Borderlands is a weekly rundown of developments in the world of United States-Mexico cross-border trucking and trade. This week: Mexico’s automotive production hits 9-year low; Amazon begins hiring for El Paso fulfillment center; Port Houston appoints first chief business equity officer; and new Arizona distribution center to support e-commerce growth.

Mexico’s automotive production hits 9-year low

Mexico’s monthly auto production and exports for passenger and commercial vehicles continue to be pummelled by the effects of both the COVID-19 pandemic and semiconductor chip shortages.

The country’s passenger vehicle manufacturing sector produced 257,813 cars and light trucks in October, a 25.9% decline from the same period a year earlier, according to Mexico’s National Institute of Statistics and Geography.

It was the lowest level for October since 2012. Exports of passenger vehicles dropped 19.9%, to 224,535 units during the same period.

Manufacturing of commercial vehicles declined 4.5%, to 13,660 vehicles, while exports declined 40.3%, to 5,571 units.

“One of the biggest difficulties we have faced in recent months is the shortage of semiconductors chips,” said José Zozaya Délano, executive president of the Mexican Automotive Industry Association (AMIA), said in Vanguardia-Industrial.

“This problem is the result of the over-demand of these components for the manufacture of equipment such as video game consoles, cell phones, computers, whose demand increased unexpectedly due to COVID-19.”

Mexico’s automotive production industry — which includes vehicle assembly and parts manufacturing — is the No. 1 foreign investment attractor to Mexico, according to AMIA.

There are 26 assembly plants across Mexico, employing almost 1 million people.

More than 80% of Mexico’s auto production is for export. The United States continues to be the main destination country for exports of passenger vehicles and tractor trucks at 94% of total sales in October, followed by Canada at 2.4% and Colombia with 1.7%.

The ports of entry in Laredo, Texas, and Otay Mesa, California, just south of San Diego, are the two busiest U.S.-Mexico border crossings for imports of assembled vehicles and auto parts.

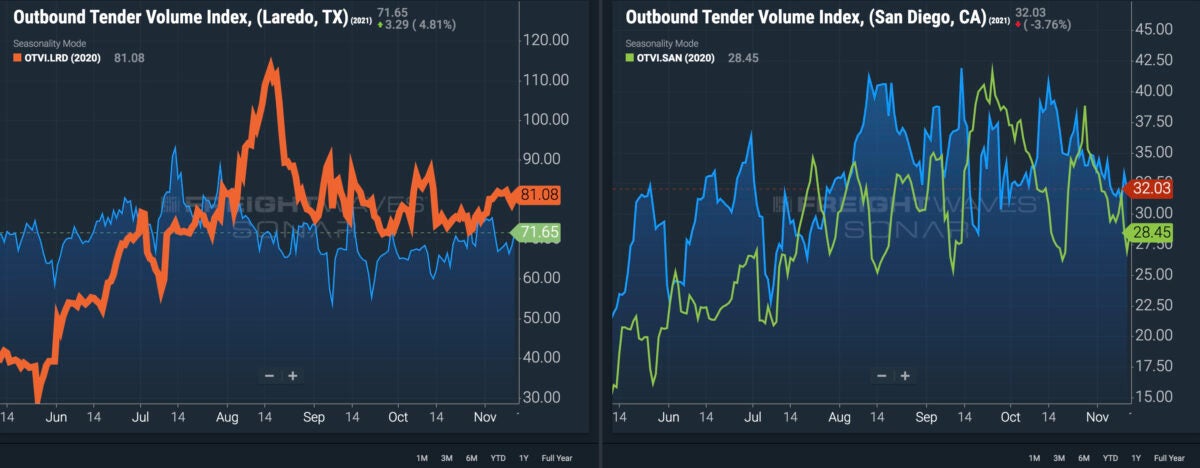

According to FreightWaves’ SONAR platform, freight volumes in Laredo (OTVI.LRD) are up week-over-week as of Thursday but down slightly year-over-year. San Diego’s outbound tender volumes (OTVI.SAN) are up compared to last year but down week-over-week.

The passenger vehicle automakers in Mexico with the biggest year-over-year decreases in production during October were:

- General Motors (NYSE: GM), -68.6%.

- Kia (KRX: 000270), -38.4%.

- Volkswagen (OTCMKTS: VWAGY), -37.6%.

- Audi (OTCMKTS: AUDVF), -32.3%.

- BMW (OTCMKTS: BMWYY), -31.3%.

During October, GM, Ford Motor Co. (NYSE: F) and Nissan (OTCMKTS: NSANY) halted plant operations in Mexico due to a shortage of semiconductor chips.

“The scheduling adjustment is due to a temporary supply constraint caused by the global shortage of semiconductors,” GM said in a statement. “However, this period will provide us with the opportunity to complete unfinished vehicles at the plant and ship those units to dealers to help meet the strong customer demand for our light-duty pickup trucks.”

Mexico-based truck maker Dina (Diesel Nacional) showed zero production during October, compared to 16 units it manufactured during the same month last year, according to data from Mexico’s Administrative Register of the Automotive Industry of Heavy Vehicles.

Other truck makers in Mexico showing declining year-over-year production during October were:

- Isuzu (OTCMKTS: ISUZY), -63.6%, 24 trucks produced

- Freightliner (OTCMKTS: DMLRY), -13.7%, 7,329

- Kenworth (NASDAQ: PCAR), -8.5%, 1,269

Japanese truck maker Hino (OTCMKTS: HINOF) produced 87 trucks at its plant in Silao, Mexico, during October, a 295% increase compared to the same period last year. International Trucks saw production increase 14% during the month, manufacturing 4,643 trucks.

Amazon hiring 500 people for El Paso fulfillment center

Amazon (NASDAQ: AMZN) announced Wednesday it has begun hiring workers for more than 500 full-time positions ahead of the launch of its fulfillment center in El Paso, Texas.

The 625,000-square-foot fulfillment center is scheduled to open by the end of November. Employees will work alongside Amazon robots to pick, pack and ship small items such as books, electronics and toys to customers, according to a release.

Amazon’s minimum starting wage is $15 an hour. The facility was announced by Amazon in July 2020 and could eventually create a total of 700 full-time jobs.

Port Houston hires first chief business equity officer

Maxine Buckles has been named Port Houston’s chief business equity officer, where she will be responsible for implementing and administering diversity, equity and training programs.

In the newly created position, Buckles will serve as a member of the executive leadership team, which is focused on diversity, equity and inclusion at the port.

Buckles previously served as Port Houston’s chief audit officer, responsible for planning and executing operational, financial and compliance policies. She has also held the position of corporate controller at the port.

Buckles holds a bachelor of science degree in accounting from Xavier University and an MBA from Tulane University.

New Arizona distribution center to support e-commerce growth

Chicago-based real estate developer CA Industrial recently held the groundbreaking for the first phase of the Luke Logistics Center in Glendale, Arizona.

The 1.5 million-square-foot industrial development will include four buildings on 90 acres aimed at supporting the e‑commerce sector in Arizona, according to a release.

“The rapid growth of e‑commerce has created an unprecedented need for logistics-oriented spaces, and this momentum is not expected to slow down anytime soon,” said Michael Podboy, president of CA Industrial, in a statement.

Each building will feature 32-to-40-foot clearance for tractor trailers, along with cross dock and rear loading capabilities, a gated truck court, trailer storage, and 60-foot speed bays (a space adjacent to the loading areas used to move goods quickly).

Glendale is in the Phoenix metro area.

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

Texas filling border barrier gaps with shipping containers