Management from less-than-truckload carrier Old Dominion Freight Line told analysts on a Wednesday call that demand has remained “consistently strong” and that it continues to receive inquiries from customers “regarding the general lack of capacity within the LTL industry.” The favorable setup could allow the carrier to hang a sub-70% operating ratio on the scoreboard during the second quarter.

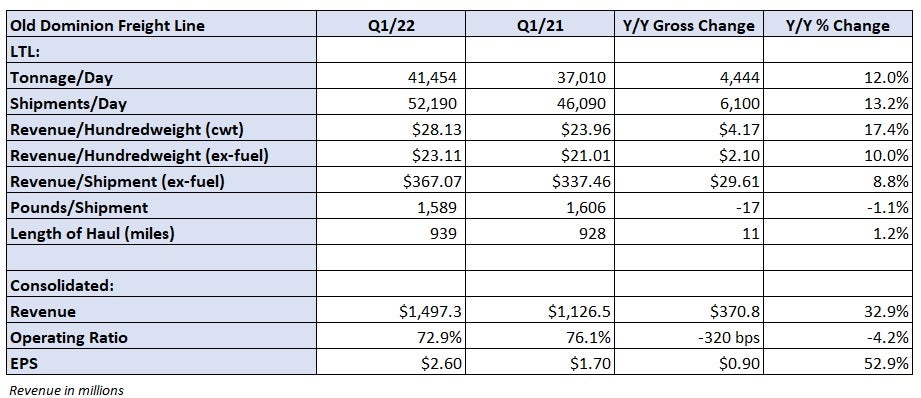

First-quarter revenue of $1.5 billion was 33% higher year-over-year (+25% excluding fuel surcharges) as tons per day increased 12% and revenue per hundredweight, or yield, jumped 17%. The tonnage increase was the combination of a 13% increase in shipments and a 1% decline in weight per shipment. Excluding fuel, yields were 10% higher on average in the quarter.

Old Dominion (NASDAQ: ODFL) reported earnings per share of $2.60, 19 cents ahead of the consensus estimate and 90 cents higher year-over-year. The company established quarterly records for both revenue and EPS in the first quarter, historically the slowest period of any year.

“As we continue to have conversations with our customers and with our sales team, we continue to get positive feedback as it relates to demand for our service,” CFO Adam Satterfield said on the call.

Old Dominion’s revenue per day so far in April is 28% higher year-over-year. The growth rate is even more impressive when stacked on top of the 47% revenue increase logged in the second quarter of 2021.

The company posted a 72.9% OR (27.1% operating margin) in the period, 320 basis points better year-over-year and a company-best for any first quarter. A network full of freight and higher yields drove the improvement. Growth in revenue per shipment (16.1%) outpaced growth in cost per shipment (10.8%) by 530 bps.

On a two-year comparison, Old Dominion’s OR was 850 bps better. The 2020 comp included only a modest negative impact from the pandemic’s onset.

Most expense lines saw reductions as a percentage of revenue. Salaries, wages and benefits declined 300 bps even as the carrier grew employee count by 19% year-over-year to 24,277. Only two cost buckets saw increases as a percentage of revenue. Operating supplies (mostly fuel) increased 180 bps and purchased transportation (mostly third-party linehaul capacity) increased 40 bps.

The year-over-year increase in purchased transportation was less than half that recorded during the fourth quarter. The company will continue to add headcount during the second quarter to support growth and reduce its reliance on outside capacity. However, delays in tractor deliveries are forcing it to continue to use third-party operators.

Q2 OR could crack 70%

Normally, Old Dominion records 350 bps to 400 bps of sequential OR improvement from the first to second quarters each year. However, the first quarter was anything but normal. Historically the softest quarter for freight demand, robust market fundamentals from the fourth quarter carried into the start of 2022. While the truckload spot market tightened further in January and February before collapsing in March, no such weakness has been exhibited in Old Dominion’s network.

“Our trends are good. Our feedback from customers is very strong,” said Greg Gantt, president and CEO. “We’ve had two of our top 10 accounts [3PLs] in the building in the last couple of weeks, and they’re both very positive on their business and their customers. Their outlook is very strong at this point in time.”

Six of Old Dominion’s top 10 customers are 3PLs. Industrial-related freight accounts for 55% to 60% of its overall revenue book.

“When you look at all the industrial numbers, those are all favorable for sure and we’re seeing good growth,” Satterfield added. “Our revenue growth in the first quarter was pretty balanced between both our industrial- and our retail-related businesses.”

Satterfield said it’s best to benchmark sequential margin trends from the fourth quarter through to the second quarter given the unseasonal outperformance recorded in the first. He noted favorable cost trends to start the year will moderate moving forward but said normal sequential trends imply a 70.2% OR in the second quarter.

“If we operate anywhere that starts with a 6, if it’s a 69.9, we will certainly be very excited to see that kind of number,” Satterfield said. “We’re sitting here like Burt Reynolds and Jerry Reed [Smokey and the Bandit] trying to do something that they said couldn’t be done and we think that we can get it done.”

The record for the company was set in the second quarter at 72.3%.

Core cost inflation, excluding fuel, is expected to be 4.5% higher year-over-year in 2022. Management expects to continue to capture yield increases of “cost-plus.” Through the cycle, the company aims to improve OR by 100 to 150 bps annually. The metric improved 390 bps year-over-year in 2021, prompting management to move the long-term target to 70% or better on its fourth-quarter call in February.

Old Dominion generated net cash flow from operations of $389 million in the quarter. The company recorded only $94 million in capital expenditures in the period but maintained its full-year capex guidance of $825 million ($300 million for real estate projects and $485 million for equipment), which will support growth initiatives including the addition and expansion of terminals.

The carrier opened three new service centers in the quarter with the expectation of adding eight to 10 in total this year. The goal is to operate with 20% to 25% excess capacity in the network as Old Dominion prefers to add infrastructure ahead of onboarding new accounts. Currently, there is only 15% to 20% slack in the system.

Click for more FreightWaves articles by Todd Maiden.

- GTI Transport Solutions acquires container transport provider Foxconn Logistics

- Landstar model partially insulated from spot rate chaos

- Knight-Swift says trucking downturn would favor carriers with large trailer pools