Record-breaking year also showed strains in supply chains as busiest U.S. East Coast port.

Despite the strain of a last-minute dash for imports, the Port of New York & New Jersey aims to handle even more cargo this year by increasing efficiency and fluidity at its major marine terminals.

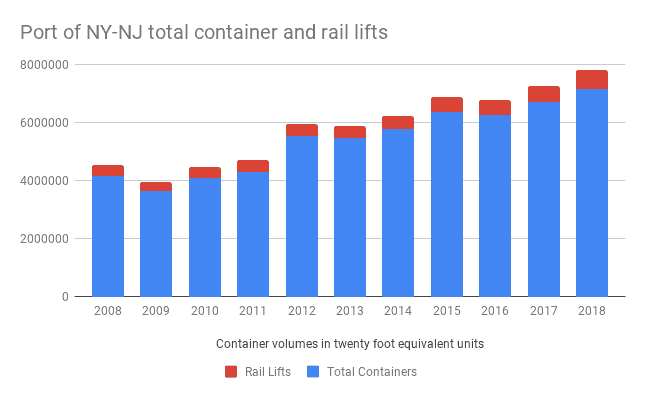

The nation’s third largest reported a “record-breaking” 2018 with full-year container volumes rising 7 percent to 7.179 million twenty foot equivalent unit (teu), the most it’s ever handled. One in three containers entering the U.S. East Coast went through New Jersey and New York marine terminals.

As for this year, the Port expects growth between 3 percent and 3.5 percent this year in volumes.

Of course, many U.S. ports broke records for container volume last year thanks to consumer retail spending and the rush to bring in shipments ahead of threatened tariffs on Chinese goods.

But Port Authority Assistant Director Bethann Rooney says the port’s fundamentals of massive consumer reach and that most vessel make their first call at New York and New Jersey were the main drivers of volume growth. Indeed, import container volumes showed 8.2 growth, slightly better than overall container handling growth.

“One-third of of the nation’s GDP is within 250 miles of the port,” Rooney said. “The population we are able to reach is significantly larger than other U.S. East Coast gateways.”

That reach is extending this year thanks to the opening of the ExpressRail facility at GCT Bayonne. Rooney says the Port’s fourth on-dock rail site gives shippers out of that terminal extended reach into Midwest, Southern and U.S. Northeast markets. As the first port of call for the U.S. East Coast, shippers also get a time advantage.

With today’s massive ships taking two or three days to unload, a container discharged on the first day “could potentially be in Chicago before the ship even leaves New York and New Jersey to go south” Rooney said.

But the more common issue lately has been how long it takes to get a box out of NY-NJ marine terminals. Rooney admits January saw some truck and container delays due to poor weather and a backlog caused by six extra ships coming into NY-NJ during the holidays.

“It’s supply chain inefficiencies that were caused by short holiday work weeks, extra loaders that were deployed to the East Coast and snow- and ice-related delays,” Rooney said. “All those factors affect the on-time schedule for vessels and trains.”

Yet improvements are still coming to help container fluidity. Rooney says APM Terminal is expected to implement a new in-gate system that will also allow drivers to make appointments. Maher Terminal is increasing the capacity of their ship-to-shore cranes. And Maher and Port Newark Container Terminal are also investing in new straddle carriers for their container yards.

The Port Authority is also looking at how to revamp its web portal for drivers and shippers, Port Truck Pass. Along with better information about the pick-up status of containers, the port wants to tie in chassis availability data so drivers will also have the proper equipment to pick up containers.

“We are constantly identifying areas of improvement so we can remain the premier port on the U.S. East Coast,” Rooney said.

Hapag-Lloyd plans first LNG ship conversion

The 15,000-teu ship will be able to use both gas and regular fuel. (Transport Weekly)

Tankers are idle in Caribbean due to Venezuela sanctions

U.S. moves against state-oil company put oil 7 million barrels of oil in limbo. (Safety4Sea)

Philadelphia port touts low turn time

PhilaPort says truck turn times under 40 minutes thanks to efficiency. (VesselFinder)

Tanker markets set for slow growth

Brokerage sees slower oil demand growth ahead, affecting tanker demand. (Splash 247)

Australia sees box port record

The U.S. is not alone in seeing its container handling records being broken. FreightWaves’ Jim Wilson reports Australia’s largest port also saw a banner 2018. The Port of Melbourne saw volumes reach just over 3 million teu for 2018, a first for any port in Australia. The growth stems from the economic strength of the region’s served by Melbourne, and the geographic isolation of each ports means it’s not easy to reach those regions from other gateways.