Delay in tariffs comes after a week of talks in Washington with Chinese officials; but the threat certainly good for volumes coming into Seattle.

President Donald Trump, the self-descried “tariff man”, decided not to pull the trigger on additional tariffs on imports from China, citing the progress both sides have made in ongoing trade talks to end the nearly one-year trade war between the two largest world economies.

President Trump had set a March 1 deadline to boost tariffs on $200 billion worth of imported goods from 10 percent to 25 percent if China was not showing progress on trade talks. But in a Sunday announcement, the President said the current progress being made means those tariffs will be delayed. Trump will meet with his Chinese counterpart Xi Jinping to finalize a trade deal.

I am pleased to report that the U.S. has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues. As a result of these very……

— Donald J. Trump (@realDonaldTrump) February 24, 2019

“As a result of these very productive talks, I will be delaying the U.S. increase in tariffs now scheduled for March 1. Assuming both sides make additional progress, we will be planning a Summit for President Xi and myself, at Mar-a-Lago, to conclude an agreement. A very good weekend for U.S. & China!.”

China’s Vice Premier Liu He was in Washington D.C. last week meeting with U.S. officials on trade, with a final meeting on Friday with Trump. At the time, Trump said the talks had been going well with the last details to be worked out with Xi Jinping.

“Ultimately, I think the biggest decisions and some even smaller decisions will be made by President Xi and myself,” the president said. “I think President Xi and I will work out the final points. Perhaps and perhaps not.”

Expert says Maersk could cut carbon dioxide emissions faster

Professor says Danish ship giant could reach climate goals with more spending. (Hellenic Shipping News)

Goldman Sachs counsels on IMO 2020 hedging

Scrubber-fitted ships should just take unhedged exposure on marine fuel. (Seatrade Maritime)

Greece does not like Cosco plan for port

China’s largest shipping firm planned upgrades at Piraeus not sitting well. (Seatrade Maritime)

Venezuela’s navy threatens aid ship

Beleaguered country turned away from Puerto Rico amid standoff with U.S. (Maritime Executive)

Northwest Seaport Alliance sees good start to 2019

The Northwest Seaport Alliance reported a strong start to 2019 as container volumes hit a January record. The Alliance, which operates the Ports of Seattle and Tacoma, reported total container volumes reaching 326,228 twenty-foot equivalent (teu), a 27 percent rise from a yearly growth seen over the last 12 months by the Alliance. Imports led growth with loaded inbound containers showing 33 percent growth for the year, also the highest in the last 12 months. Fears over the imposition of additional tariffs on Chinese goods drove volumes into the fifth largest container gateway to North America, along with seasonal surge ahead of the Lunar New Year holiday in Asia. Indeed, SONAR data show that truck freight volumes coming out of the Seattle metropolitan region remained elevated from a year ago. (SONAR: OTVI.SEA)

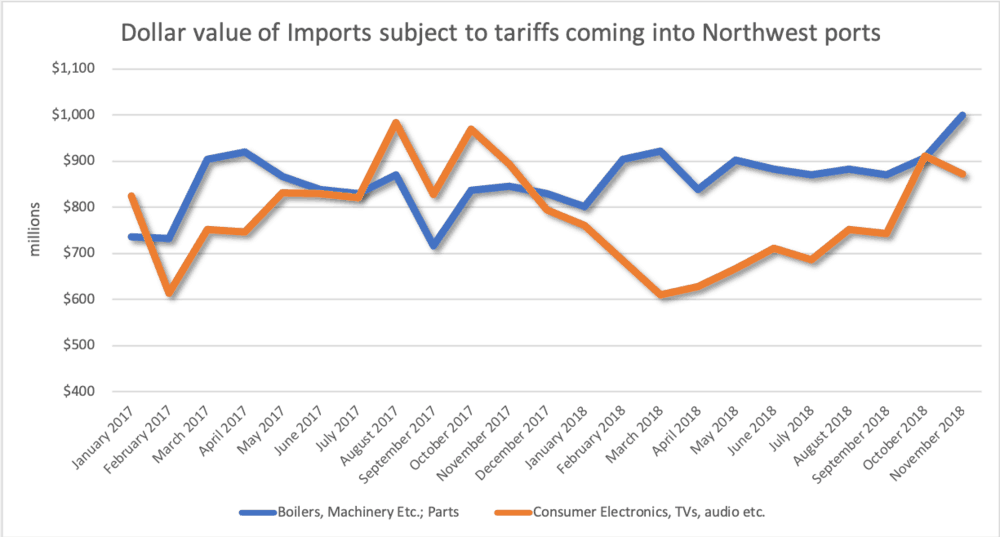

Last year was one of the best on record for import goods that were either targeted in the first two rounds of tariffs. The import category that includes washing machines and microwave ovens saw the dollar value into Alliance’s ports reach $998 million last November, a two-year high.

The Alliance’s Chief Commercial Officer Tong Zhu said the region’s ability to keep absorbing goods will hinge on building additional warehousing and distribution space, which he pledged is coming. “As we work to build on the strong import volumes we saw in January, the Seattle-Tacoma gateway will be adding more than 7 million square feet of new industrial warehousing space this year to diversify our customers’ supply chain,” Zhu said. The Pacific Northwest’s warehouse vacancy rate hovers around 7 percent. (SONAR: WHVAC.SEA)