Noting a slowing economy, management from logistics warehouse owner and operator Prologis said demand for space remains firm and leasing fundamentals are strong.

“With regard to our markets and leasing activities, the bottom line is that conditions remain healthy and there is little we see across our results or proprietary metrics that point to a meaningful slowdown,” CFO Tim Arndt told analysts Wednesday on the fourth-quarter earnings call.

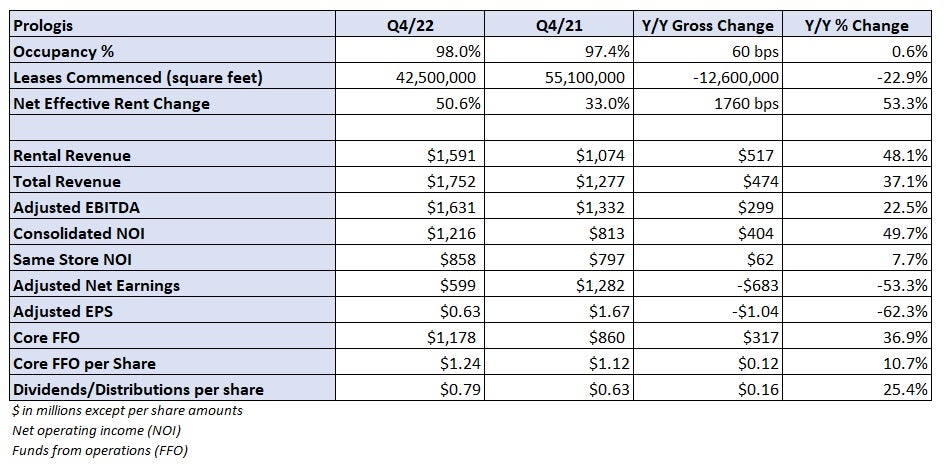

Prologis (NYSE: PLD) reported core funds from operations (FFO) of $1.24 per share Wednesday before the market opened, 3 cents light of consensus but 12 cents higher year over year (y/y).

Occupancy across its portfolio was 98.2% in the period, with more than 99% of available space either leased or in negotiation. Leases commenced represented 42.5 million square feet of space, a 23% step down from the record pace established a year ago.

Rent growth was 5% in the fourth quarter, pushing full-year 2022 growth to 28%. Net effective rent change (over the entire lease term) was 50.6%, up nearly 18 percentage points y/y but 910 basis points lower than in the third quarter. However, the entirety of the sequential decline was tied to a change in mix and not indicative of softening market rents.

“We see a normalization of demand and when combined with low vacancy it continues to translate to a meaningful increase in rents,” Arndt added.

Prologis expects rents to grow 10% in the U.S. this year and 9% globally. That number is more than 500 basis points higher along the U.S. coasts. Further, Arndt noted the company’s previous forecasts proved to have some conservatism embedded.

Arndt did say that 565 million square feet of space in the development pipeline will push vacancies from a low-3% range currently to roughly 4% by year-end as these sites come online. But an increase in decision times regarding incremental lease plans, given an unstable macro outlook, could weigh on development starts, pushing vacancy rates back down in 2024 and beyond.

True months of supply, which compares current vacancies plus the development pipeline to trailing net absorption, increased to 25 months from 22 months in the third quarter and 18 months at the end of the second quarter. However, the metric for space availability remains well below the 36-month average over the past decade.

Prologis’ 2023 guidance calls for core FFO growth of 6% at the midpoint of a $5.40- to $5.50-per-share range. The guide was slightly below the consensus estimate of $5.58 at the time of the print. Average occupancy is expected to be between 96.5% and 97.5%.

Same-store cash net operating income is expected to increase by 8.5% to 9.5% y/y. Management said that growth rate is largely baked in as most of 2023’s leasing is accounted for and the portfolio is carrying a lease mark-to-market near 70%.

“[Customers] are not in the hoard mentality of let’s go get this space because if we don’t somebody else will. I think the market has rationalized with respect to pace of leasing demand and people are being more thoughtful about how they go about taking space,” co-founder and CEO Hamid Moghadam stated.

Moghadam said vacancies would have to get to 7% to 8% and stay there to result in softening market rents. He estimates that would take more than 1 billion to as much as 3 billion square feet of unleased space coming online.

“In 20 years of doing this, this is the biggest disconnect that I’ve seen between the macro economy and the prospect for our business,” Moghadam said. “Absent a nuclear war type of scenario, I just don’t see vacancy rates going to a level that will lead to a reduction in rents.”

Prologis ended the year with more than $4 billion in liquidity and investment capacity totaling $20 billion.

More FreightWaves articles by Todd Maiden

- J.B. Hunt hopeful for Q2 demand inflection

- Bank of America bullish on TL stocks as ‘truck demand near floor’

- XPO taps equities analyst as new chief strategy officer

John Shontz

As more companies move away from an extremely tight JIT inventory system, warehouse space will continue to demand a premium.