If you thought the trans-Pacific market was crazy in September and October, buckle up. Containerized import demand is not abating and cargo volumes are now backing up at anchorage.

The Port of Los Angeles Signal tool offers a short-term indicator of market strength. Ship charter rates provide a longer-term bellwether. In both cases, the latest data shows no evidence of any trans-Pacific demand respite. In fact, the numbers point in the opposite direction.

Signal spike and what it means

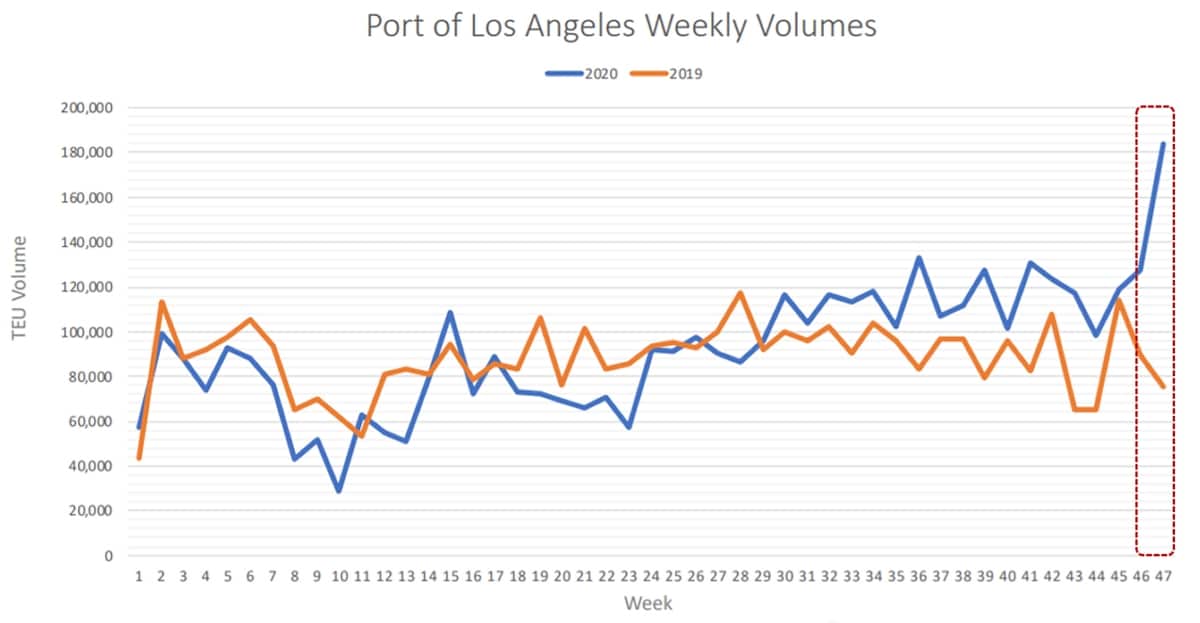

It takes two to three weeks for containers to cross the Pacific Ocean from China to California. The number of arriving boxes can be determined in advance. The Port of Los Angeles released The Signal, a tool powered by Port Optimizer, to show what’s en route.

Nine of the top 10 carriers calling in Los Angeles feed their data into the system. Since August, the weekly numbers have bounced around between 100,000 and 130,000 twenty-foot equivalent units (TEUs).

According to data from manifest records through Friday, this week’s volume is 118,568 TEUs, up 4% year-on-year.

Next week’s volume is 127,896 TEUs, up 30% year-on-year and 7% week-on-week.

Then the numbers go ballistic. For the week of Nov. 15-21, The Signal shows imports into Los Angeles of 183,878 TEUs, up 30% week-on-week and 59% year-on-year.

This spike needs to be put in context, however.

Port of Los Angeles spokesperson Phillip Sanfield explained that the Nov. 15-21 data also includes TEUs that were supposed to enter the terminals in prior weeks but are still at anchorage.

He confirmed that volumes crossing the Pacific due to arrive the week of Nov. 15-21 are also strong. It’s a combination of the two factors.

‘Shipageddon’ fears persist

The good news for the already strained West Coast import system is that there is not an enormous wave of containers — up almost 60% year-on-year — about to crash down upon California the week after next. The bad news is that The Signal data points to a pile-up of ships delayed at anchorage.

This raises yet more concerns about the so-called “Shipageddon” supply-chain scenario: the fear that holiday demand will collide with inventory restocking and overwhelm the system.

During the quarterly call of Matson (NYSE: MATX), CEO Matt Cox said that holiday-season cargo typically arrives in the U.S. by now but “that’s not what we’re seeing.” There’s still more to come.

Investment banks Jefferies and Evercore ISI published data and surveys showing that inventories depleted during lockdowns are not even close to being replenished.

Taken together, it appears the combination of restocking cargoes and holiday cargoes will push up trans-Pacific volumes and keep pressure on the West Coast port system — possibly into 2021.

Charter rates highest since 2011

Another market indicator is container-ship charter rates. Carrier fleets are a mix of owned and leased vessels. Leases can last for months or years. The more capacity carriers need to service future cargo demand, the higher the charter rates and the longer the charter durations.

Alphaliner reported this week that charter rates have gone “through the roof,” with rates “rising quickly for all ship types on the back of increasingly tight supply.”

It said that the 7,500- to 11,000-TEU segment remains sold out, as do the 5,300- to 7,499-, wide-bream 4,300- to 5,499-TEU, and the 3,000- to 3,999-TEU segments.

The classic Panamax 4,000- to 5,299-TEU segment “is nearly sold out” and “is seeing charter rates that would have been unthinkable only a few months ago,” said Alphaliner.

Hapag-Lloyd chartered the 5,039-TEU CSL Manhattan for five to six months at $25,000 per day, “a rate level unseen for this class of ship since 2011,” noted Alphaliner. It also reported a 12-month charter of a 4,400-TEU vessel at $19,750 per day, up 11% from what a comparable ship went for two weeks before. “Similar tonnage is now being discussed at over $20,000 a day,” noted Alphaliner.

Tonnage available to charter is vanishing. According to Alphaliner, there are only 107 ships inactive, totaling 378,802 TEUs, representing just 1.6% of the total global fleet.

Of those, 13 ships (55,198 TEU) are sanctioned Iranian ships and nine (73,990 TEU) are at the yards for maintenance of scrubber retrofits. Excluding those categories, the inactive fleet is a mere 1.05% of the world total.

Tonnage provider earnings roundup

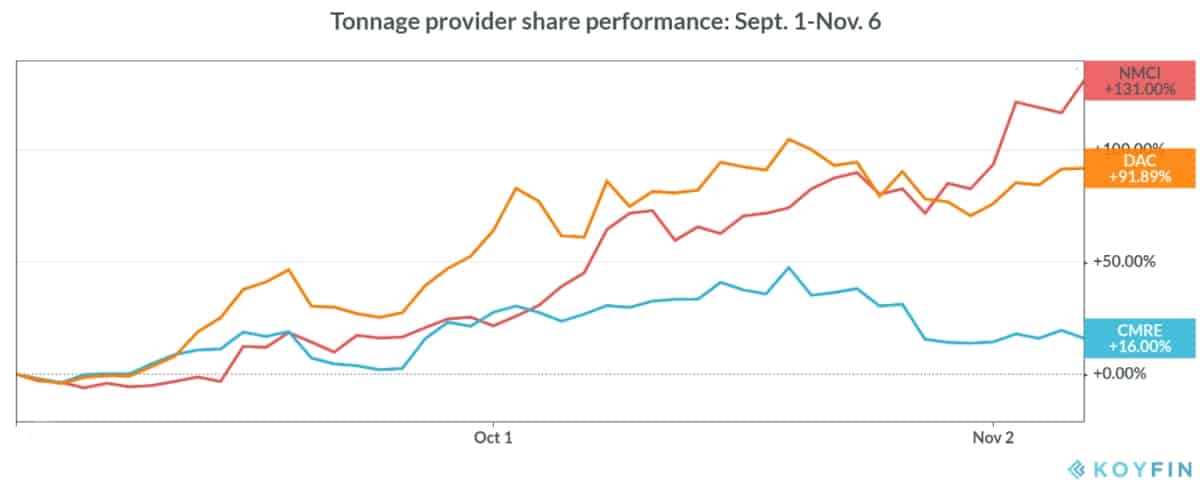

The trans-Pacific bull run is not just important to carriers, shippers, ports, truckers and rail companies. It’s also a key issue for investors in “tonnage providers” — the companies that lease ships to carriers.

Public companies in this segment include Costamare (NYSE: CMRE), Danaos (NYSE: DAC), Global Ship Lease (NYSE: GSL), Capital Product Partners (NYSE: CPLP), Navios Containers (NASDAQ: NMCI), Atlas Corp. (NYSE: ATCO) and Euroseas (NASDAQ: ESEA). The Q3 results of these companies reflect charters booked in a much weaker market than the current one.

Costamare — the largest pure tonnage provider measured by market cap (at $717 million) — released results on Oct. 27, posting net income of $25.2 million for Q3 2020 compared to $36 million in the same period last year. Adjusted EPS of 22 cents came in just below the consensus forecast for 23 cents.

Navios Containers reported results on Tuesday. While one of the smaller players, with a market cap of just $65 million, it has been a big winner in terms of share price. Its stock is up a whopping 131% since Sept. 4. Navios Containers reported a net loss of $1.1 million for Q3 2020 versus net income of $4.1 million in Q3 2019.

After the closing bell on Thursday, Danaos reported Q3 2020 net income of $24.8 million compared to $37.9 million in Q3 2019. Adjusted EPS came in at $1.91, above the consensus forecast for $1.86.

“The container trade has staged a remarkable recovery since the end of May,” affirmed Danaos CEO John Coustas during the conference call on Friday.

“The charter rates being reported in the market are phenomenal. These are rates we have not seen since 2011.

“Nobody knows how long this demand is going to keep up,” said Coustas. “And if a carrier can’t service its customers, its customers will go somewhere else. That is why carriers are trying to secure as many vessels as they can.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON THE TRANS-PACIFIC TRADE: Holiday ‘shipageddon’ update: Container sector scrambling: see story here. Mounting evidence that container spike could last into 2021: see story here. Container slots sell out, risking holiday ‘shipageddon’: see story here. U.S. import bonanza could extend into 2021 on ‘record’ restocking: see story here.