There’s no global trade embargo on Russia. No sanctions barring shipments of most consumer goods or manufacturing components. But you don’t need to target the cargo itself to throw a monkey wrench into a supply chain.

Russia’s import options are dwindling as it becomes more difficult for ships, trucks, planes and railways to move Russian cargo — and as shippers and carriers “self-sanction.”

Most Russian-flagged cargo ships were banned from calling at EU ports starting this past Saturday. Russian and Belarusian trucks were barred from EU roads as of Sunday.

The new vessel and trucking restrictions follow earlier bans on Russian planes in EU and U.S. airspace, and U.S. and EU sanctions against Russian Railways, whose network links China with the EU. Meanwhile, most ocean carriers have preemptively suspended Russian bookings.

Taken together, it’s still far from a full blockade. But it’s a “death by a thousand cuts” scenario for Russian logistics.

Russian Central Bank Chairwoman Elvira Nabiullina admitted Monday that sanctions had “primarily affected the financial market but now they will begin to increasingly affect the real sectors of the economy. The main problem will be … restrictions on imports, foreign trade logistics, and in the future, possible restrictions on exports.

“This problem is not yet so strongly felt because there are still reserves in the economy, but we see that sanctions are being tightened almost every day. We see restrictions on the transportation of Russian goods and the work of Russian carriers. The period when the economy can live on reserves is finite.”

Shipping data confirms a sharp drop in container services to Russia. It also reveals the extent some services continue, including ongoing port calls by the world’s top two container lines, MSC and Maersk.

Port calls to Western Russia cut in half

Russia’s main container ports are St. Petersburg and Kaliningrad on the Baltic Sea, Novorossiysk on the Black Sea, and Vladivostok on the Pacific side.

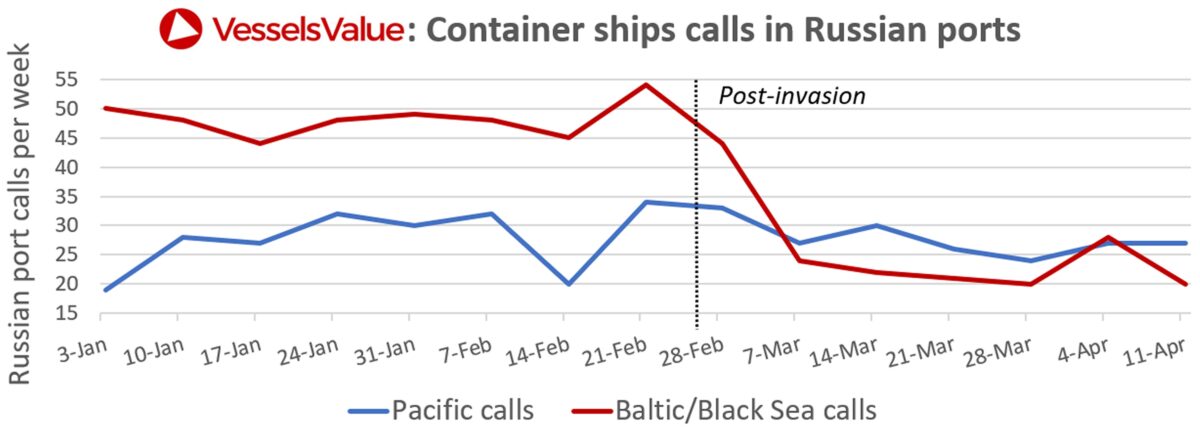

According to data from VesselsValue, there were an average 22.5 container calls per week to western Russian ports during the six weeks after the invasion, a 53% plunge versus an average of 48 per week in the six weeks prior to the invasion. The drop in the average number of Pacific Russia calls was only 11%, to 26.8 per week from 30.2 over the same periods.

Peter Williams, trade flow analyst at VesselsValue, told American Shipper, “There has been a drop-off in vessels visiting Russian ports in the Black Sea and the Baltic since the Ukraine invasion, while the number in the Russian Pacific remains fairly constant.”

Data from Windward shows the same trend: a fall in post-invasion container-ship calls to Russia but not a full stoppage. Windward shows an average of 11.4 calls per day in January to all Russian ports (including western and Pacific) versus 7.9 in March, a decline of 31%.

“It’s clear from the data that the number of port calls did decrease since the invasion, but did not stop completely,” said Windward.

FreightWaves’ SONAR platform features a proprietary index of bookings measured by day of departure and indexed to January 2019. Bookings of Russia-bound cargo (in this particular data set) plunged by 80% from a high of 220 index points on Feb. 28 just after the invasion to only 45 points on Tuesday, and by 91% to just 19 points for bookings scheduled to depart the following Tuesday.

MSC, Maersk continue port calls

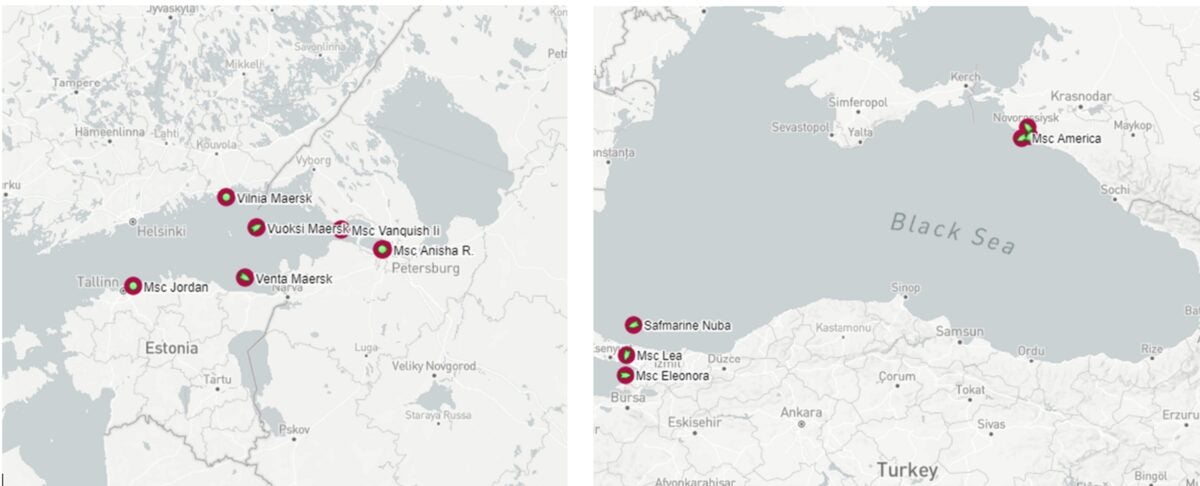

American Shipper used ship-tracking data from MarineTraffic to see which ships still call at Russia’s ports on the Black Sea and the Baltic.

Of container ships that recently departed a western Russia port or will arrive at one as their next port of call, around half were ships of MSC and Maersk.

The others were operated by small regional players, not major global carriers, and had much lower per-ship capacities than the MSC and Maersk vessels still serving St. Petersburg and Novorossiysk.

The ship-positioning date showed calls by 10 MSC ships: the 2,604-twenty-foot equivalent unit MSC Lara; 1,733-TEU MSC Lea; 2,680-TEU MSC America; 2,604-TEU MSC Eleonora; 4,112-TEU MSC Anisha R.; 2,668-TEU MSC Jordan; 1,678-TEU MSC Vanquish II; 2,169-TEU MSC Masha 3; 2,250-TEU MSC Andriana III; and 2,024-TEU MSC Rhiannon.

The data showed five Maersk ships still calling in western Russia, half as many as MSC: the 3,596-TEU Vuoksi Maersk; 3,600-TEU Vilnia Maersk; 2,478-TEU Safmarine Nuba; 3,600-TEU Venta Maersk; and 3,600-TEU Vistula Maersk.

Booking suspensions still in place

MSC suspended all bookings to and from Russia on March 1, with the exception of food, medicine, medical equipment and humanitarian aid.

Asked about MSC’s continued port calls by so many vessels seven weeks later, MSC spokesperson Giles Broom told American Shipper that the booking suspension remains in place, but “we are also continuing to screen and clear a small pipeline of cargo shipments which were arranged prior to our March 1 policy coming into effect.”

He emphasized that “MSC condemns the ongoing violence in Ukraine” and is supporting Ukrainian refugees as well as Ukrainian office staff and seafarers, and Russian seafarers.

Asked about Maersk’s ongoing calls in Russia, a company spokesperson referred American Shipper to comments made by Maersk CEO Soren Skou at the March 15 annual general meeting.

Skou said that Maersk stopped all new bookings to and from Russia except for food and medicine on Feb. 28. It halted even food and medicine bookings to St. Petersburg and Kaliningrad on March 3. It announced that it would sell all its Russian assets including its terminal business on March 11.

“Practically speaking, though, it’s not that easy to stop doing business in a country like Russia. We have about 50,000 of our containers in Russia today,” said Skou in mid-March. “Many of them are empty. They’re our property. We need them and we would not be happy to leave them in Russia. Therefore, we still have some ships going to Russian ports.

“Before the war broke out, we also had more than 50,000 import bookings in our network en route to Russia. We tried to deliver these containers as quickly as possible. The cargo in the containers does not belong to us, but to our customers. Many of those customers are not Russian. Many of the containers contained perishable foodstuffs. There were also practical issues in storing containers in already crowded ports on the continent. So, we expect it will take us until the end of April to get all of the containers out of the system one way or another.”

In other words, Maersk port calls are just part of a wind-down. Soon, there won’t be any. And Russia will have even fewer import options left.

Click for more articles by Greg Miller

Related articles:

- Shipping isn’t waiting for sanctions. It’s refusing to move Russian cargo

- Biden-EU energy pact: LNG shipping game changer or wartime hype?

- Armada carrying US LNG heads to Europe, but it won’t be enough

- War and shipping stocks: Containers, dry bulk, product tankers up

- Why Russia-Ukraine war has not ignited crude tanker rates (yet)

- How Russian invasion of Ukraine could impact ocean shipping

- Russian invasion propels price of ship fuel to historic high