Despite surging inflation and waning consumer confidence, Port of Los Angeles Executive Director Gene Seroka sees America’s import boom persisting in the months ahead.

“While we’re all cost-minded and we feel it at the pump and at the grocery store, we’re going to continue to buy,” he predicted at a press conference Tuesday, pointing to Americans’ more than $2 trillion in savings and $1.2 trillion in revolving credit.

Americans aren’t buying the same kind of goods they were at the height of the pandemic. But “retailers continue to replenish inventories … sales of finished goods remains strong, and parts and components going to American factories are equally as impressive.”

“Peak season cargo is on the way,” said Seroka. He expects an early start to peak volumes this year, “with arrivals beginning at the end of this month.”

He reported no impact on his port’s import flows from the COVID lockdowns in Shanghai, now in their 12th week. “The number of ships leaving Asia has been very steady” across the lockdown period, he said. This week, 47 container ships departed Asia bound for Los Angeles or Long Beach, according to data from the Marine Exchange of Southern California cited by Seroka. That’s up 27% from departures in the first week of January.

3rd best month ever

The neighboring Port of Long Beach already reported exceptionally strong numbers for May. Los Angeles followed suit on Tuesday.

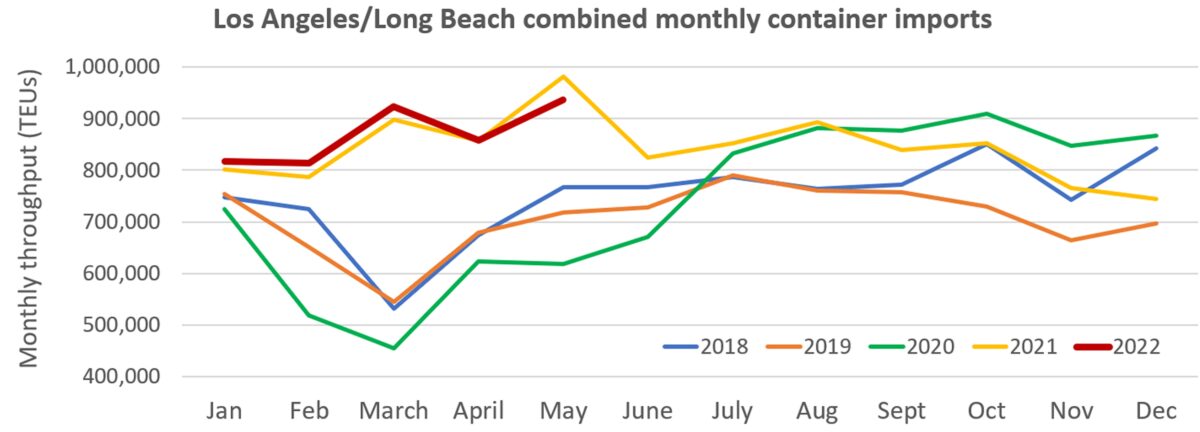

May’s total throughput was 967,900 twenty-foot equivalent units, making it the third-best month in the port’s history, behind only May 2021 and October 2020. May throughput was 21% higher than the 2017-2021 average for that month.

Los Angeles handled 499,960 TEUs of imports, 20% higher than the prior five-year average. Exports rose to 125,656 TEUs, up 14% year on year to the highest total since November 2020.

Empty containers came in at 342,285 TEUs. “Imports remain high coming from Asia to Los Angeles, and the need for [empty] containers to turn them around quickly in Asia is strong,” said Seroka.

Looking at the combined monthly imports of Los Angeles and Long Beach, 2022 remains almost exactly on track with 2021 — and far above 2018-2020 trends. The two ports’ combined imports in January-May are essentially flat year on year (down 0.5%, by just 23,316 TEUs).

“As anticipated, we’re matching 2021’s record-setting year box for box,” said Seroka.

Challenges for Los Angeles ahead

If Seroka is right — and imports do not fall off a cliff amid economic headwinds — the second half will be challenging for supply chains. Several performance indicators remain problematic.

On the positive side, Southern California’s ship queue is getting shorter. There were 27 container vessels waiting for berths in Los Angeles or Long Beach on Tuesday, down from a high of 109 in January.

On the negative side, the 30-day average of cargo moving off docks is 179,000 TEUs, down from over 200,000 TEUs recently. The street dwell time for containers and chassis is at nine days. Normally, it’s 3.5 days.

The situation with on-dock rail is particularly problematic. There are now 29,000 containers on the terminals waiting for rail; 15,000 of those have been waiting for nine days or more. In normal times, there’d be around 9,000 containers, none waiting over nine days. As recently as February, there were no containers waiting nine days or more, but since then, rail cargo has increased sixfold.

Asked about container dwell times stagnating and failing to improve further, Seroka replied, “Right now it’s all about the rail. We’re working all out to catch up with this rail cargo.”

Yet another possible challenge for peak season: fallout from contract talks between the dockworkers union and their employers. The port labor contract expires July 1. The two sides issued a joint statement on Tuesday stating that an agreement was unlikely before then — the deadline will pass — but cargo operations will continue.

“Neither party is preparing for a strike or lockout, contrary to speculation in news reports,” they claimed.

Click for more articles by Greg Miller

Related articles:

- Boom times not over yet: US container ports still near highs

- US import demand is dropping off a cliff

- Ports get ‘much needed respite’ as container-ship traffic jam eases

- Container shipping jackpot continues: CMA CGM profits soar

- Blockbuster container shipping results collide with sinking sentiment

- Container shipping rates: Still sky high but falling back to Earth

- Has the peak of container shipping’s epic boom already passed?