Knight-Swift Transportation Holdings (NYSE: KNX) reported revenue growth and rising income across much of the company, with the notable exception of Swift’s refrigerated segment, during its second quarter 2018 earnings call.

The company, which merged last year, reported $1.3 billion in total revenue, a 5.2 percent increase over what Knight and Swift reported separately for the second quarter of 2017. This quarter combined adjusted operating income ballooned to $135 million, a 47 percent jump from what each entity reported in the second quarter of 2017.

“Our year-over-year combined revenue growth was achieved despite shedding some underperforming business and implementing more stringent driver hire requirements at Swift,” Knight-Swift Chief Financial Officer Adam Miller said. “We believe our ability to convert increases in revenue per mile into meaningful improvement in operating income demonstrates the type of industry-leading operating leverage we continue to see in each of our segments.”

Knight’s “remarkable” operating ratio

Knight’s trucking business boasted a 77.7 percent operating ratio during the second quarter. That number includes the first full quarter of Abilene Motor Express, which performed at an 82.4 percent operating ratio.

“When we look at this quarter, this is arguably the best quarter in Knight Transportation’s history, given that it was done with a fuel headwind due to rising fuel prices,” Knight-Swift CEO Dave Jackson said. “It was achieved with rates being up, with miles per tractor being up meaningfully. With even the fleet size growing, our driver turnover in the Knight Transportation business is at record lows right now.”

Knight’s average revenue per tractor increased 24.1 percent as a result of a revenue per loaded mile increase of 20.9 percent and a 3.9 percent improvement in miles per tractor in the second quarter.

Jackson said Knight benefited from a positive spot environment and “meaningful improvement” in contractual freight.

“As we begin the third quarter, approximately, 85 percent of all contractual rates have been revised within the last six months,” Jackson said. “And so, that gives you a sense for how far the implementation has gone with new contractual rates as we move towards the back half of the year. And, of course, different in this cycle than previous cycles this late in the bid season, it’s not normal or typical to still see the kind of freight available and the rates available in the spot market, which suggest the strength that we’re experiencing.”

Jackson said he expects Knight’s trucking segment to continue operating in the 70s throughout the third and fourth quarters, then into 2019.

Knight’s logistics segment adjusted operating ratio improved to 94.6 percent in the second quarter of 2018 from 95 percent in the second quarter of 2017.

Foundational changes at Swift

Swift saw an operating ratio of 87.4 percent in its truckload segment, 85.4 percent in its dedicated segment, 98 percent in its refrigerated segment and 95.6 percent in its intermodal segment.

“During the second quarter of 2018, our two largest segments (based on average tractor count), Swift Truckload and Swift Dedicated, achieved an adjusted operating ratio of 87.4 percent and 85.4 percent, respectively, which is a notable improvement from historical performance within these segments,” Knight-Swift’s earnings report reads. “Additionally, we continue to see meaningful improvement in our operating profitability within our Swift Truckload, Swift Dedicated and Swift Intermodal segments, as a result of our focus on expanding our margins by improving our revenue per tractor and revenue per container while executing on cost control.”

Average revenue per tractor increased 8.8 percent in Swift’s truckload segment compared to the second quarter of 2017. The increase was driven largely by growing revenue and was offset somewhat by a 3.8 percent decrease in miles per tractor.

Average revenue per tractor in Swift’s dedicated segment increased 3.5 percent in the second quarter of 2018, thanks to a 4.4 percent increase in contract rates. It was partially offset by a slight decrease in miles per tractor year-over-year.

“Here’s what I am seeing, I’m seeing very much we are improving our market execution at Swift. I’ve always felt like Swift was an industry leader in size and I felt like Swift should be an industry leader in market execution,” Knight-Swift Executive Chairman Kevin Knight said. “And I can tell you that with our line haul rates up 14.7 percent year-over-year, I’m pleased with the progress that we’ve made so far.”

Knight explained that Swift is undergoing “foundational changes” since the merger. These changes include things like making driver selection stricter and creating a more profit-minded culture.

Since imposing higher standards on drivers, Swift has seen safety improve. Driver counts are continuing to climb, even during the typical summer recruitment slowdown, according to Knight.

“I just want to tell you, these are foundational changes. Foundational changes actually make my job more difficult. They don’t make it easier,” Knight said. “When you have to make foundational changes and you have the intestinal fortitude to actually make those changes in spite of the fact that they’re going to make your life and your short-term look not quite so handsome. That’s what our culture is all about and that’s what we’ve chosen to do.”

Swift’s struggling refrigerated business

Knight was clear from early on in the call that Swift’s refrigerated business was not performing well, with a 98 percent operating ratio.

Average revenue per tractor in Swift’s refrigerated segment decreased 6.7 percent in the second quarter of 2018. Revenue per mile increased 3.7 percent, but any gains were offset by a 10.8 percent decrease in miles per tractor from unmanned trucks.

Still, Knight was optimistic about the future of the segment.

“I think we’re doing a really good job of improving the profit-minded culture that’s really started to help improve the margins in each of our businesses with the exception of the refrigerated business. And that’s a unique business the way Swift has set up,” Knight said. “But I can honestly tell you that we’ve got our arms around it, and that we’re in the process of now taking the steps and the actions that we need to take in order to get the refrigerated business performing at a very good return on invested capital. But it’s just going to take a little bit longer than some of the other Swift businesses.”

He later noted that part of the refrigerated business was performing well, including to OTR portion, while others parts of the business were lagging behind. The OTR portion of the refrigerated business saw rate improvements of 14 percent.

When analysts pushed Miller and Knight about to talk about why the refrigerated business was struggling and what exactly was being done to improve it, both leaders skirted the issue.

They reemphasized the Swift businesses that are thriving, and reminded investors that working everything out post-merger will take some time. Miller and Knight declined to identify the specific portion of the business that was struggling and did not provide any specifics about their intended fix.

“We won’t discuss the specifics. But, what I will say is that basically, we have identified the areas that need support in that business,” Knight said. “And we know the things that we need to do in order to get that business where it needs to get. So literally, if we do really well, we’ll get it where it needs to be in two to three or four quarters. If it takes us a little longer, it might take us a year or two. But I don’t expect that it will.”

Knight-Swift is reporting an expected adjusted EPS of $0.56 to $0.60 in the third quarter and $0.68 to $0.72 in the fourth quarter.

“Eighty percent of our trucking business between both companies, which represents about 15,300 trucks is performing well,” Knight said. “When you look at 15,300 trucks and it comes out to an adjusted OR of 83.8 percent, that isn’t bad. Now it isn’t good enough, but I’m just telling you it isn’t bad.”

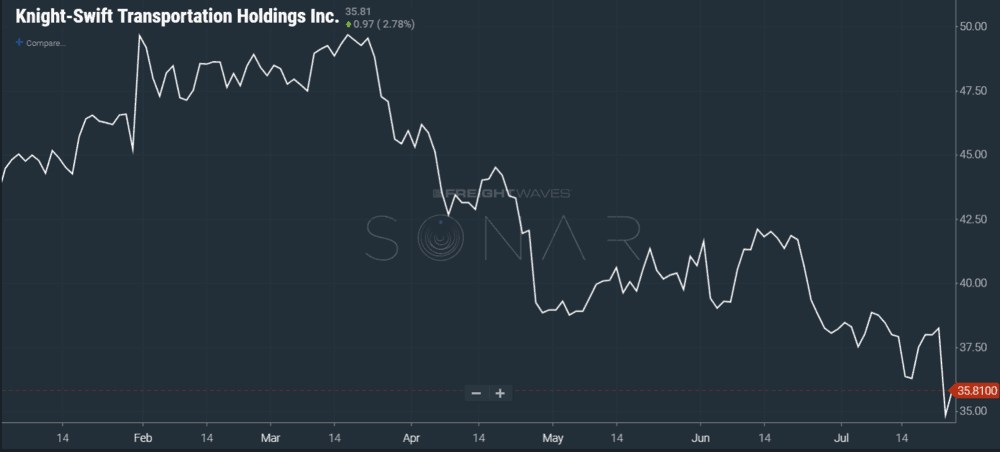

Deutsche Bank has lowered its 2018 and 2019 EPS estimates by 5 percent and 7 percent, respectively, to $2.28 and $2.81.

“Total EBIT missed our model by 9 percent, with Knight EBIT 20 percent better offset by a 25 percent miss at Swift. Over half of the EBIT miss at SWFT came within the company’s Refrigerated segment, which is a relatively small piece of the business and where results are behind expectations but ‘significant progress’ is being made,” a Deutsche Bank report reads. “Expectations were high, making today’s miss that much more disappointing. We feel compelled to note that high expectations were not set by analysts in a vacuum, as mgmt. tried to suggest on the call; but rather gleaned from company mgmt.”

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.