Image: Jim Allen/FreightWaves

Lincoln’s Logs is brought to you by FreightWaves’ Lincoln Duff

Hello and welcome to another edition of Lincoln’s Logs, where I point out some of my favorite datasets in SONAR that can empower you to make actionable decisions to help keep your trucks rolling and increase revenues.

Happy Halloween everyone! Today is the day of candy, costumes, and I’m sure many of you might be dressing up today like something scary like a pirate, ghost or goblin… or maybe something truly horrifying, nuclear verdicts! Generally in these columns I’m trying to give carriers advice on the best markets to target at the moment, but since today is Halloween, I figured I’d focus on those spooky markets…the ones where volumes have seemingly dried up and you’re forced to deadhead elsewhere or worse keep your truck sitting for far too long while working to find a load.

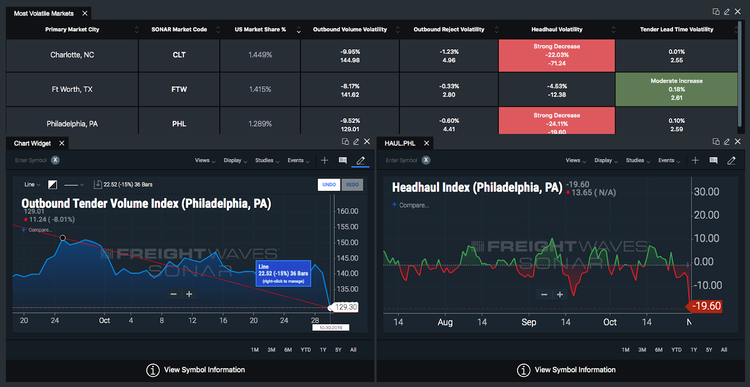

The first market that jumped out to me today was Charlotte. The Outbound Volumes (OTVI.CLT) continue to fall, down over 20% in the last six weeks. Charlotte was already squarely a backhaul market, and has become even more so as inbound volumes have stayed pretty consistent over that same time period.

Chart: FreightWaves SONAR

The second market I want to focus on is Ft. Worth, OTVI is down almost 30% in the last six weeks, and the headhaul index has now gone negative, meaning there’s more inbound freight than outbound from FTW, something that does tend to move between the two, but for now is about the lowest we’ve seen it.

Chart: FreightWaves SONAR

Lastly, the Phinal Phrightening market is Philly. Volumes have dropped by about 15% over the last few weeks, and when we look at the headhaul, it’s now at the some of the lowest levels we’ve seen from that market, with almost 20% more inbound volume right now than outbound.

Chart: FreightWaves SONAR

What does this mean for you?

These markets are generally large volume markets, but right now, it’s going to be harder to find loads. This means, if you do have loads in these markets, you should be able to sell them for more, or if you are booking loads into those markets, make sure you are getting as much money for those loads as you can, as it’s going to be more difficult to find that load out.

As always, please feel free to reach out with any questions about the data or the SONAR platform, I’m always happy to help…. Hammer down!