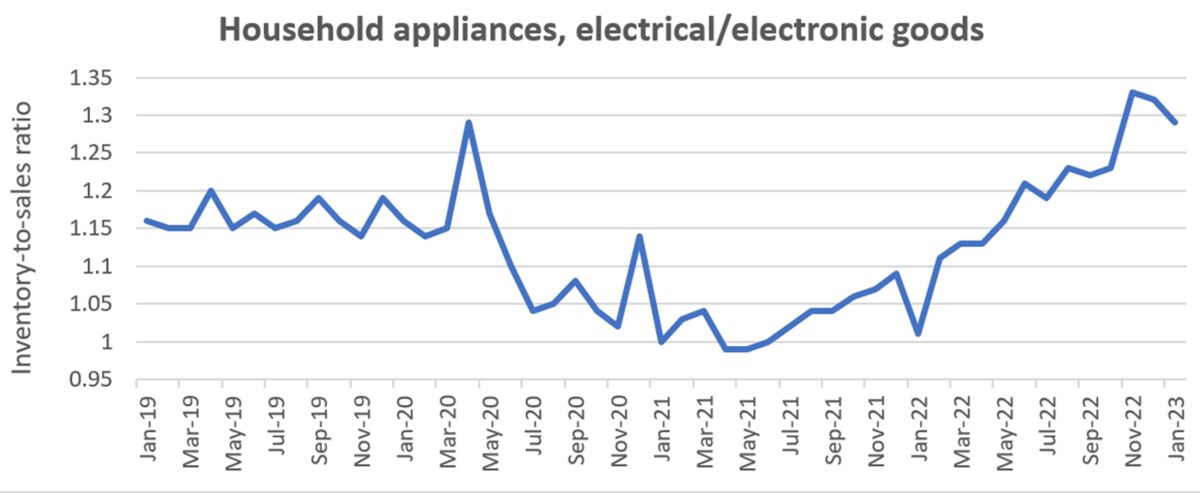

Wholesale inventory headwinds

During the recent quarterly calls of ocean carriers Hapag-Lloyd and Maersk, executives blamed weak import demand on destocking. Until excess inventories piled up in 2022 are sold off, they said, import demand will lag consumer demand. If consumption continues at current levels, they expect the inventory overhang to be whittled down and import demand to ramp back up at some point this year, with the second half stronger than the first.

Census Bureau data released Tuesday on January wholesale inventory-to-sales ratios implies destocking has a long way to go. Ratios remain high, with very limited progress in January.

Looking at some of the more heavily containerized categories, the seasonally adjusted wholesale inventory-to-sales ratio for household appliances and electric and electronic goods was 1.29 in January, still up 11% from January 2019, pre-COVID.

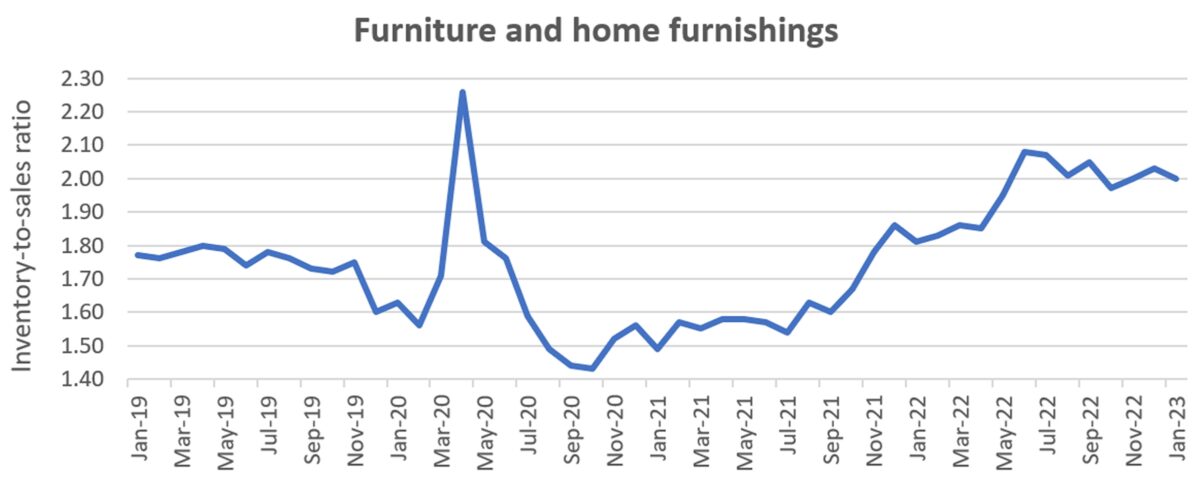

Wholesale inventory was double sales for furniture and home furnishing this January and up 13% from January 2019.

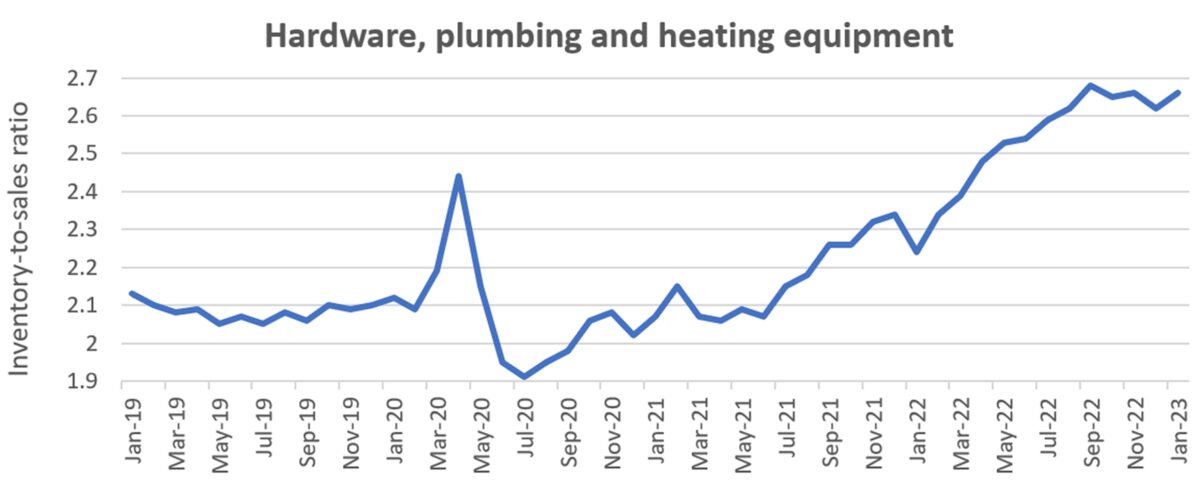

The wholesale inventory situation was even worse in the hardware, plumbing and heating equipment category.

The inventory-to-sales ratio was 2.66 in January, higher than in December and not far below the peak of 2.68 in September. This January’s ratio was 25% higher than in January 2019.

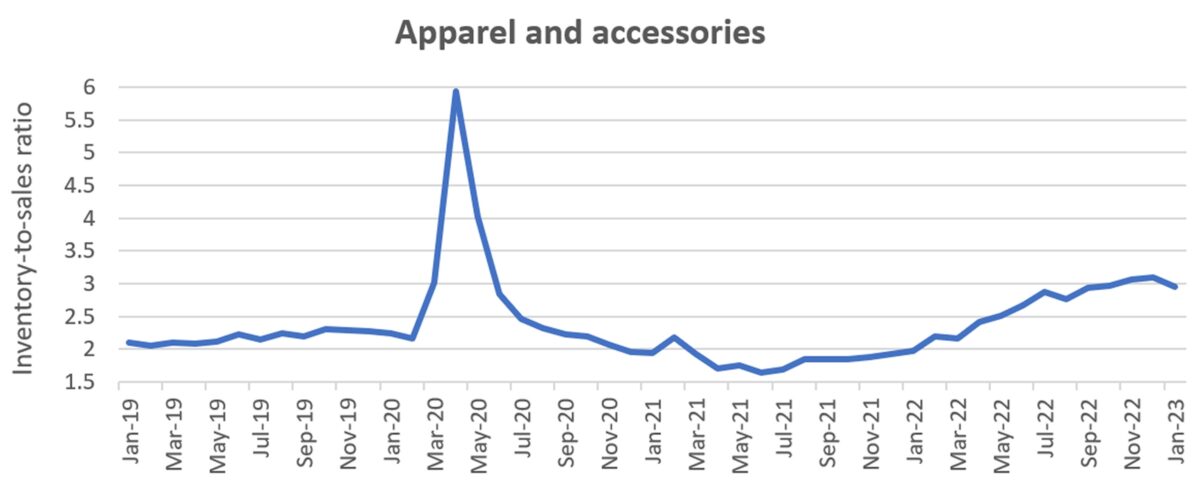

And for apparel — a major containerized cargo type — the wholesale inventory situation is particularly challenging. The seasonally adjusted inventory-to-sales ratio in January was 2.95.

Excluding the spike in 2020 during COVID lockdowns (when sales crashed, temporarily inflating the ratio), the January number was close to the recent high of 3.1 the month before. This January’s inventory-to-sales ratio was a whopping 40% above the January 2019 pre-COVID figure.

Click for more articles by Greg Miller

Related articles:

- The Fed’s supply chain pressure gauge just went negative

- Container shipping market yet to bottom as spot rates keep slipping

- Container trade’s next turn: Price wars, cheap contracts, new ships

- Maersk: Container shipping contract rates will sink to spot levels

- Hard landing? 2023 could be Hapag-Lloyd’s 3rd-best year ever

- Beleaguered Los Angeles port pins hopes on 2nd-half rebound

- January imports up from December, but February is looking weak